Another week and more disappointment for market participants eyeing rate cuts from the Federal Reserve. A slow start to the week with a lot of rangebound price action through to Thursday afternoons CPI release.

The backend of the week however did not disappoint, US and European indices alike rallying higher on Friday in particular in an attempt to finish the week strong. At the time of writing all wall streets major indexes as well as gold were trading in the green for the week.

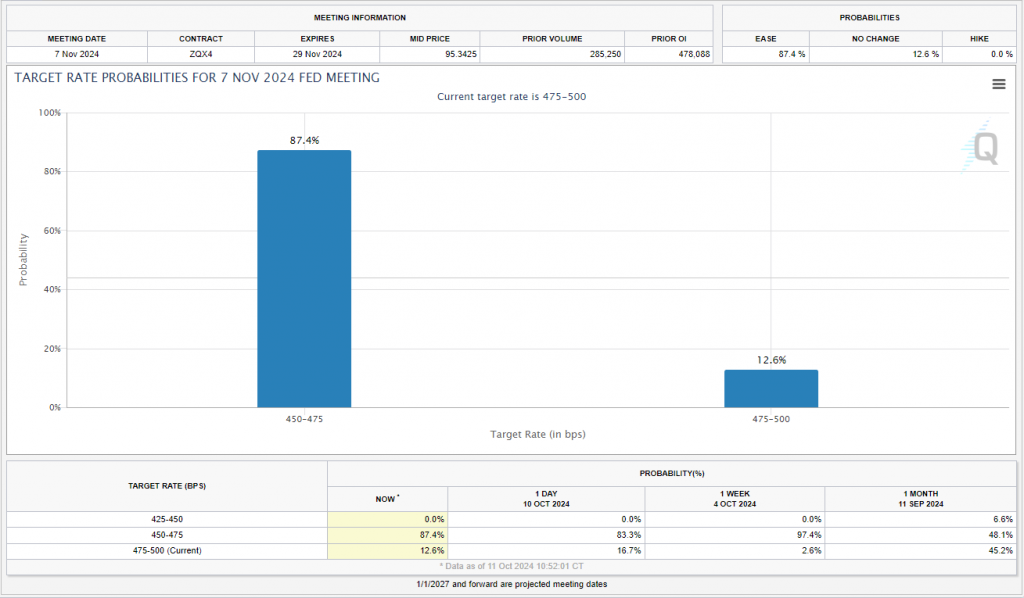

Market pricing for a 25 bps rate cut from the Federal Reserve has changed from 97% probability on October 4, to 87% probability at the time of writing.

Source: CME FedWatch Tool

Oil prices were trading just over 1% higher this week following last week’s rally. The lack of further geopolitical escalation between Israel and Iran kept oil prices in check, coupled with renewed concerns that the recent Chinese stimulus may not be enough to spur on growth.

The FX font saw the US Dollar Index dominate proceedings, with gains across the majors. Emerging market currencies however fared slightly better against the greenback, especially toward the backend of the week.

Earnings season got off to a positive start as JPMorgan Chase & Co (NYSE:JPM)profit beat estimates. The surprise came from the higher interest income and solid performance from the investment banking division. The big tech names and major earnings releases are largely scheduled for later in the month, but next week still brings some big names.

Among the names reporting next week are Netflix (NASDAQ:NFLX), Investment Banks like Blackrock (NYSE:BLK), Bank of America Corp (NYSE:BAC), Citigroup Inc (NYSE:C) and of course Taiwan Semiconductor Manufacturing (NYSE:TSM), better known as TSM.

As the US election draws closer one wonders whether we may start seeing some reaction as polls begin coming through thick and fast. For now though, the week ahead is stacked with key data releases, while the cloud of tensions in the Middle East continues to keep market participants in some sectors on edge.

The Week Ahead: CPI Data, US Earnings and ECB Interest Rates

The week ahead sees a host of CPI releases from China, Canada, New Zealand and the United Kingdom. The biggest event of the week however, is likely to be the ECB rate decision which is a big event for the Euro Area.

