We saw markets react positively and risk sentiment changed. This comes as tensions surrounding North Korea eased after North Korean leader Kim Jong Un said no attack on Guam is imminent, even though the plans are ready, even if he will watch the next actions of the US and as such that it depends on the US how things move forward from now. This statement is likely to be enough for both President Trump and Kim Jong Un to climb down the tree and lessen tensions, at least until next time. Furthermore, we have the South Korean President say that his country will do all it can to prevent the outbreak of war. As such we are seeing safe havens drop and equities move higher as global markets breathed a sigh of relief.

Currencies

EUR/USD – weak European data weakened the EUR and we started the weak with a drop, although the EUR strengthened for five consecutive weeks. There will be enough data this week for volatility, especially the FOMC statement tomorrow but also inflation data out of the Eurozone. The GDP data out of Germany this morning was also lower than expected further weakening the EUR.

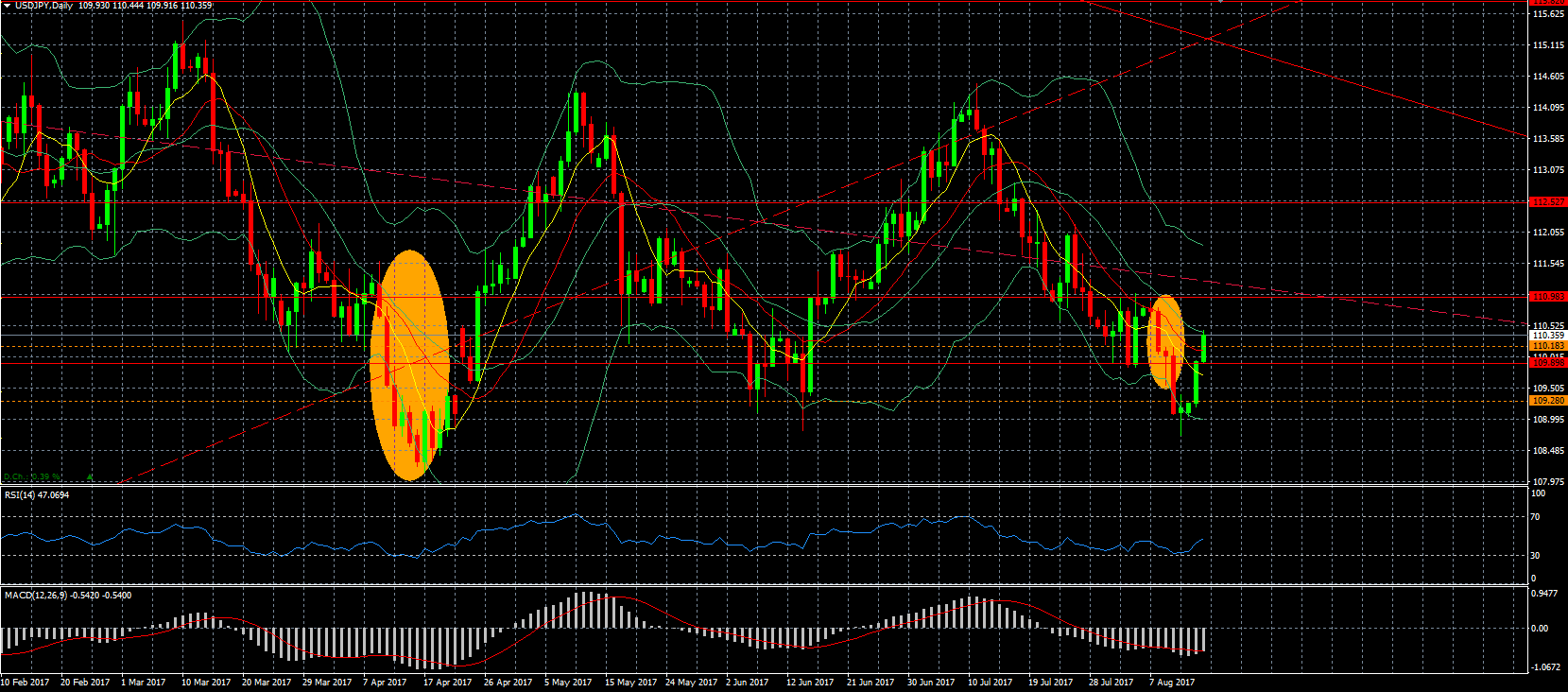

USD/JPY – moved up sharply as tensions around North Korea eased, which resulted in a lower demand for the JPY as a safe haven. This morning saw once again good data out of Japan, but just as yesterday it was not able to have any meaningful influence on the JPY. The data is obviously overshadowed by the geopolitical situation but also as no real change in the policy of the BOJ is expected, unless we see inflation data improve significantly.

