The investment management fee wars just escalated to a new level with the announcement that State Street is dropping expenses and re-naming 15 of its diversified exchange-traded funds. This transformed group will be dubbed the “SPDR Portfolio” series and is aimed squarely at the likes of Vanguard, BlackRock, and Charles Schwab (NYSE:SCHW) in testing the ultimate boundaries of minimalist fund costs.

The new average expense ratio across all 15 SPDR portfolio ETFs is an astounding 0.06%, with several offerings being listed for as low as 0.03%. That’s just $30 per year in embedded expenses for every $100,000 invested and marks a strong advancement for ETF portfolio construction. State Street has also partnered with TD Ameritrade to make these funds commission-free to trade on their brokerage platform, further maximizing the total return of these funds for shareholders.

The portfolio series is split between 9 equity and 6 fixed-income index funds based primarily on popular ETF industry benchmarks. Highlights include varying flavors of total market, market cap, international, dividend, and growth or value tilts. The bond funds are split between aggregate, corporate, and Treasury offerings of varying duration segments.

State Street has taken a unique tactic in this instance by re-tooling existing ETFs with established track records and asset bases rather than launching fresh offerings. This will likely sit well with investors who covet battle-tested ETFs over those with zero history in the market.

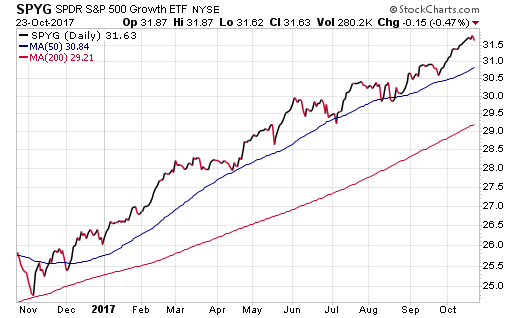

One of the more popular funds in this lineup is the SPDR Portfolio S&P 500 Growth ETF (SPYG), which has over $900 million in assets and charges an ultra-low expense ratio of 0.04%. The S&P 500 Growth Index that SPYG tracks is comprised of 330 large-cap U.S. stocks culled from the broader S&P 500 Index. These companies generally exhibit characteristics of sales growth, momentum, and earnings acceleration to be admitted to the index.

Another easy-to-use building block for diversification purposes is the SPDR Portfolio Total Stock Market ETF (SPTM). This passive ETF tracks the venerable Russell 3000 Index with a rock-bottom 0.03% expense ratio. The 3000 stocks in SPTM represents approximately 98% of the investable U.S. stock market for a highly diverse and liquid basket of holdings.

A similarly broad-based index ETF on the international side is the SPDR Portfolio World ex-US ETF (SPDW). This foreign stock fund tracks over 1,500 publicly traded securities of developed markets outside of the United States for just 0.04% expense annually. Top country allocations include Japan, United Kingdom, France, and Canada. SPDW has over $1 billion in total assets and has climbed more than 22% so far this year.

Those who want to further expand their international exposure can also consider the SPDR Portfolio Emerging Markets ETF (SPEM). This index fund targets stocks within emerging market nations such as China, India, Russia, and Brazil.

Turning to the bond side of the portfolio, the SPDR Portfolio Aggregate Bond ETF (SPAB) is likely to garner some attention for its miniscule 0.04% expense ratio. This ETF tracks the ubiquitous Bloomberg Barclays (LON:BARC) U.S. Aggregate Index and currently has over $1 billion in total assets that is likely to increase significantly because of this expense reduction.

The fixed-income corner is also home to two well-liked corporate bond funds in the SPDR Portfolio Short Term Corporate Bond ETF (SPSB) and SPDR Portfolio Intermediate Term Corporate Bond ETF (SPIB). Each charges a modest 0.07% expense ratio and currently sport nearly $5.5 billion in combined assets.

The Bottom Line

The State Street portfolio series marks a new advancement for the passive investment movement and makes an immediate impact on existing shareholders with their ultra-low fees. It’s reasonable to assume that their partnership with TD Ameritrade will lead to steadier daily trading volume and eventually higher asset levels as well.

It’s also my hope that this group will be expanded in future iterations to include enhanced indexes based on investment factors such as dividend growth, quality, momentum, and others. State Street also has the option of converting more of their existing ETFs to this model by reducing fees and working with brokerage platforms to enhance value for investors around the globe.

All told, the ETF industry fee wars continue to steadily chip away at expenses that lead to better net returns for those who use these flexible and transparent tools.

Note: At the time this article was published, the author and clients of FMD Capital Management have accounts at TD Ameritrade.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Disclosure : FMD Capital Management, its executives, and/or its clients June hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.