Growth has become a sticky point when it comes to the Euro Area and hence the anticipation for this week’s rate meeting. Will a 25 bps cut be enough to stimulate growth?

Asia Pacific Markets

In Asia, data kicks off with Chinese CPI over the weekend. China’s Ministry of Finance also announced a briefing scheduled for 10:00 GMT+8 on Saturday. Markets are largely expecting that Finance Minister Lan Fo’An will unveil a detailed stimulus plan. However, with market expectations running high, there’s potential for disappointment.

Australia will release labor data but eyes will be on the New Zealand CPI print following a 50 bps rate cut this past week. Third-quarter CPI figures are set to be released on Wednesday and could influence the size of the upcoming rate cut by the Reserve Bank of New Zealand.

A sharper than expected drop off in inflation could lead to an increase in rate cut expectations. There is a big gap between the November and February meetings of the RBNZ, thus a softer than expected inflation print could see markets price in an aggressive rate cut for February which could weaken the New Zealand Dollar further.

Europe + UK + US

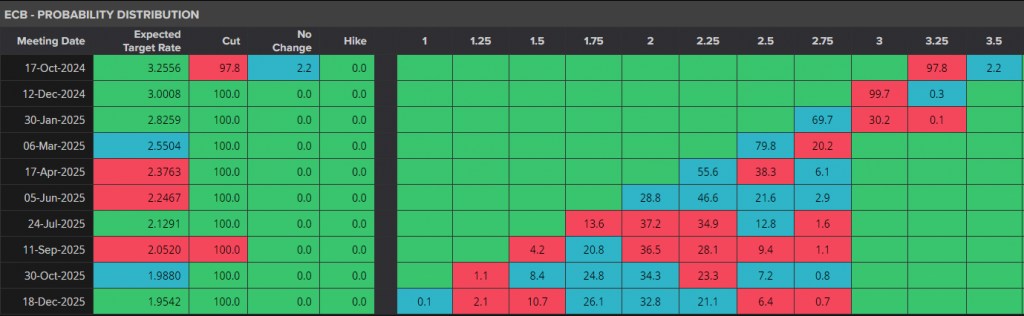

In developed markets, the European Central Bank interest rate meeting will keep the attention of market participants. There has been a stark change over the past month as rate cut bets have significantly increased for the ECB. This has been largely attributed to a wider slow down in the Euro Area while the struggles of Germany continue. At present markets are pricing in around 98% probability that the ECB will cut rates by 25 bps.

Source: LSEG Refinitiv

In the UK, Wednesday’s CPI figures are crucial as analysts assess the Bank of England’s next steps. Based on the UK Overnight Index Swaps (OIS), investors currently see a 75% likelihood of a 25-basis point cut on November 7, with a 60% chance of an additional cut in December.

The August employment report and September retail sales will be released on Tuesday and Friday. Investors will be looking to see if wage growth slowed down and whether consumers continued to spend last month.

The US finally gets a breather as the US Earnings season will take center stage. A host of banks mentioned above coupled with US retail sales will be the highlights.

Chart of the Week

This week’s focus is back to the US Dollar Index (DXY) as it has run into a key confluence area. The conflicting signals between the technical and fundamental picture makes this even more intriguing to keep an eye on.

The confluence area where the 100-day MA rests around 103.20 should provide a stern challenge for the DXY bulls in the early part of next week. A break above this high will face another confluence area where the 200-day MA rests around 103.65.

Conversely, there is potential for a pullback. The Friday daily candle close may give us more insight into the possibility of an early week pullback in price. A bearish or doji close will increase the probability of a pullback, however as i mentioned any downside may be limited depending on Geopolitical conditions and other external dynamics.

Source: TradingView.Com (click to enlarge)

Key Levels to Consider:

Support:

- 102.60

- 102.16

- 101.18

Resistance:

- 103.20

- 103.65

- 104.00

Another chart that may be of interest in the S&P 500 which hit fresh highs this week. There is a massive triangle technical pattern which is still in play that may be of some interest.

Source: TradingView.Com (click to enlarge)