Investing.com’s stocks of the week

Moving Averages are an interesting indicator to me because they can be so important in some cases and so innocuous in others. Much like other technical indicators, they need to be considered in context. When you are using them to explain a story they can be very powerful. Usually stocks tend to stay on one side of a moving average. Above the average = bullish, below the average = bearish.

A crossover then usually switches the stocks tendency from bullish to bearish and vice versa. Also, like other indicators, the longer term timeframe we are looking at the more powerful the moves tend to be, hence why a crossover on an hourly chart means much less than a crossover on a monthly chart. There have been a few good examples lately of how they can be of use for entries and exits, setting stops or limit orders, etc.

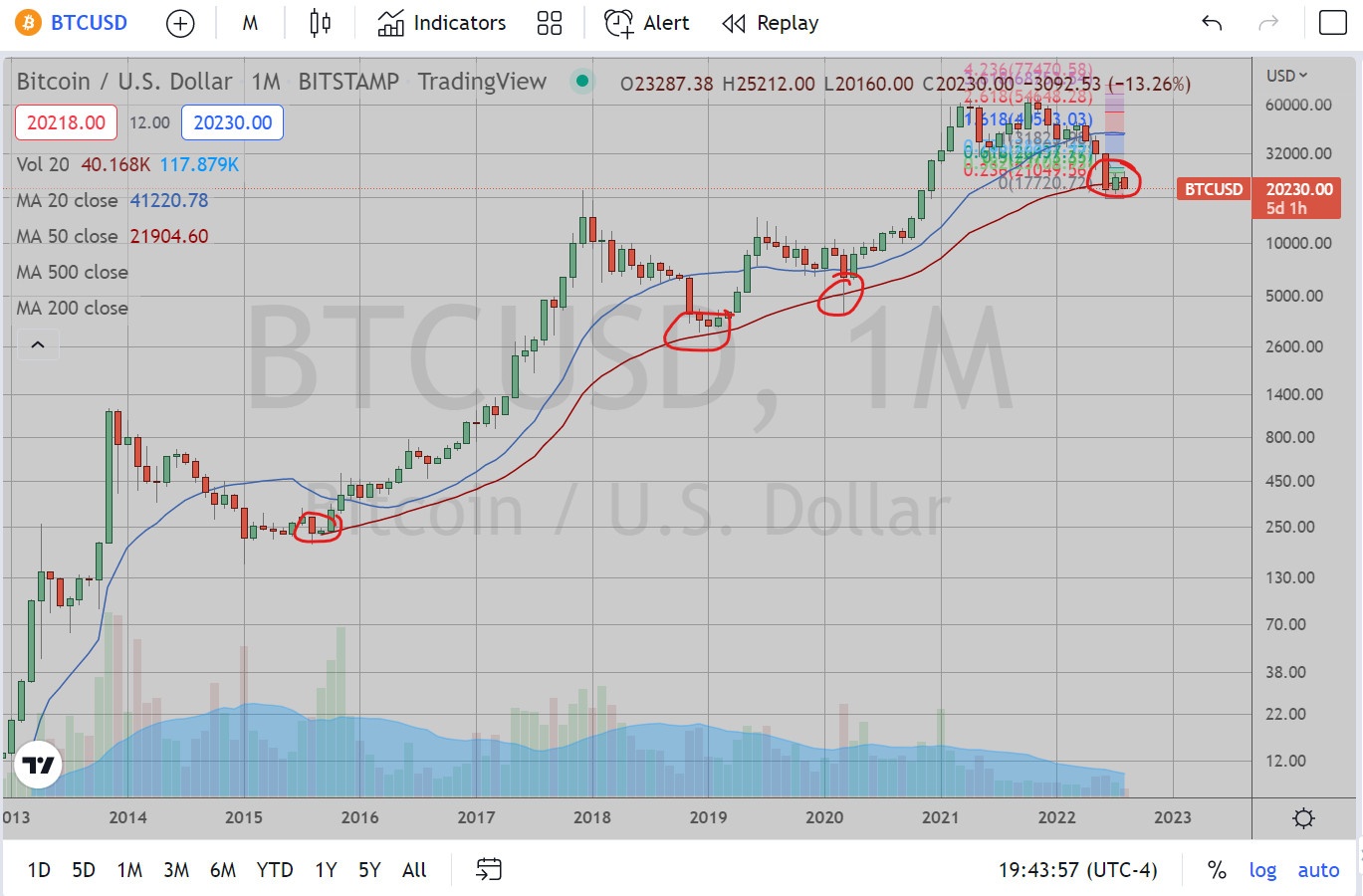

I don’t trade Bitcoin, but I have been bearish on it for some time (albeit even before its meteoric rise so that is not saying much), But it is at a key spot right now that is telling about its near-term future. In this case, the 50-month Exponential Moving Average is at 21904. It has tested this moving average 3 times since 2015 and this fourth time is different. It did trade beneath it in 2020 during the Covid bear market, but closed the monthly candle above this average.

However, this last test is looking much different. It closed a candle beneath it in June, attempted a recovery in July, but is now back below it in August. This is looking for a very bearish crossover. Target? Not sure, that is perhaps better determined using some other technical tool measurement and outside the scope of this discussion. The key is the changing of the winds in sentiment around Bitcoin.

