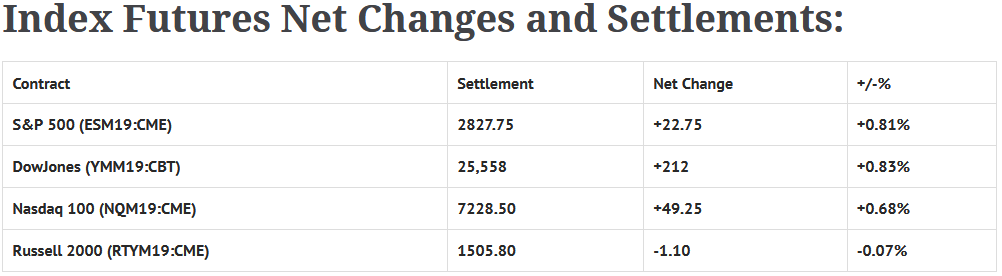

*As of 7:00 a.m. CST

Foreign Markets, Fair Value and Volume:

- In Asia 6 out of 11 markets closed higher: Shanghai Comp -1.17%, Hang Seng +0.26%, Nikkei -0.01%

- In Europe 13 out of 13 markets are trading higher: CAC +0.65%, DAX +0.73%, FTSE +0.66%

- Fair Value: S&P +0.77, NASDAQ +4.66, Dow +6.65

- Total Volume: 1.73 million ESM & 295 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Challenger Job-Cut Report 7:30 AM ET, International Trade 8:30 AM ET, Jobless Claims 8:30 AM ET, Productivity and Costs 8:30 AM ET, Robert Kaplan Speaks 8:40 AM ET, Quarterly Services Survey 10:00 AM ET, EIA Natural Gas Report 10:30 AM ET, John Williams (NYSE:WMB) Speaks 1:00 PM ET, Fed Balance Sheet & Money Supply 4:30 PM ET.

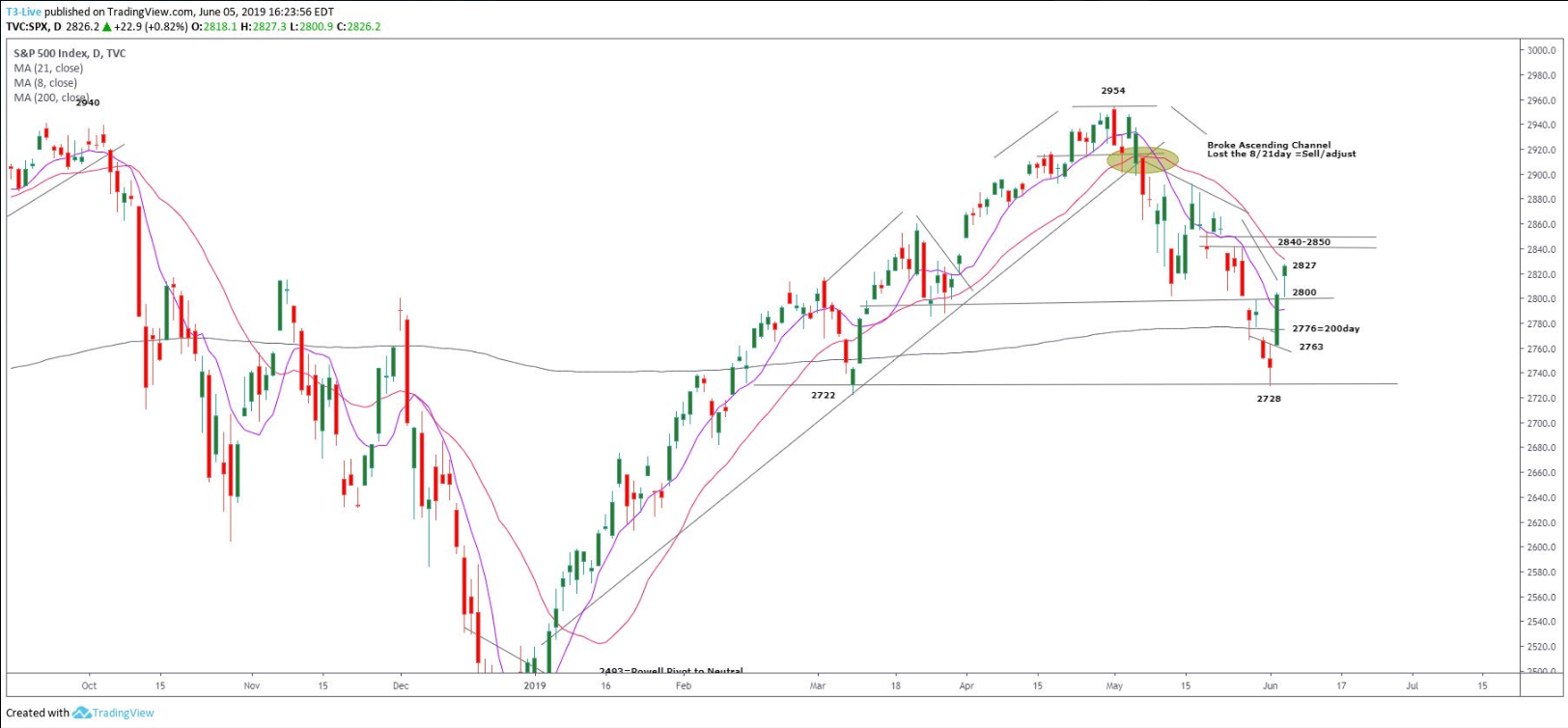

S&P 500 Futures: #ES Up 100 handles In 2 Days

Chart courtesy of Scott Redler @RedDogT3 – Good morning. Mixed markets around the World. $spx futures +8 Ignoring the Mexico/US News. $spx is opening above 2827 and has a big resistance zone at 2840-2850 to trim longs and perhaps look for cute shorts.

The bulls are doing a bang up job just as President Trump threatens another neighbor and trading partner with tariffs. Soon the U.S. will be negotiating with China, EU, Canada, and Mexico while in a war of words with North Korea and Iran. There is a lot going on, and while we cant rule out a few drops, we feel the pops will be bigger. It’s just how it works, the ES takes bad news and makes good of it.

Yesterday, overnight strength was quickly derailed after the 8:30 CT bell. After rallying a few handles up to 2821.75, sellers immediately stepped in and proceeded to pound the futures down, first stopping and 2808.75, and eventually puking down to a new low at 2801.00.

Once the low was in, the ES did an about face, and with the help of some buy programs and a few trade headlines, by 11:00 had traded back up to the RTH opening range. The bulls would remain in charge for the rest of the day, and would eventually take out the Globex high.

Going into the end of the session, the futures springboarded when the 2:45 cash imbalance reveal came out showing $635 million to buy, and printed 2827.25 on the 3:00 cash close, and 2827.50 on the 3:15 futures close, up +22 handles on the day.

In the end, the overall tone of the ES was strong, printing new highs on the close. In terms of the days overall trade, total volume was average, with 1.7 million futures contracts traded.