Last December, the cryptocurrency market raced to hit a market cap of over $800 billion. And early in 2018, all prediction for the industry pointed towards breaching the $1 trillion market cap. Most analysts even had started to compare the crypto market value with the market cap of Apple (NASDAQ: NASDAQ:AAPL) and Alphabet (NASDAQ:GOOGL) (NASDAQ: GOOG).

However, since then Apple’s market value has topped $1 trillion while Alphabet continues to get ever closer. On the other hand, the cryptocurrency market has plunged to a market cap of less than $250 billion. For instance, the price of bitcoin which now stands at about $3,600 was trading within touching distance of $20,000 around this time in 2017.

This decline has created a created uncertainty about investing in the likes of Bitcoin, Ether, and Litecoin among other notable cryptocurrencies.

Yet, startups looking to disrupt the industry continue to launch their own token sales right, left and center, all looking to disrupt specific segments of the global financial market. Investors though are growing more cautious and this could explain in part, why the crypto market led by the price of bitcoin has plummetted in the last few months.

Nonetheless, the crypto industry has still maintained its status as a disruptive force in the global financial markets and there are those who firmly think things could get better in the near term. But unless you engage in the short-term trading strategies, buying and holding cryptocurrencies might not be the most lucrative opportunities right now. Not unless you try to explore other ways of investing in the industry.

Just like in the stock market, unless the market is on a bull run, the only way holding a long position in a company’s stock would make sense is if it pays dividends. But dividends are a residue of profits made from company revenues. You don’t get this in the cryptocurrency market unless you own shares of a crypto startup.

The other way of making a residual income from crypto investing regardless of the direction of cryptocurrency prices is by investing in masternodes.

So, what are they and is now a good time to invest in cryptocurrency masternodes?

If the market keeps sending mixed signals about the direction of cryptocurrency prices in the short-term, then investing in a few masternodes that could earn you residual income regardless of crypto prices could do no harm. In fact, during a bear market, it becomes cheaper to acquire coins for the required minimum stake amount required to run a masternodes project. However, before you invest in one, it is good to get a grasp of what a masternode is in the cryptocurrency market.

In computing, a node is a device that runs and maintains a computer network. In the cryptocurrency market, there are three common types of nodes, which include full nodes-which can access and store a network, light clients (can access and download part of the network), and masternodes, which are designed to perform specialized functions in a blockchain network. Masternodes have a greater level of responsibility and authority in a network.

In most cases, community members are tasked with setting up the masternodes of a cryptocurrency project to support the smooth functioning of the project, but in some cases, the project creator might choose to do this through his own server. People who choose to run a masternode are rewarded financially for supporting the smooth running of the cryptocurrency project. As such, the more masternodes an investor runs the higher the rewards.

Some cryptocurrencies that offer investors an opportunity to invest in masternodes have likened the practice to the same as having a savings account where one is required to lock up a specified number of coins of the given cryptocurrency in a process called staking in order to run a masternodes project. The rewards paid to masternodes investors are akin to dividends in the stock market, or interest from a savings account.

While most top cryptocurrencies including the likes of Bitcoin, and Litecoin have no such projects, several cryptocurrency projects have adopted this model, which enables crypto investors to invest in the market in more ways than day trading and “HODLing” (buying and holding a cryptocurrency for a long period).

Which cryptocurrencies should you consider for masternodes investing?

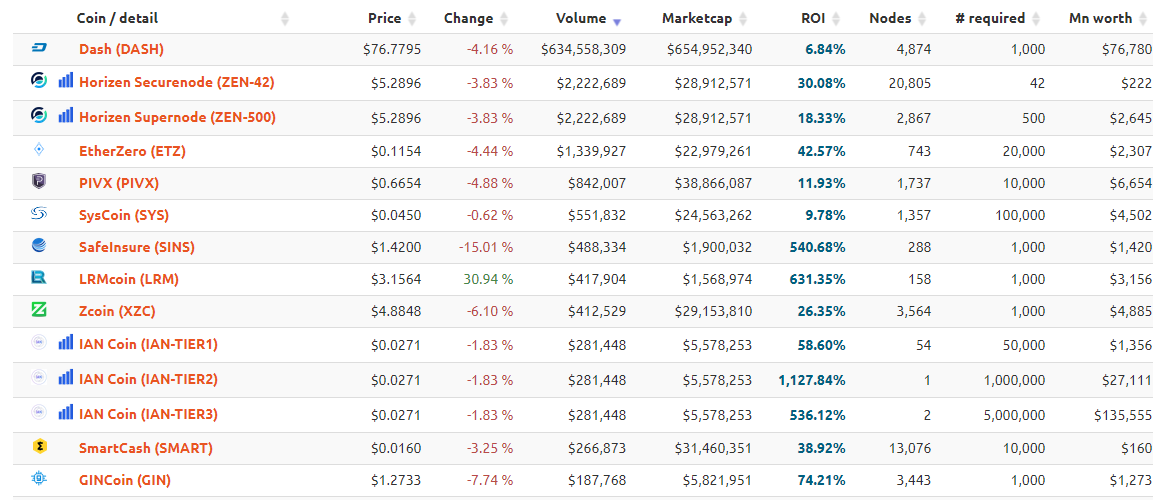

Currently, the most popular cryptocurrency offering investors an opportunity to invest in masternodes according to masternodes.online is Dash (DASH), which incidentally is the pioneer of crypto masternodes as an alternative method of investing in cryptocurrencies. Others that have grown in the last few years to become popular in the cryptocurrency markets include PIVX (PIVX), Horizen Securenode (ZEN-42), and Zcoin (XZC) among others.

Dash may be the most popular masternode in the market, but it is not the most expensive to run. To invest in a Dash masternode, one is required to stake at least 1,000 Dash coins, which based on the current Dash price equates to $76,780 in masternode worth. On the other hand, the Tier 3 of IAN Coin (IAN-TIER3) requires one to buy 5,000,000 coins to run its masternodes, which based on the prevailing price of IAN Coin Tier 3 equates to about $135,555 in masternode worth.

Dash coin masternodes have an average annual Return On Income (ROI) of about 6.84% based on 4874 masternodes run by crypto investors.

On the other hand, PIVX coin, which is another great masternodes project to run has an ROI of 11.93% while Zcoin yields about 26%. One thing to note though about the ROI is that unless the value of the cryptocurrency running the project to that of the US dollar or bitcoin plays a crucial part.

Notably, some masternodes like the Tier 2 of IAN Coin (IAN-Tier2), which offers an ROI of over 1,127% has to date sold just a single masternode while its Dollar price per coin stands at just $0.0271.

Therefore, while Dash might appear to offer a low ROI, its value when pegged to popular cryptocurrencies and fiat currencies is more compelling to masternodes investors, which explains why it continues to maintain the top spot in the top-ranked masternodes in the cryptocurrency market.

Conclusion

In summary, masternodes present crypto investors with a unique opportunity to enjoy some benefits akin to dividend investing in the stock market. One major challenge though of investing in masternodes is the computing power required to support the smooth running of a cryptocurrency project.

Author disclosure: Trading cryptocurrencies or investing in ICOs or related products involves risk. This is not an endorsement to invest in or trade any of the cryptocurrencies or stocks mentioned in this article. I have no positions in the cryptocurrencies and stocks mentioned.