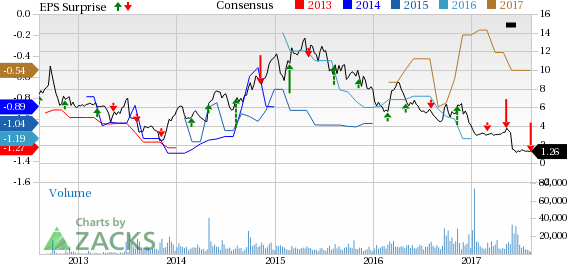

Merrimack Pharmaceuticals, Inc. (NASDAQ:MACK) reported a loss of 22 cents per share in the second quarter of 2017, wider than the Zacks Consensus Estimate of a loss of 14 cents. The company had reported a loss of 41 cents in the year-ago quarter.

Merrimack completed the sale of Onivyde and a generic version of Doxil to Ipsen in Apr 2017 through a definitive asset purchase and sale agreement for $1.025 billion. Merrimack did not record any revenues in the quarter as there was no marketed product. The Zacks Consensus Estimate for revenues was $18 million.

Merrimack’s shares lost nearly 3% following the release of its second-quarter results. Moreover, shares of Merrimack have underperformed the industry so far this year. The shares of the company tumbled 69.1% while the industry gained 8.7% in the period.

In the quarter, research and development expenses were down 28.7% year over year to $19.8 million due to a shift in the company’s focus from Onivyde to its pipeline.

General and administrative expenses were up 81.8% year over year to $14.8 million during the quarter due to costs related to transition after asset sale including legal expenses.

Onivyde Sale

As part of a strategic review of Merrimack’s business, the company sold all the rights to Onivyde and its generic version of Doxil injection to Ipsen S.A. The company had announced its plan to divest the asset and focus on its pipeline of cancer drugs in January.

The company received $575 million in cash upon the close of its asset sale to Ipsen, which was recorded as income from discontinued operations. Merrimack is also eligible to receive up to $450 million in additional regulatory approval-based milestone payments as part of the deal. Moreover, the company has retained the rights to milestone payments of up to $33 million from a previous license and collaboration agreement with Shire plc (NASDAQ:SHPG) for the development and commercialization of Onivyde outside the U.S.

The company used the proceeds from the sale to redeem senior notes debt due in 2022 and invested in the development of its oncology pipeline. The board also authorized a special dividend of $140 million to its shareholders from the proceeds, which was paid in May.

Pipeline Updates

With the sale of its only marketed product, the company can now focus its resources on the development of its three pipeline candidates – MM-121/seribantumab (heregulin-positive, locally advanced or metastatic non-small cell lung cancer (NSCLC), MM-141/istiratumab (pancreatic cancer) and MM-310 (solid tumor). The company has already completed enrollment in a phase II study on MM-141 in combination with standard of care in naive metastatic pancreatic cancer in Jun 2017. The data from this study is expected in first half of 2018.

The company is conducting a phase II study, SHERLOC on MM-121 in non-small cell lung cancer. Top-line data from the study is expected in the second half of 2018. The company expects to initiate another phase II study of the candidate in patients with HER2 negative metastatic breast cancer later this year.

A phase I dose escalation study of MM-310 in patients with solid tumors is ongoing. Data from the study is expected in the second half of 2018, which will determine the recommended dose to be used in the phase II study.

Our Take

With sale of Onivyde, Merrimack is now a developmental stage company. Thus, the successful development of three key candidates in its pipeline is critical for Merrimack’s growth prospects. Moreover, the candidates are in early to mid-stage of development. We expect investors to remain focused on further updates provided by the company on its pipeline candidates.

Zacks Rank & Stocks to Consider

Merrimack carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the pharma sector include Aduro Biotech, Inc. (NASDAQ:ADRO) and Enzo Biochem, Inc. (NYSE:ENZ) . Both the stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Enzo Biochem’s loss estimates narrowed from 12 cents to 7 cents for 2017 over the last 60 days. The company came up with a positive earnings surprise in all the four trailing quarters with an average beat of 55.83%. The stock is up 61.1% so far this year.

Aduro Biotech’s loss per share estimates narrowed from $1.46 to $1.36 for 2017 over the last 30 days. The company delivered a positive surprise in two of the four trailing quarters with an average beat of 2.53%. The stock is up 6.5% so far this year.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Enzo Biochem, Inc. (ENZ): Free Stock Analysis Report

Merrimack Pharmaceuticals, Inc. (MACK): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Shire PLC (SHPG): Free Stock Analysis Report

Original post

Zacks Investment Research