Earnings Expected To Reach A Record High In Q4

According to a recent report by Zack’s Investment Research, 484 members of the S&P 500 have reported Q4 earnings thus far. Total earnings from these companies have grown 7.4% in Q4 compared to 3.6% in Q3 while revenues have increased 4.9% in Q4 vs 2.1% in Q3.

Although 16 companies have yet to report, it is now safe to assume that Q4 earnings growth for S&P 500 listed members will reach its highest level in nearly two years. Furthermore, the absolute earnings total for these companies is expected to reach a record high: ~$289 billion. This compares to $285 billion in Q3 and a much lower $269 billion in Q4 '15.

With stocks at record highs and now earnings expected to follow suit, value investors may be having difficulty finding stocks trading at a reasonable price. Here are five that are also expected to report earnings this week.

5 Attractive Stocks Reporting Earnings This Week

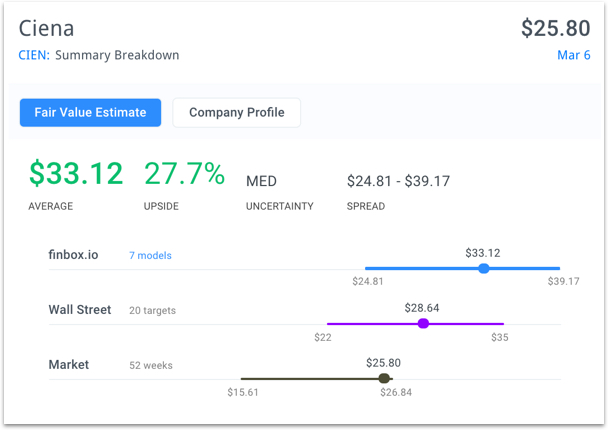

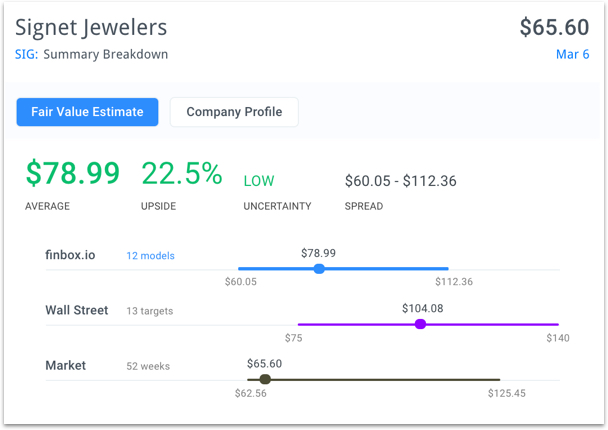

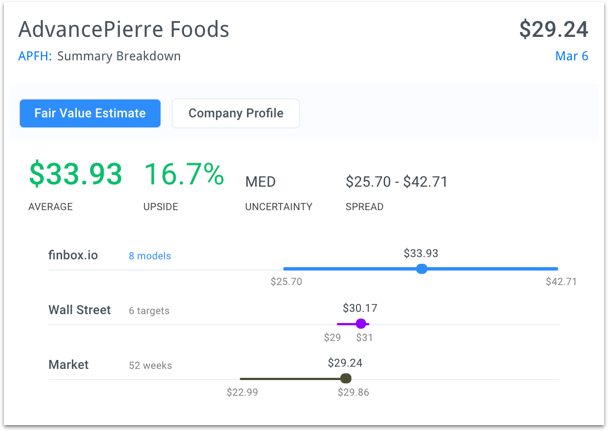

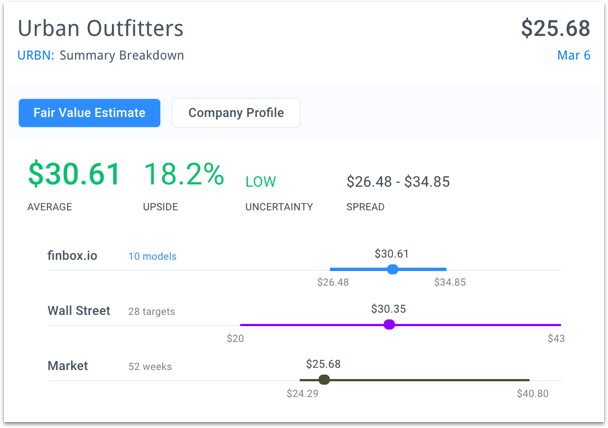

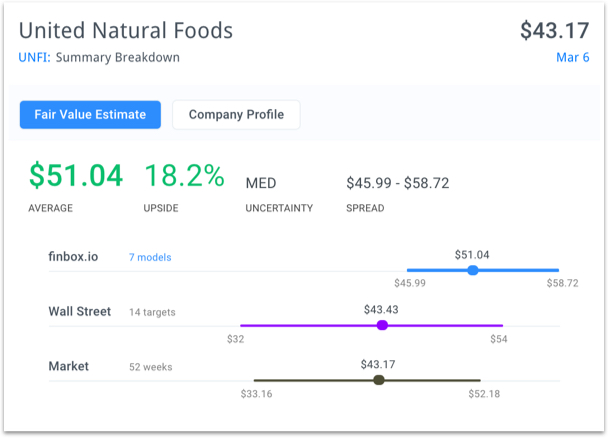

According to Yahoo (NASDAQ:YHOO) finance, there are 475 companies still expected to report earnings this week (3/7 - 3/10) and only a few appear fundamentally undervalued. Finbox.io's intrinsic value data shows that only five of these companies have at least 15% or more upside: Ciena Corp (NYSE:CIEN), Signet Jewelers Ltd (NYSE:SIG), Advancepierre Foods Holdings Inc (NYSE:APFH), Urban Outfitters (NasdaqGS:NASDAQ:URBN) and United Natural Foods Inc (NASDAQ:UNFI).

Ciena is expected to report on Wednesday and seven separate cashflow analyses imply that the stock’s over 25% undervalued.

Signet Jewelers is expected to report earnings on Thursday and the stock is currently trading near its 52 week low. Finbox.io fair value data implies that shares are over 20% undervalued while Wall Street's consensus price target of $104 per share implies over 50% upside!

AdvancePierre Foods is also expected to report earnings on Thursday while eight valuation models conclude that shares are approximately 17% undervalued.

Six valuation analyses imply that Urban Outfitters is approximately 18% undervalued prior to reporting earnings (expected Tuesday). This figure is right in line with Wall Street.

United Natural Foods appears to be trading at an 18% discount to its intrinsic value before earnings (expected Wednesday).

These stocks all have strong fundamentals and could easily trade 15% higher based on their underlying earnings. Value investors may want to take a closer look at these names prior to earnings this week.