- The Federal Reserve’s policy change and economic projections have significantly impacted markets, leading to a rise in US yields.

- The US PCE data released on Friday rose less than expected, alleviating some selling pressure on US equities.

- The Bank of Japan held rates steady, defying expectations of a rate cut, while the risk of a U.S. government shutdown increased.

- The upcoming week is expected to have thin liquidity and range-bound trade due to the Christmas holiday and a bank holiday in the UK and other countries.

Week in Review: Hawkish Fed Sends Markets into a Frenzy

A week that finally confirmed the long anticipated ‘pivot’ by the Federal Reserve from a policy perspective. I do not like using the word pivot until the Fed actually confirms that rate cuts are over, however, this week’s announcement and update to the economic projections have had such an impact.

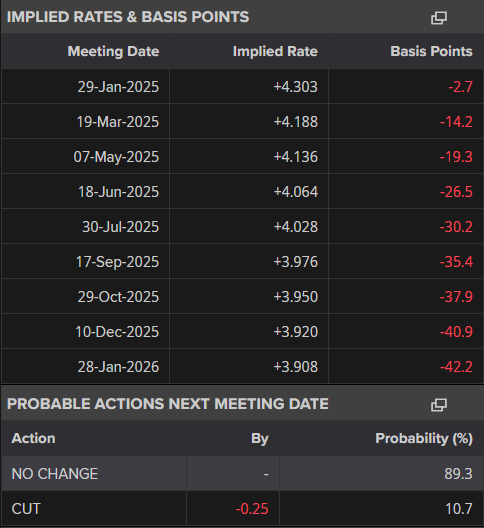

Market participants are now pricing in around 40 bps of cuts through December 2025 as a rise in US Yields has also been mooted.

Source: LSEG (click to enlarge)

The impact was widespread across markets with US equities experiencing their worst day since August. The VIX (volatility index) experienced its second-largest daily jump in history as markets attempted to digest the Fed outlook.

The losses extended to global equities on Thursday and early Friday before the US PCE data provided some respite. Although the PCE (US personal consumption expenditure) remains strong it did rise less than expected which helped alleviate some selling pressure on US equities.

Similar moves were experienced on the FX front with the US Dollar strengthening across the board as the US Dollar Index breached a crucial resistance area.

EUR/USD was back in the 1.0300 area while Gold prices plummeted, surrendering the $2600/oz handle before bouncing back above on Friday as well.

Oil prices continue to feel the weight of growing demand concerns. Given the change in rate cut expectations for 2025, markets are even more concerned about the impact this will have on demand moving forward.

In Asia, the Bank of Japan (BoJ) held rates steady and defied growing expectations of a rate cut. Improving data in Japan did not do enough to convince the BoJ yet, but a rate hike in early 2025 looks probable.

As the Japanese Yen continues to weaken this might also play a role in when the BoJ may decide to hike rates. The Central Bank has said that the decision will not be based on exchange rate, but if anything has become clear, it is that what the BoJ says and does are usually not the same.

The risk of a U.S. government shutdown went up this week after President-elect Donald Trump told Republican lawmakers not to back a temporary funding bill that was expected to pass in Congress. With no backup plan in place, the government is once again at risk of shutting down. While it might not hurt the economy as much as the 2018 shutdown, it’s still a tough situation for public workers, especially during the holiday season.

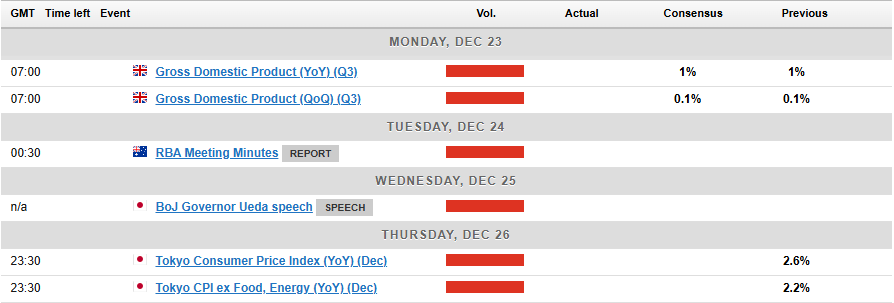

We are heading into a relatively quiet week for markets with Christmas on Wednesday. There is some high-impact data next week but I expect thin liquidity and a lot of rangebound trade.

The Week Ahead: Thin Liquidity Expected with Japanese Inflation and UK GDP Data

Asia Pacific Markets

The week ahead in the Asia Pacific region still brings some high-impact data from Japan.

