Asian stocks were mixed amid low trading volume. The Japanese yen is trading in a narrow range. Watch out for low volatility in British, Chinese and US assets thanks to bank holidays in those regions.

Oil

‘’Sold the fact’’

Oil prices have cooled off this morning following a week of gains as OPEC members agreed last Thursday to extend supply cuts until March 2018.

Crude Oil

Crude’s next target mark is $51.55. Today is a test for the commodity, if it slips below $48.35, bearish tones may overtake crude.

Today’s range should be between $48.35 and $51.55, with the expectation of a bullish sentiment.

Forex

Dollar

The dollar is inching upwards after Friday’s US GDP growth figures were revised higher by more than anticipated. GDP rose 1.2% instead of the 0.9% expected.

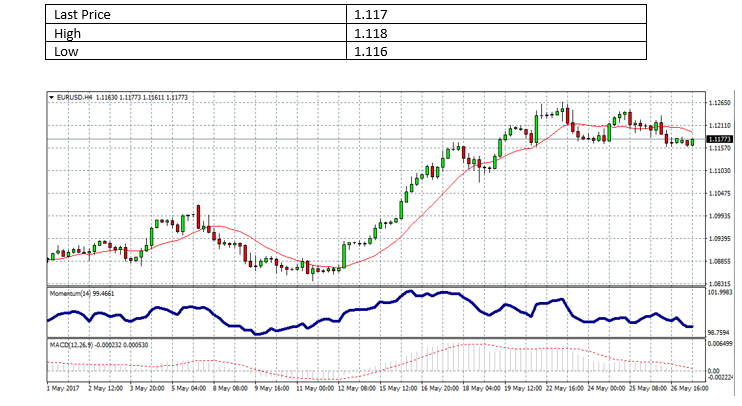

Euro

Angela Merkel indicated that Europe is drifting away from the US under Trump, announcing that after the long-held alliance between the two regions “are to some extent over.” The euro is lagging as a result.

Possible bearish movements towards $1.113 as there is a downward sloping moving average.

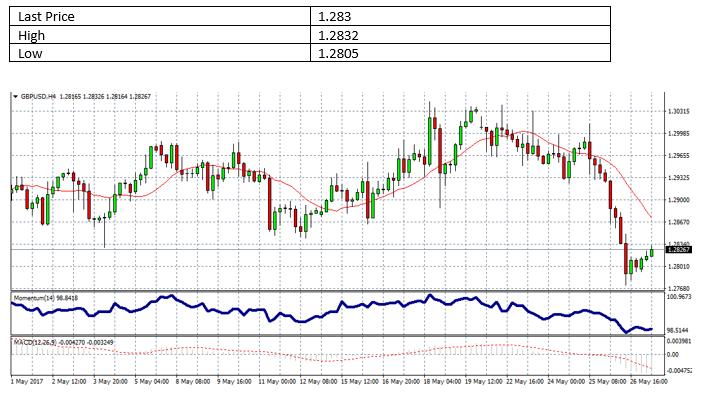

The pound

Sterling has rebounded slightly after polls showed Conservatives had lost some support to Labour. The pound is at 1.28 against the dollar.

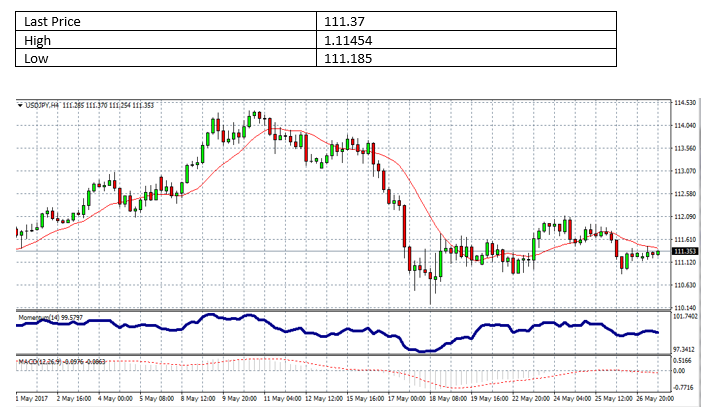

Yen

As geopolitical fears ease and equities rise to record highs, the Japanese yen has fallen back. The yen is down 0.04% against the greenback.

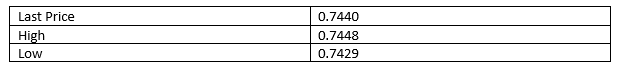

Aussie Dollar

The slump in iron ore prices has pushed the Australian dollar down this morning. Since public holidays are set for the US, China and the UK, we can expect a quiet day for the Aussie dollar. Sentiment for the single currency may derive from USDJPY which is heavily influential on the single currency.

US Equities

The S&P 500 closed at a record high on Friday. The rally was spurred by better-than-expected US GDP results.

Investors feel that the US economy can withstand an increase in interest rates next month.

European Equities

European stocks were slightly lower. Italian backs are set to close branches in an attempt to cut costs.

Cryptocurrencies

Bitcoin

BITPoint is the latest company to allow travellers to use bitcoin as a form of payment, and are planning to allow thousands of Japanese retailers to accept the cryptocurrency.

After regulations acknowledging bitcoin as a form of payment were passed last month, Bitcoin has surged and now Japanese investors are the majority holders of the digital asset.

Bitcoin got close to $2800 and had a correction back to $2100. After over doubling in value this year, bitcoin was headed for a correction.

Ethereum

On January first, ethereum was trading at under $8. Today, the digital asset is trading at $162. The fall back in bitcoin eased all major cryptocurrencies. Ethereum has slightly rebounded and is trading up 7% this morning.