The Zacks Medical – Products industry consists of companies that provide medical products and top-notch technologies for diagnosis, observation, consultation, treatment along with other healthcare services. Focus on research and development is a key growth strategy for companies in the space.

The industry serves important therapeutic areas like cardiovascular devices, nephrology and urology devices, ophthalmic devices, neurological devices, dermatological devices, respiratory devices, skin care devices, dental devices, orthopedic devices and gastrointestinal devices.

Here are the three major industry themes:

- AI, Medical Mechatronics & Robotics: The growing prevalence of minimally-invasive robot-assisted surgeries, self-automated home-based care, use of IT for quick and improved patient care and shift of the payment system to a value-based model indicate the high prevalence of AI in the Medical Products space. Mechatronics — a high-end technology incorporating electronics, machine learning and mechanical engineering —also characterizes the industry now. Intuitive Surgical (NASDAQ:ISRG) (ISRG) is worth a mention when it comes to AI, robotics and medical mechatronics. The company designs, manufactures and markets the da Vinci surgical system — an advanced robot-assisted surgical platform. This Mechatronic-based platform enables minimally-invasive surgery that helps reduce the trauma associated with open surgery.

- Rampant M&As: Of late, there has been a pickup in M&A activities in this space. This strategy has been helping dominant Medical Products players to expand customer bases and gain leverage apart from lessening pricing pressure and competition. Of the recent ones, Stryker’s(SYK) acquisition of K2M Group Holdings deserves a mention. In fact, MedTech behemoth Medtronic (NYSE:MDT) (MDT) has also taken over Mazor Robotics, an Israel-based robotic surgical guidance systems company, to boost its spine surgery business.

- Emerging Markets Hold Promise: Backed byrising medical awareness and economic prosperity, emerging economies are witnessing solid demand for medical products. Anaging population, relaxed regulations, cheap skilled labor, increasing wealth and government focus on healthcare infrastructure make these markets a happy hunting ground for global medical device players. Zimmer Biomet Holdings (ZBH) has been adopting strategic initiatives to strengthen its foothold in emerging markets that provide long-term opportunities. The company’s investments in these regions to improve operational and sales performance are yielding results. Following the integration of Biomet, the combined company has started to benefit from its solid presence in emerging markets with an expanded portfolio that includes upper and lower joints.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Medical Products industry falls within the broader Zacks Medical sector. It carries a Zacks Industry Rank #83, which places it in the top 33% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

We will present a few stocks that have the potential to outperform the market based on a strong earnings outlook. But it’s worth taking a look at the industry’s shareholder returns and current valuation first.

Industry’s Stock Market Performance

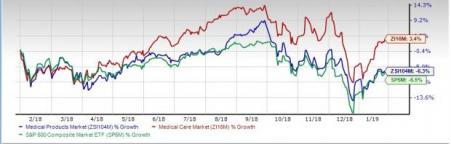

The industry has outperformed the Zacks S&P 500 composite but has lagged its own sector in the past year.

The industry has declined 6.3% over this period compared with the S&P 500’s 6.5% fall. However, the broader sector has returned 3.4% in a year’s time.

One Year Price Performance

Industry’s Current Valuation

On the basis of the forward 12-month price-to-earnings (P/E) ratio, which is commonly used for valuing medical stocks, the industry is currently trading at 19.59X compared with the sector’s 16.84X and the S&P 500’s 16.15X.

Over the past five years, the industry has traded as high as 54.63X, as low as -3.10X, and at the median of 23.00X as the charts show below.

Price-to-Earnings Forward Twelve Months (F12M)

Price-to-Earnings Forward Twelve Months (F12M)

Bottom Line

Apart from the trends discussed above, a bipartisan two-year suspension of a 2.3% excise tax on Medical Products and Medical Device manufacturers at the beginning of 2018 has encouraged massive investments in the sector.

Meanwhile, per a CISION report, the United States remains the largest Medical Products market in the world, raking in more than $180 billion a year owing to rising research and development activities and growing exposure to AI.

Here, we present three stocks that have a Zacks Rank #2 (Buy). These stocks are well positioned to grow in the near term. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Abbott Laboratories (NYSE:ABT) (ABT)

Abbott’s performance in emerging markets has been impressive. We are optimistic about the strong and consistent performance by the company’s EPD and Medical Devices segments organically. Meanwhile, the company has been hogging the limelight within the Diabetes Care segment.

Within the Structural Heart unit, worldwide strong demand of MitraClip improves further following the FDA approval of its upgraded version. These apart, synergies from Alere consolidation, in the form of revenues from Rapid Diagnostics, have been driving growth.

The Zacks Consensus Estimate for the company’s full-year sales is pegged at $31.92 billion, mirroring a 4% rise year over year. The same for adjusted earnings stands at $3.20, reflecting an increase of 11.1% year over year.

The company has returned 10.6% in a year’s time.

Price and Consensus : ABT

.jpg)

BioLife Solutions, Inc. (BLFS)

BioLife’s flagship products like CryoStor and HypoThermosol have been raking in huge profits.

Management further stated that the company's proprietary biopreservation media products have been used in multiple customer clinical applications, including dozens of CAR T-cell and other T cell immunotherapies targeting blood cancers and solid tumors.

The Zacks Consensus Estimate for the company’s full-year sales is pegged at $19.8 million. The same for adjusted earnings is pinned at 15 cents, reflecting an increase of 171.4% year over year.

The company has returned 140.3% in a year’s time.

Price and Consensus : BLFS

.jpg)

Meridian Bioscience Inc. (VIVO)

The company’s solid focus on R&D investment is likely to be beneficial in fiscal 2020 and 2021. Recently, Meridian has also received approval for Novel molecular CMB assay for newborns. In addition, the company established a strategic partnership with the DiaSorin to drive sales of HPSA assay leveraging on DiaSorin liaison instrument.

The Zacks Consensus Estimate for the company’s full-year sales is pegged at $220.7 million, up 3.3% year over year. The same for adjusted earnings stands at 76 cents, indicating a 2.7% increase year over year.

The company has returned 1.5% in a year’s time.

Price and Consensus : VIVO

.jpg)

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Zimmer Biomet Holdings, Inc. (ZBH): Get Free Report

Meridian Bioscience Inc. (VIVO): Free Stock Analysis Report

Stryker Corporation (NYSE:SYK): Free Stock Analysis Report

Medtronic PLC (MDT): Get Free Report

Intuitive Surgical, Inc. (ISRG): Get Free Report

BioLife Solutions, Inc. (BLFS): Get Free Report

Abbott Laboratories (ABT): Free Stock Analysis Report

Original post