Microsoft Corp. (NASDAQ:MSFT) recently announced an extended partnership with Box (NYSE:BOX) . The duo will offer Box’s cloud content management to enterprise customers based on Microsoft’s Azure platform.

Moreover, both the companies agreed to share “go-to-market investments” and “co-sell” Box and Azure. The combined offering is expected to be available in late 2017.

Additionally, Azure’s artificial intelligence (AI) and machine learning features will be incorporated into Box’s platform in the future.

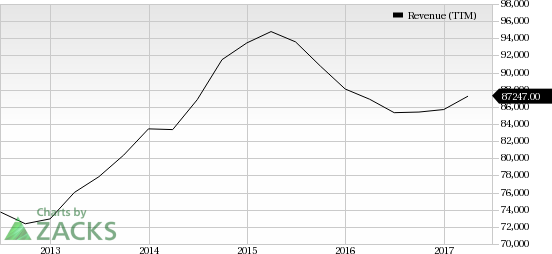

We believe this partnership will be beneficial for both the companies and help them to establish a strong foothold in the cloud management market. Cloud has been a strong driving force for Microsoft’s growth. Notably, the company has outperformed the S&P 500 on a year-to-date basis. While the index gained 10.4%, the stock returned 12.7% over the same period.

Growth Opportunity in the Cloud Market

Per Gartner, the worldwide public cloud services market is anticipated to increase 18% in 2017 to $246.8 billion, up from $209.2 billion in 2016. Cloud system infrastructure-as-a-service (IaaS) is projected to grow 36.8% in 2017 to $34.6 billion. Cloud application software-as-a-service (SaaS) is expected to grow 20.1% to $46.3 billion.

How are Microsoft and Box Placed in the Cloud Market?

We note that both Microsoft and Box are well positioned to take advantage of the projected growth in the cloud segment.

As evident from its third-quarter fiscal 2017 results, Microsoft’s cloud segment has been gaining momentum. Commercial cloud annualized revenues run rate exceeded $15.2 billion in the last reported quarter.

Partnerships such as the recent one will help drive the segment further, providing Microsoft with deeper market penetration in the enterprise segment. This will give it a competitive edge against the likes of Amazon’s (NASDAQ:AMZN) AWS and Alphabet (NASDAQ:GOOGL) .

Notably, Box, which sells cloud based file storage and transfer services to enterprise customers, already has a customer base that includes prominent names like General Electric (NYSE:GE) and The GAP. Following this partnership, Box will also have access to Microsoft’s vast market, which will be another positive for the company.

The partnership is anticipated to positively impact the top line of both the companies.

Zacks Rank

Both Microsoft and Box currently have a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Box, Inc. (BOX): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Original post

Zacks Investment Research