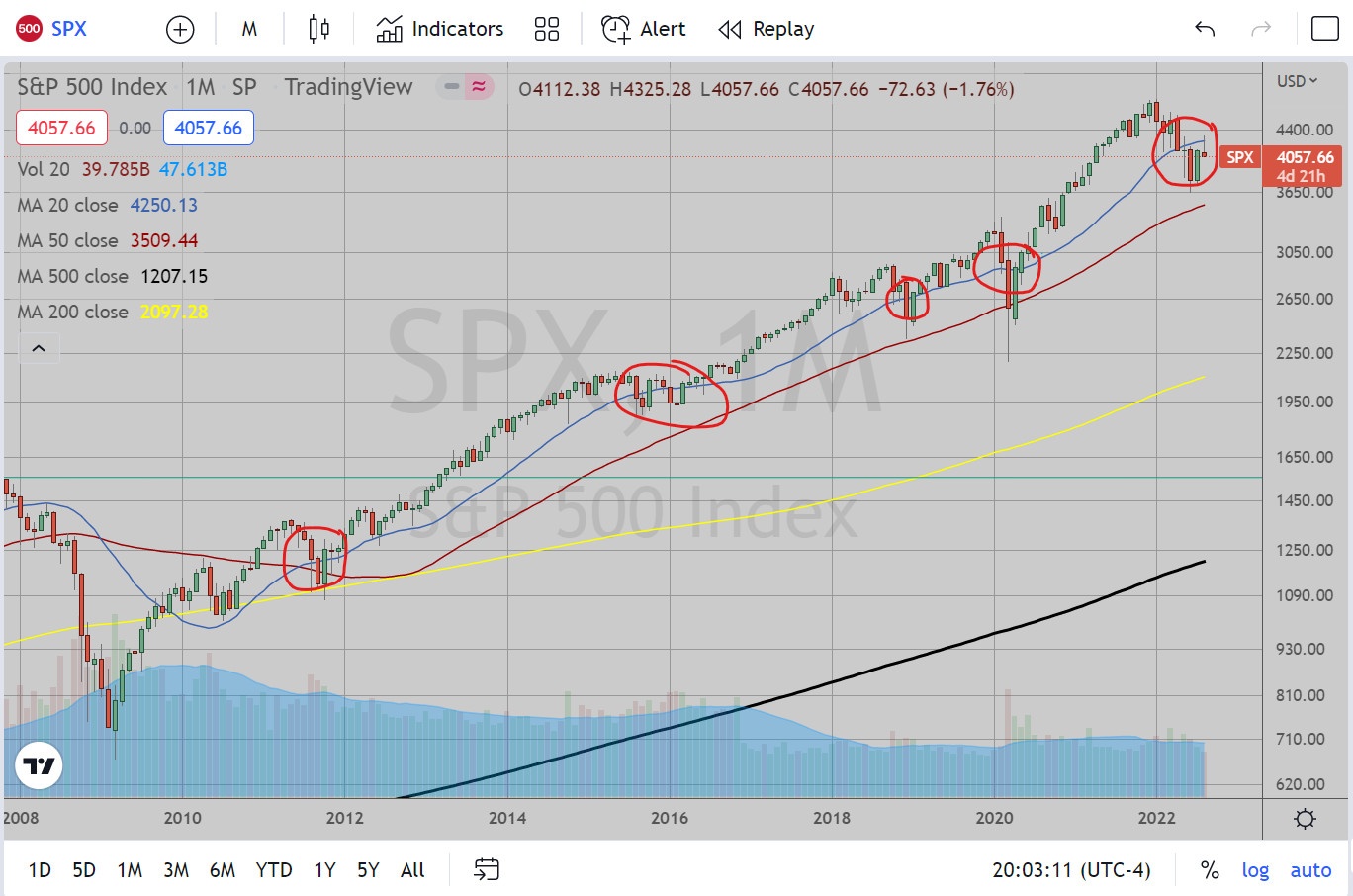

You knew this was coming. This is probably my favorite crossover that I have seen lately. The reason for my excitement is that since the crossover in October 2009 it has tested the 10-month EMA 5 times. The first time was a clean basing pattern which stayed clearly above the average and broke upward. The remaining 4 times were interesting as each time the monthly candle closed beneath it, followed by a reversal candle back above it.

This most recent time, we see a volatile doji star after breaking down through it (May candle), a bearish red candle (June), attempted reversal (July) followed by a reversal breakout attempt and failure (August). This is interesting because this is the longest amount of time we have seen this much market action beneath this average since 2008. A failure here indicates bullish failure and continuation downward. How far is best left to other indicators (perhaps the next lower 50-month EMA at 3500? I think lower, but that is my opinion for other reasons).

