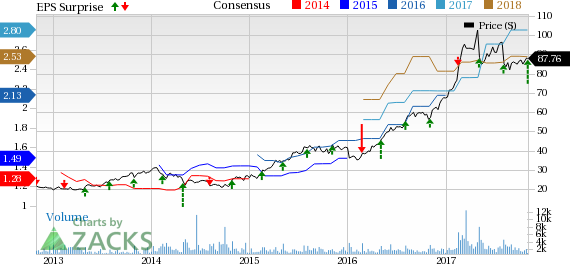

Masimo Corp. (NASDAQ:MASI) reported earnings of 70 cents per share in the third quarter of 2017, outperforming the Zacks Consensus Estimate of 53 cents. The bottom line also improved from the year-ago figure of 52 cents.

Revenues improved 15.6% to $193.7 million from $167.6 million in the year-ago quarter and beat the Zacks Consensus Estimate of $189 million.

Quarter Details

Worldwide direct product revenues (87.7% of product revenue) increased by $21.7 million to $159.1 million. OEM sales (12.3% of product revenues) declined 3% to $22.2 million from the year-ago quarter. Total U.S. product revenues increased 4% to $119.3 million on a year-over-year basis.

The company’s Rainbow product revenues in the reported quarter totaled $21.5 million, which were up 19.9% on a year-over-year basis. During the quarter under review, Masimo shipped approximately 51,000 SET Pulse Oximeters and Rainbow SET Pulse CO-Oximeters, excluding handheld units. Per company estimation, its worldwide installed base was 1,566,000 units, as of Sep 30, 2017, up 5.7% from 1,482,000 units as of Oct 1, 2016.

Financial Condition

As of Sep 30, Masimo’s total cash and cash investments were $289.9 million compared with $306 million as of Dec 31, 2016. The company generated $9 million in cash from operations.

Guidance

Masimo now expects fiscal 2017 revenues of approximately $774 million, up from the previous guidance of $769.0 million. Total fiscal 2017 product revenues are projected at approximately $741 million, up from the prior guidance of $736 million. Royalty revenues projection is unchanged at approximately $33.0 million. Fiscal 2017 earnings per diluted share are expected at around $2.95, up from $2.80.

Zacks Rank & Key Picks

Masimo has a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader medical sector are PetMed Express, Inc. (NASDAQ:PETS) , Luminex Corporation (NASDAQ:LMNX) and Intuitive Surgical, Inc. (NASDAQ:ISRG) . Notably, PetMed and Luminex sport a Zacks Rank #1 (Strong Buy), while Intuitive Surgical carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed reported earnings per share of 43 cents for the second quarter of fiscal 2018, up 79.2% from the year-ago quarter’s 24 cents. Also, gross margin expanded 548 bps year over year to 35.2% in the reported quarter.

Luminex reported adjusted earnings per share of 19 cents in the third quarter of 2017, up 216.7% year over year. The company’s revenues in the quarter increased almost 4.1% year over year to $74.1 million.

Intuitive Surgical posted adjusted earnings of $2.77 per share in the third quarter of 2017, up 34.5% on a year-over-year basis. Also, revenues increased 18% year over year to $806.1 million.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

Luminex Corporation (LMNX): Free Stock Analysis Report

Masimo Corporation (MASI): Free Stock Analysis Report

Original post

Zacks Investment Research