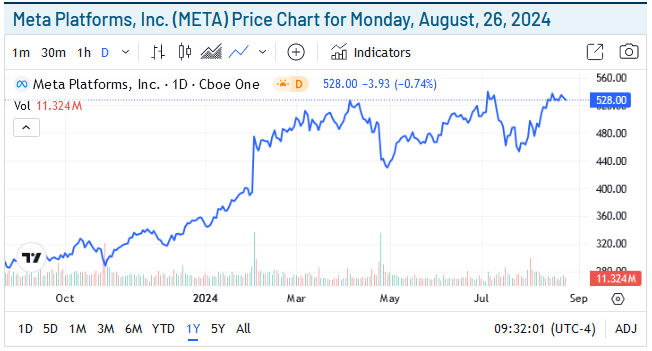

- Shares of Meta have been rallying hard since last month’s selloff.

- They’ve already hit a fresh all-time high, and further gains look imminent.

- The most recent analyst update is calling for further gains of more than 20% by the end of the year.

Despite falling close to 20% during the late July / early August selloff, shares of tech titan Meta (NASDAQ:META) have already recovered. They’ve done more than just recover, in fact, as they hit a fresh all-time high during last Thursday’s session off the back of a 25% rally in just a single month.

The broader market has also recovered most of its gains, the S&P 500 for example gaining 10% since the first week of August. The benchmark index closed within touching distance of a record on Friday, which bodes well for the broader market, Meta included.

Much of the bounce back and return of risk-on sentiment has been fuelled by Fed Chair Powell’s statement that “the time has come” for interest rates to be cut. Considering it was, in the face of a worryingly poor jobs report in July, fears that the Fed had left it too late to cut rates, this was just the right kind of tonic.

Bullish Price Action

The fact that Meta is among a small handful of stocks that have hit a higher price than before all the volatility speaks volumes about the underlying demand for their shares from investors. The social media giant has been on an absolute tear since the last quarter of 2022, gaining more than 500% in that time. In many ways, last month’s dip was a healthy correction that allowed some profit-taking, meaning Meta can now start the next phase of its multi-year rally.

So, what can investors expect next? Well, according to Tigress Financial, there’s a clear path to at least 20% of additional upside from here. The team there are bullish on what they called Meta’s “increasing cash flow” which will fuel additional investments into key areas like artificial intelligence. This in turn is seen as the key to unlock additional growth in their user engagement and resulting advertising revenue.

As part of the update they reiterated their Strong Buy rating on the stock, and boosted their price target up to $645. Were Meta shares to find their way up to that level in the coming weeks, they’ll have added close to $120 to their share price, or just over 22%.

Optimistic Outlook

There are plenty of reasons to think they’ll do it, not least their strong and consistent fundamental performance.

Looking back at least the last six quarters, Meta has delivered strong beats on analyst expectations for its earnings. After a few dodgy reports during 2022, this is more like what Meta investors and Wall Street are used to.

This was the case at the end of July when Meta delivered revenue growth of more than 22% year on year for Q2, while guiding higher than expected for the current quarter. Their next report, due in October, will be closely watched and, based on recent price action, it’s fair to expect the stock to trade bullishly in anticipation of this.

The team over at Wells Fargo spoke to this recently when they highlighted Meta as one of the few mega-caps worth buying into ahead of Q4. They’re bullish on the market overall and see the S&P 500 gaining an additional 4% through the end of the year, but it’s in some individual stocks like Meta where real potential lies.

This month has seen Loop Capital take a similar bullish stance, with Barclays and Guggenheim doing the same. All teams have reiterated their Buy rating on Meta shares and expect the stock to continue to outpace the market and its peers through the end of the year.

Getting Involved

Investors thinking about getting involved should be excited the stock has been among the strongest to recover from the recent sell off. The fact that Meta was able to hit a fresh high last week suggests there’s a ton of demand for their shares that’s unlikely to go away anytime soon.

Some of the bears might point out that Meta failed to close at a high and closed down on Friday while the S&P 500 closed up, and this potential divergence will have to be watched this week. But it will likely take a lot more than that to shake Meta out of its multi-year rally, which, for all the world, is looking like it’s on the verge of starting a brand new phase.