Major credit card processors are scheduled to report earnings over this week and the next. While, American Express Company (NYSE:AXP) and Visa Inc. (NYSE:V) are scheduled to report earnings within a day of each other, Mastercard Inc.’s (NYSE:MA) earnings are due for release next week.

Visa has profited considerably from American Express’ loss of its lucrative partnership with Costco Wholesale Corporation (NASDAQ:COST) , which it has now added to its bag of tie-ups. The reunion with Visa Europe has also strengthened the card processor.

Meanwhile, Mastercard is benefiting from its inorganic growth strategy, such as its acquisitions of VocaLink and NuData Security. Its partnerships, such as its deal with PayPal Holdings, Inc. (NASDAQ:PYPL) have also widened its business opportunities. Meanwhile, Mastercard is making significant progress in its digital strategy and continuously investing in technology.

With Visa and Mastercard scheduled to report within a week of each other, on Jul 20 and Jul 27, respectively this may be a good time to consider which of these is a better stock. Both stocks carry a Zacks Rank #2 (Buy) rating. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price Performance

Shares of both Mastercard and Visa have notched up gains in the year to date period. Visa is marginally ahead with a gain of 24.1%. However, Mastercard is not far behind with an increase of 23.4%, ahead of both the Zacks Financial Transaction Services industry and the S&P 500 which have gained 20.2% and 10%, respectively during this period.

Valuation

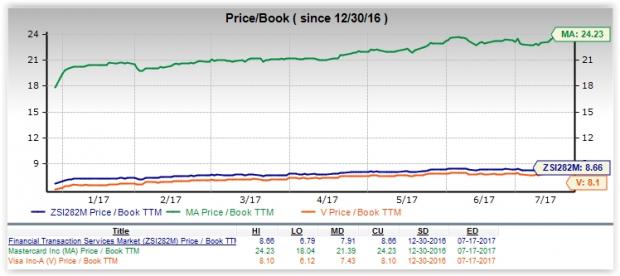

The average one year trailing 12-month P/B ratio is the best multiple for valuing the card processing business because of large variations in earnings results from one quarter to the next.

Coming to the two stocks under consideration, with a P/B ratio of 24.23, Mastercard is overvalued compared to the Zacks Financial Transaction Services industry. On the other hand, Visa has a P/B ratio of 8.10, which is why it is undervalued compared to both the broader industry as well as Mastercard.

Dividend Yield

.jpg)

Coming to dividend yield, while the Financial Transaction Services industry offers a dividend yield of 0.7%, Mastercard offers a marginally lower return of 0.69%. Visa is not far behind, with a dividend yield of 0.68%, which means that this round is too close to call.

Earnings History ESP, Estimate Revisions and EPS Growth

Riding on higher revenues, Visa posted second-quarter fiscal 2017 (ended Mar 31, 2017) earnings of 86 cents per share, beating the Zacks Consensus Estimate of 79 cents. Also, the bottom line improved 27% year over year. Net operating revenue of $4.5 billion surpassed the Zacks Consensus Estimate of $4.2 billion. Also, revenues climbed 23% year over year.

Meanwhile, Mastercard reported first-quarter 2017 earnings of $1.01 per share, which surpassed the Zacks Consensus Estimate of 94 cents by 7.4%. Also, earnings improved 17.4% year over year. MasterCard posted revenues of $2.73 billion for the reported quarter, which topped the Zacks Consensus Estimate of $2.64 billion. On a year-over-year basis, revenues increased 11.8%.

Considering a more comprehensive earnings history, both Mastercard and Visa have delivered positive earnings surprises over the last two quarters. However, Visa holds a slight edge with an average earnings surprise of 7.2% versus Mastercard’s figure of 6.4%. Visa also has a higher expected earnings growth rate of 18.4% for the current year, compared to Mastercard’s expected rate of 13.9%.

However, when considering Earnings ESP, there is nothing to choose from between the two stocks, with both having readings of 0. Estimate revisions for both stocks have increased by 0.1% over the last 30 days.

Conclusion

Our comparative analysis shows that there is nothing to choose between Mastercard and Visa when considering Earnings ESP and estimate revisions. Additionally, both stocks carry a Zacks Rank #2. While Mastercard offers a marginally higher dividend yield, Visa holds a clear edge when considering earnings history, price performance, expected EPS growth and valuations. This is why it may be better to bet on Visa over Mastercard.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

PayPal Holdings, Inc. (PYPL): Free Stock Analysis Report

American Express Company (AXP): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

Mastercard Incorporated (MA): Free Stock Analysis Report

Visa Inc. (V): Free Stock Analysis Report

Original post

Zacks Investment Research