Forex News and Events

When the smoke clears (by Arnaud Masset)

We are almost at the one-week mark since the historic Brext vote. The market’s initial reaction was to sell everything, from equities to emerging-market currencies and in a panic-stricken mood, investors rushed into bonds and safe-haven currencies. Since the beginning of the week, the situation has stabilised as traders realise that they overreacted to the news. Of course, who can blame them? After all, there is no historic precedent, no benchmark that could have helped them to assess the immediate and long-term consequences of such an event.

Of course, the uncertainty stemming from the Brexit vote will likely persist over an extended period of time. However, as the smoke begins to clear somewhat, a few elements are becoming clear. Since the decision has no short-term consequences -- the UK will likely not trigger article 50 before the end of the summer at least. In the meanwhile, there is plenty of room for a momentary rally. Secondly, it is still not 100% sure that the UK will in fact leave the EU. Indeed, the result of the referendum is not legally binding for the parliament. They could therefore in theory chose to ignore the people’s decision -- just like France and the Netherlands did with the Lisbon treaty. For now, the pound sterling continues to trade within its upward channel and EUR/CHF is back at around 1.09. The FTSE 100 returned to its pre-Brexit level and EM currencies continue to trade higher on the outlook of low interest rates in the US. While the market will of course continue to keep a watchful eye over Brexit developments, we expect attention to now largely drift back to the Fed and the upcoming release of several economic indicators.

Mexico likely to raise rates amid Brexit vote (by Yann Quelenn)

Financial markets are expecting Mexico’s central bank to raise its overnight rate later today to 4% from 3.75%. The Mexican peso has strengthened since Friday’s brexit vote and Mexican yields have also declined after the demand for Mexican bonds surged. The 10-year government Mexican Bond yield has gone from 6.25% to 5.9% in three days.

In our view, despite the sluggishness of the Mexican economy, inflation is running below the central bank’s target of 3%, currently at 2.6%. We believe that the Mexican Central Bank is trying to stabilize the peso to prevent it from further weakening. This will be the second time this year that rates are increased by fifty basis points. The rationale behind this raise would be to avoid loss on domestic bonds should the peso weaken too much. In doing so, Mexican policymakers are hoping to minimise capital outflows from foreign holders of Mexican debt. The peso has largely weakened since the start of the year, losing more than two figures against the greenback. We nonetheless target the currency to again hit the 19-mark.

The Risk Today

Yann Quelenn

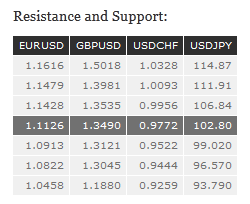

EUR/USD is still pushing slightly higher after the big turmoil on the Brexit "leave" vote. Hourly support is given at 1.0913 (24/06/2016 low) while hourly resistance is located at 1.1129 (29/06/2016 high). Strong resistance is given at 1.1479 (06/05/2016 high). Sharp moves do not have to be ruled out as there are still a lot of uncertainties on asset pricing in the market. In the longer term, the technical structure favours a very long-term bearish bias as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

GBP/USD is pushing higher after the big drop amid the Brexit "leave"vote. Hourly support lies at 1.3121 (27/06/2016 low) and hourly resistance is given at 1.3534 (29/06/2016 high). Expected to show further strengthening. The long-term technical pattern is negative and favours a further decline. Key support at 1.3503 (23/01/2009 low) has been broken, as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200-day moving average).

USD/JPY is increasing, even though slowly. The technical structure continues to favour a second leg lower. Hourly supports are given at 101.41 (27/06/2016 low0 and 99.02 (24/06/2016 low) while hourly resistance is given at 102.83 (28/06/2016 high). Expected to further increase in the short-term. We favour a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF's upside has faded. Hourly resistance is given at 0.9837 (28/06/2016 high). The road is nonetheless wide-open to further resistance at 0.9920 (03/06/2016 high). Hourly support is given at 0.9648 (24/06/2016 low). Expected to continue consolidate before entering another upside move. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias since last December.