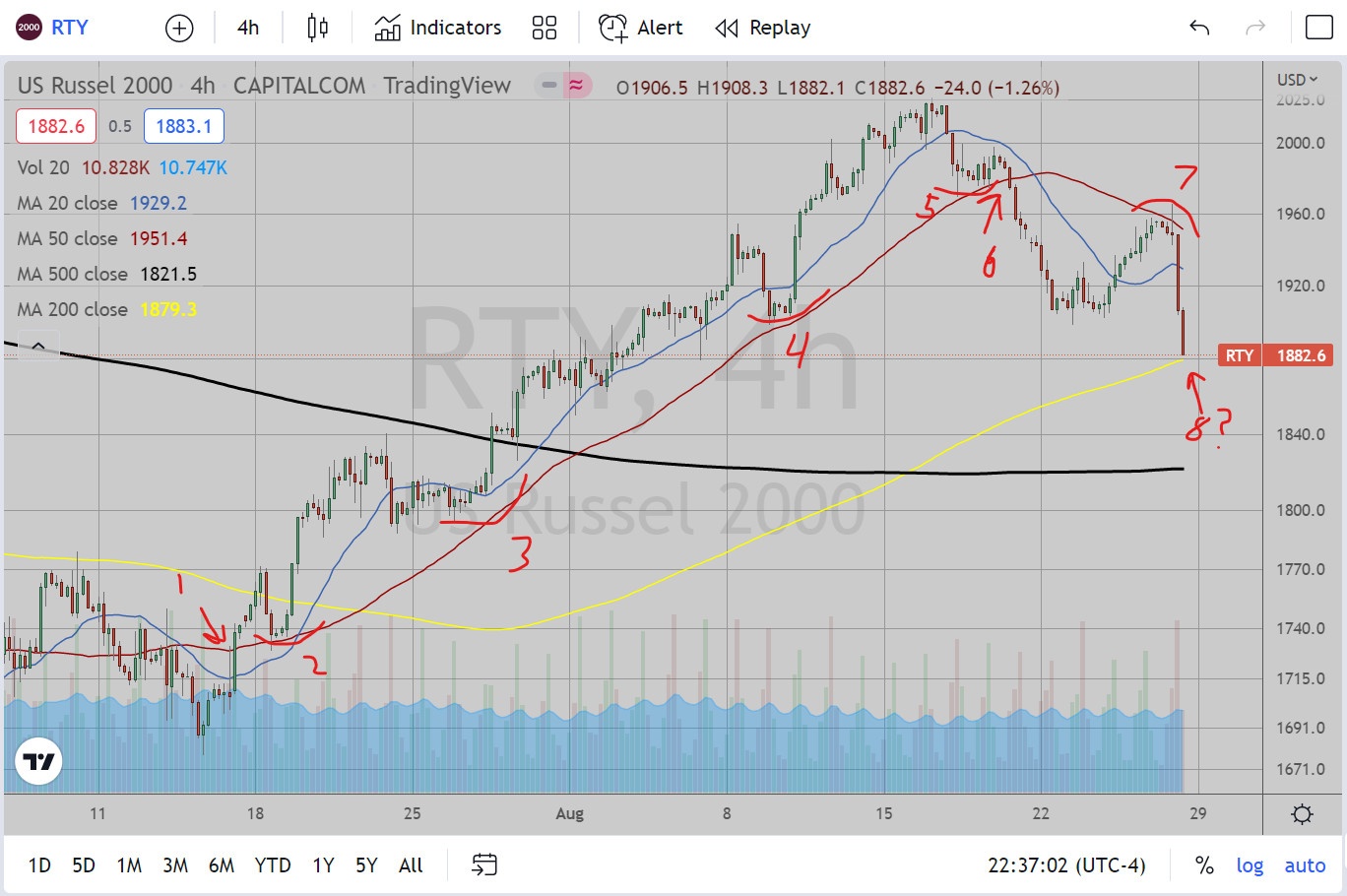

The Russell 2000 on a 4-hour chart looks interesting. Rather than go out monthly, I wanted to show how shorter time frames might work. This had a successful bullish crossover over the 50-4hr EMA back in July 15. There was a pullback retest on July 18. This got close to that 50 EMA a few times and successfully pushed higher and even attempted another base on August 18 (spot 5) but failed and crossed back beneath this average at spot 6. Then we saw a perfect retest from under this average at spot 7 for a rollover we saw Friday.

Finally, spot 8 is an interesting place. This average is the 200 EMA, which is usually a powerful average. I’m sure we’ve heard many times about the 200-day EMA for the S&P 500 plenty of times on financial talk shows. We managed to close almost exactly in that zone. So what does this mean? We haven’t tested this average before so we will have to wait and see. Since this is untested, however, I imagine we may see some consolidation around it but ultimately follow through it downward.

Moving averages are really meant to be just that, an average. There is nothing specifically magical about them, though it is mesmerizing when we see them work so perfectly sometimes. I find that the best usage I get from them is after a broader market trend is determined, then these can be played for good entry and exit points.

I use simplified round numbers for my moving averages, specifically 20, 50, 200, and 500. I have seen others use Fibonacci sequence numbers, such as 8, 21, 55, and 144 in addition to 200 (200 is not a Fibonacci number, but just a widely used Moving Average), but I see no reason to overcomplicate things. Much like all indicators I have found, these should be used to determine “zones” and watching the price action once it gets there to determine next moves.