Tokyo inflation data is due out on December 26th and this will come just one day after a speech by BoJ Governor Ueda. Markets might look toward the Ueda speech for more clues on when the BoJ might finally make its policy move.

An uptick in inflation could also be seen as a positive for a potential rate hike early in 2025.

Europe + UK + US

In developed markets, it is a quiet week as well with the biggest data release being UK GDP Q3 data due out on Monday. The UK has a bank holiday on December 26 along with a host of other countries which makes the week a short one as well.

The Turkish Central Bank will have its rate cut meeting next week. The Central Bank of Turkey hinted that it might start cutting interest rates soon, with a possible move in December. The bank explained that any rate cuts will depend on both current and expected inflation levels. This means they will carefully consider inflation data before and after making any changes.

As things stand, a rate cut does appear likely with my best estimate in the range between 200-250 bps of cuts.

Chart of the Week

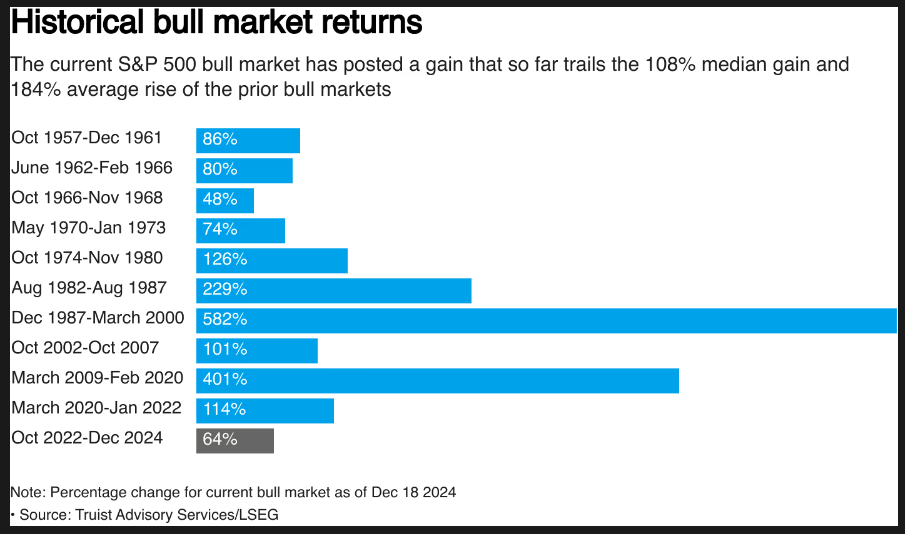

This week’s focus is on US Equities and the S&P 500 in particular following its worst day since August.

Despite the selloff this week, there remains significant optimism for the US Equity market and thus the S&P 500. The S&P has just enjoyed back-to-back years of tremendous growth and yet the historical data supports further gains.

The S&P 500 has gained an average of 12.3% following the eight instances of back-to-back 20% annual gains since 1950, according to Ryan Detrick, chief market strategist at Carson Group, compared to a 9.3% overall average increase over that time. The index increased six of the eight times.

The biggest concern is that weighting of the index is providing a skewed view of actual performance given the Magnificent 7 accounts for more than 30% of the index. Until Friday, the S&P had 13 straight days with a greater number of S&P 500 components closing lower than those closing higher, the longest streak since 1978. This is a concern in my humble opinion.

Source: LSEG

The S&P 500 looked in danger of a deeper correction early on Friday having breached the weekly low. The index touched a daily low of 5789 and came within a whisker of the 100-day MA.

The rally late on Friday has changed the outlook given the size of the rally with the index up around 1.5% at the time of writing.

The PCE print may have had a hand in the rise while there are also options worth $6.6 TRILLION in notional value expiring today which could be having an impact as well.

Looking ahead and a daily hammer candle close as things stand will alter the outlook and likely embolden bulls once more. On the daily timeframe, this could be seen as a pullback following the break of bullish structure on Wednesday.

However, if you drop down to a four-hour timeframe (H4), structure has changed to bullish once more with the previous lower high being broken by the current H4 candlestick.

However, caution may still be the smart play if the index approaches the 6000 and 6030 handles respectively. A clean break and H4 candle close above the 6060 handle could bring the 6170 handle back into focus.

S&P 500 Daily Chart – December 13, 2024

Source: TradingView.Com

Key Levels to Consider:

Support

- 5910

- 5871

- 5828

Resistance

- 6000

- 6030

- 6093