The MDU Resources Group Inc. (NYSE:MDU) announced that its board of directors has approved an 2.6% increase in the quarterly dividend rate. The revised dividend will be 19.75 cents, payable on Jan 1, 2018, to shareholders of record at the close of business on Dec 14, 2017.The annualized dividend rate of the company comes to 79 cents while the current dividend yield is 2.94%, better than the S&P 500 yield of 1.81%.

MDU Resources belongs to an exclusive group of companies that raise dividend rate consecutively. The current hike marks 27 consecutive years of dividend increases. The company has been distributing dividends for the last 80 years.

The company intends to fund the dividend payment through its operating cash flows and no equity issuance will be required to fund its 2017 capital expenditure or dividend.

Can the Company Continue its Dividend Run?

MDU Resources has gone through a transition. It exited the E&P business and sold interest in refining business and natural gas processing plant, which helped to lower overall risk profile of the company.

The strategic move has helped the company to focus more on its two business lines — Regulated Energy Delivery and Construction Materials & Services. Growth in these two businesses through organic and inorganic routes will generate enough funds to sustain dividend payouts.

Thanks to rate hike approval by the commission, the company introduced new rates post Jan 1, 2017, resulting in an annual increase in revenues by $37.3 million. However, $15.4 million in rate cases is still pending.

MDU Resources expects its customer base to increase 1-2% annually. The consistent capital expenditure in its regulated business and rate hikes will help it sustain earnings growth over the long term and increase dividend rates.

Zacks Rank & Stocks to Consider

MDU Resources currently has a Zacks Rank #4 (Sell). Some better-ranked stocks in the Zacks Gas Distribution industry are Chesapeake Utilities Corporation (NYSE:CPK) , ONE Gas, Inc. (NYSE:OGS) and Spire Inc. (NYSE:SR) . All of them carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Chesapeake Utilities Corporation’s third-quarter 2017 earnings of 42 cents per share surpassed the Zacks Consensus Estimate of 35 cents by 20%. The company’s 2017 earnings estimates increased 0.7% to $2.85 from $2.83 per share in the last 30 days.

ONE Gas’ third-quarter 2017 earnings of 36 cents per share surpassed the Zacks Consensus Estimate of 28 cents by 28.6%. The company’s 2017 earnings estimates increased 0.7% to $3.01 from $2.99 per share in the last 30 days.

Spire Inc. third-quarter loss of 22 cents was narrower than the Zacks Consensus Estimate of 27 cents. The company’s 2017 earnings estimates increased 1.1% to $3.70 from $3.66 per share in the last 90 days.

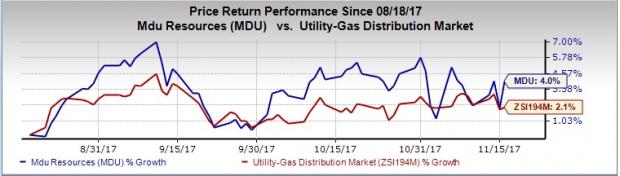

Price Movement

MDU Resources’ shares have returned 4% in the last three months, outperforming 2.1% rally of the industry it belongs to.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Chesapeake Utilities Corporation (CPK): Free Stock Analysis Report

MDU Resources Group, Inc. (MDU): Free Stock Analysis Report

ONE Gas, Inc. (OGS): Free Stock Analysis Report

Spire Inc. (SR): Free Stock Analysis Report

Original post

Zacks Investment Research