Medtronic plc (NYSE:MDT) , a leading global player in medical technology, services and solutions, has made another encouraging move with respect to its Cardiac Rhythm & Heart Failure (CRHF) business. The companyrecently announced the CE Mark approval for Attain Stability Quad MRI SureScan Active-Fixation heart lead.

This is in line with the company’s strategy to focus on research and development of high-end medical device products within its core business lines. Notably, the company is engaged in clinics trials for evaluating Attain Stability Quad MRI SureScan Active-Fixation heart lead in the United States, Canada and other regions.

Medtronic’s latest offering features active-fixation technology that assists in precise lead placement and stability when paired with the company’s quadripolar cardiac resynchronization therapy-defibrillators (CRT-D) and -pacemakers (CRT-P). The company also initiated a multicenter clinical study with a target to enroll roughly 471 patients across 56 sites in the United States, Canada, Europe, Hong Kong and Malaysia. This global study is aimed at evaluating the safety and efficacy of the lead in heart failure patients.

Interestingly, Medtronic’s Cardiac & Vascular group (CVG) segment accounted for 35.9% to total revenues in first-quarter fiscal 2018. Moreover, the company’s CRHF sub-segment was the highest contributor, making up for 52.3% of the total CVG revenues. This was largely backed by strong growth in Arrhythmia Management as well as the HeartWare International acquisition. Thus, the company’s latest development will help boost performance in this segment.

Medtronic’s strategy to gain traction in the CRHFsub-segment seems to be aligned with data provided by Allied Market Research. Per the report, the global Cardiac Monitoring and Cardiac Rhythm Management market is expected to see a CAGR of 7.6% from 2016 to 2022 to reach a value of $32,216 million.

We believe the high incidence of cardiac diseases due to unhealthy lifestyle, penetration by the concerned companies in the untapped markets, technological advancements and increasing awareness among people will continue to drive the global acceptance of this technology. In the view of these encouraging factors, we believe that the company’s European development for Attain Stability Quad MRI SureScan Active-Fixation heart lead is strategic and will broaden its customer base.

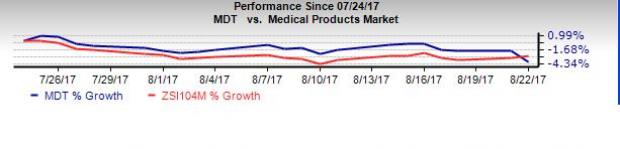

However, over the last month, Medtronic has been underperforming the broader industry. The stock has declined 3.9% as compared to the industry’s 2.9% fall. It also underperformed the 0.9% decline of the S&P 500 over the same time frame. Nevertheless, we believe the latest CE Mark approval will boost investor confidence in the stock.

Zacks Rank & Key Picks

Medtronic currently has a Zacks Rank #3 (Hold). A few better-ranked medical stocks are Edwards Lifesciences Corporation (NYSE:EW) , Lantheus Holdings, Inc. (NASDAQ:LNTH) and IDEXX Laboratories, Inc. (NASDAQ:IDXX) . Edwards Lifesciences sports a Zacks Rank #1 (Strong Buy), while Lantheus Holdings and IDEXX Laboratories carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Edwards Lifesciences has a long-term expected earnings growth rate of 15.2%. The stock has gained around 20.5% over the last six months.

IDEXX Laboratorieshas a long-term expected earnings growth rate of 19.8%. The stock has rallied roughly 6.8% over the last six months.

Lantheus Holdings has a long-term expected earnings growth rate of 12.5%. The stock has gained 28.5% over the last six months.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

IDEXX Laboratories, Inc. (IDXX): Free Stock Analysis Report

Medtronic PLC (MDT): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH): Free Stock Analysis Report

Original post