Michael Kors Holdings Limited (NYSE:KORS) , a global luxury lifestyle company, came out with fourth-quarter fiscal 2017 results, wherein earnings of 73 cents a share beat the Zacks Consensus Estimate of 70 cents but plunged 28.4% from the prior-year quarter.

Management now projects first quarter earnings in the range of 60–64 cents a share and fiscal 2018 earnings between $3.57 and $3.67 per share. The current Zacks Consensus Estimate for the quarter and fiscal year stand at 75 cents and $3.93, respectively, which could witness a downward revision in the coming days.

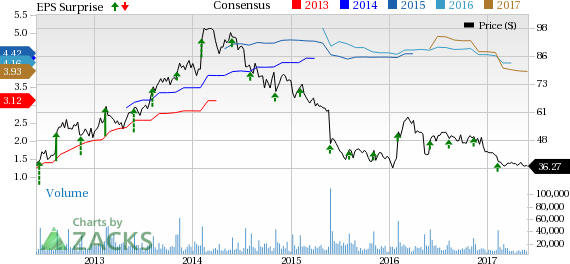

Earnings Estimate Revision: The Zacks Consensus Estimate for fiscal 2018 has declined by a penny in the last 30 days. In the trailing four quarters, excluding the quarter under review, the company outperformed the Zacks Consensus Estimate by an average of 7.6%.

Revenues: Michael Kors generated total revenue of $1,064.8 million that decreased 11.2% year over year but came ahead of the Zacks Consensus Estimate of $1,048 million. Management now forecasts first quarter total revenue in the range of $910–$930 million and expects fiscal 2018 revenue to be approximately $4.25 billion.

Key Events: Michael Kors repurchased 6,641,815 shares for approximately $250 million. Recently, the company's board of directors authorized a new $1 billion share buyback program. The company plans to close 100 to 125 full-price retail outlets over the next two years.

Zacks Rank: Currently, Michael Kors carries a Zacks Rank #4 (Sell) which is subject to change following the earnings announcement.

Stock Movement: Michael Kors’ shares are down nearly 8% during pre-market trading hours following the earnings release.

Check back later for our full write up on Michael Kors’ earnings report!

More Stock News: 8 Companies Verge on Apple-Like Run

Did you miss Apple (NASDAQ:AAPL)'s 9X stock explosion after they launched their iPhone in 2007? Now 2017 looks to be a pivotal year to get in on another emerging technology expected to rock the market. Demand could soar from almost nothing to $42 billion by 2025. Reports suggest it could save 10 million lives per decade which could in turn save $200 billion in U.S. healthcare costs.

A bonus Zacks Special Report names this breakthrough and the 8 best stocks to exploit it. Like Apple in 2007, these companies are already strong and coiling for potential mega-gains. Click to see them right now >>

Michael Kors Holdings Limited (KORS): Free Stock Analysis Report

Original post

Zacks Investment Research