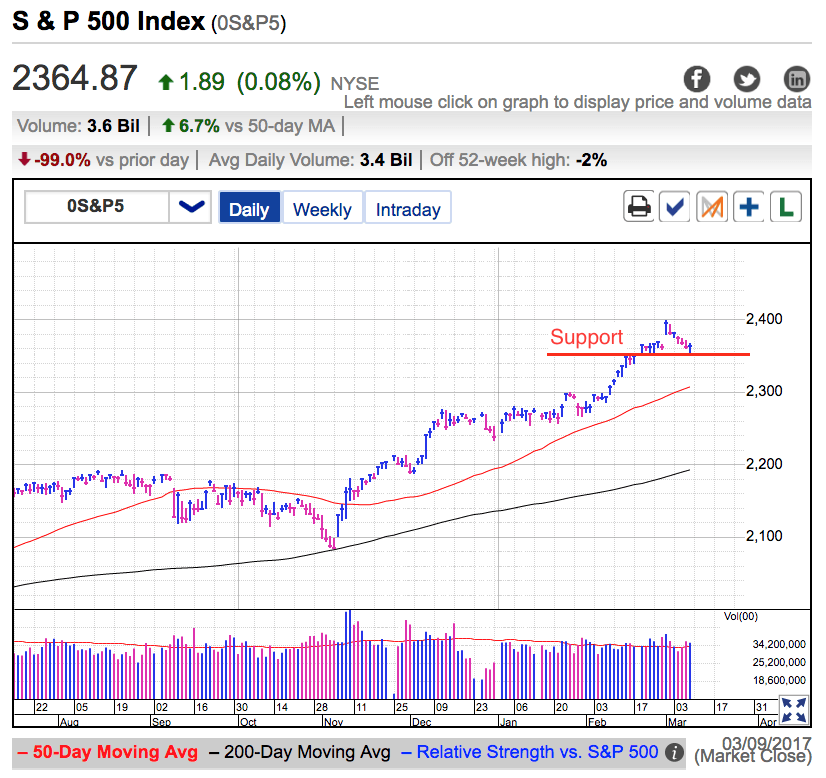

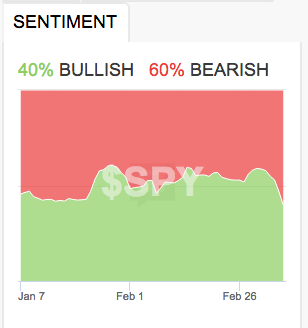

The S&P 500 continues hovering above 2,360 while oil fell under $50 for the first time this year. The last few weeks of enthusiasm is crumbling and giving way to second thoughts. This shift is clearly evident in popular sentiment measures. The StockTwits’ SPDR S&P 500 (NYSE:SPY) stream plunged from 60% bullishness last week to 40% on Thursday. AAII’s weekly sentiment survey saw bearishness spike nearly 11% and is at the highest level since the election. Given how dramatically sentiment changed, surely it must have been a painful week for stocks.

While we slipped almost every day since last Wednesday’s record high, the losses have been relatively trivial and we are down little more than 1% from last week’s all-time high. Clearly something is askew and as traders it is our job to figure out who is right, the resilient market, or the increasingly pessimistic crowd.

When all else is equal, we always give the benefit of doubt to the market. While it is not always right, it is far larger than we are and will run over us if we get in its way. One of the most useful techniques I found for analyzing the market is focusing on what it is not doing. This is typically far more insightful than trying to guess at what it is doing and why it is doing it.

This week’s dramatic swing in sentiment tells us the crowd thinks stocks went too-far and are vulnerable to a pullback. I can relate because that is exactly what I was expecting last week too. But here’s the rub, we haven’t pulled back very far after a week of selling. As I often write, breakdowns from unsustainable levels are breathtakingly fast. The market rarely gives us this much warning before crushing us.

Jumping back to the “what is the market not doing?” view of the market, the obvious answer is it is not crashing. When the market isn’t doing what the crowd expects, that means it is setting up to do the opposite. While I’m not ready to predict another strong move higher, at this point that is far more likely than the widely feared imminent collapse. That means we should be looking for dips to buy, not selling stocks and adding shorts.