GBP/USD – moved down as the USD strengthened across the board, but also GBP weakness has a part as Brexit is still in the headlines. We are moving down and towards the lower band of the range we have been trading in for the past week. There are some who think that a Brexit can still be averted, but that seems highly unlikely. The question is also if PM May will be able to handle the negotiations, something that is being increasingly doubted and as such insecurity is increasing once more and impacting the GBP ahead of today’s inflation data.

AUD/USD – after the RBA meeting minutes the AUD initially strengthened before turning around as the RBA warned of the negative effects on inflation and growth in case the AUD gets too strong.

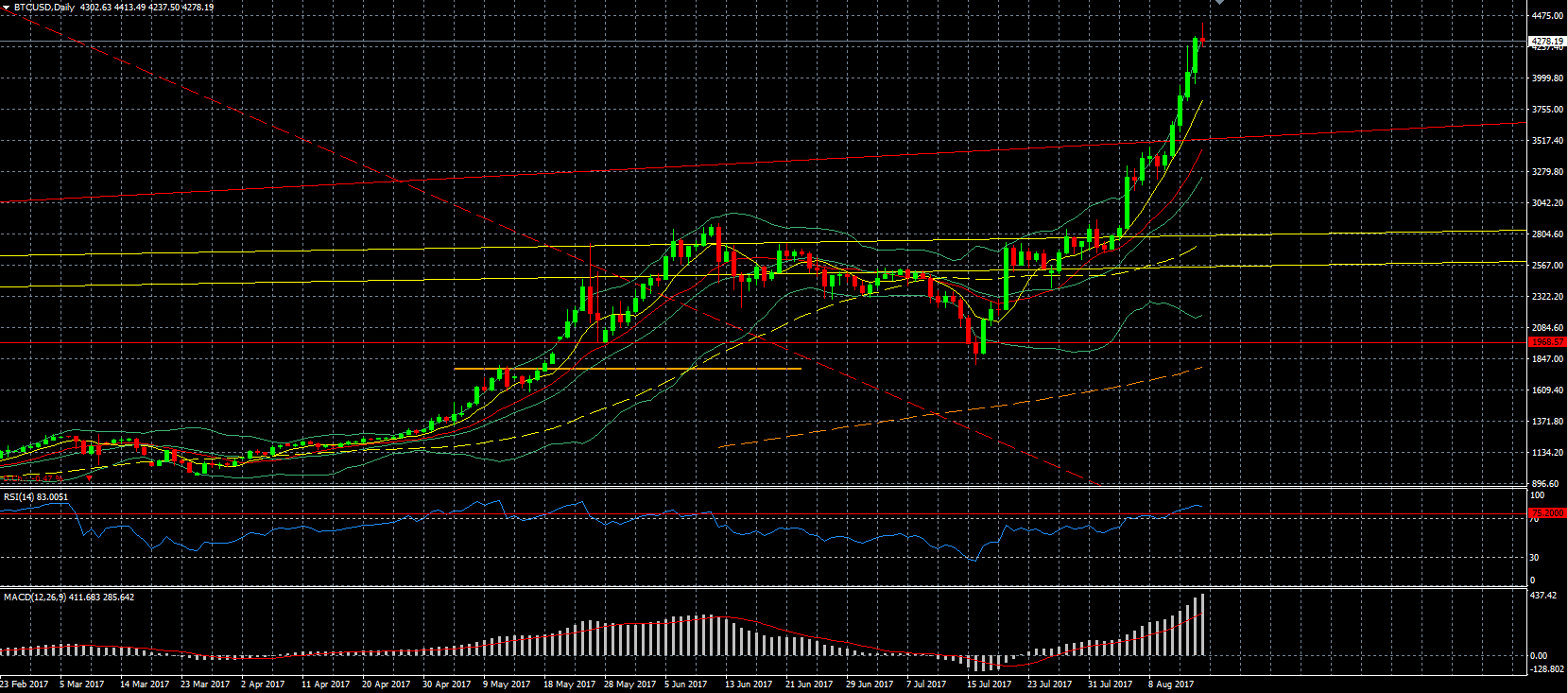

Bitcoin – continues to move up unabated and as such reached a new record high. Goldman Sachs (NYSE:GS) is warning that Bitcoin could be due for a correction after it reached a price just below the 5000 level. For now those who have been betting against Bitcoin have obviously been proven wrong until now.

Indices

Dollar Index – was able to move up as safe havens saw less demand and an influx in USD assets was seen. The USD got a further boost as FED’s Dudley had some positive comments and said that another rate hike is still a possibility, which comes after the weaker than expected inflation data of last week. This will make tomorrows FOMC statement even more interesting.

S&P 500 – the improved risk sentiment was evident in the S&P which rose 1% as all sectors except the energy sector were in the green. As long as the tensions don’t flare up again we could see the S&P attempt to reach a new record high, especially since President Trump will be trying to move forward on his fiscal plans.

VIX – dropped sharply and is nearly trading at levels at which it was trading before the tensions with North Korea erupted. If we see a further reduction in tension and no other developments, we can expect the VIX to drop further.

Commodities

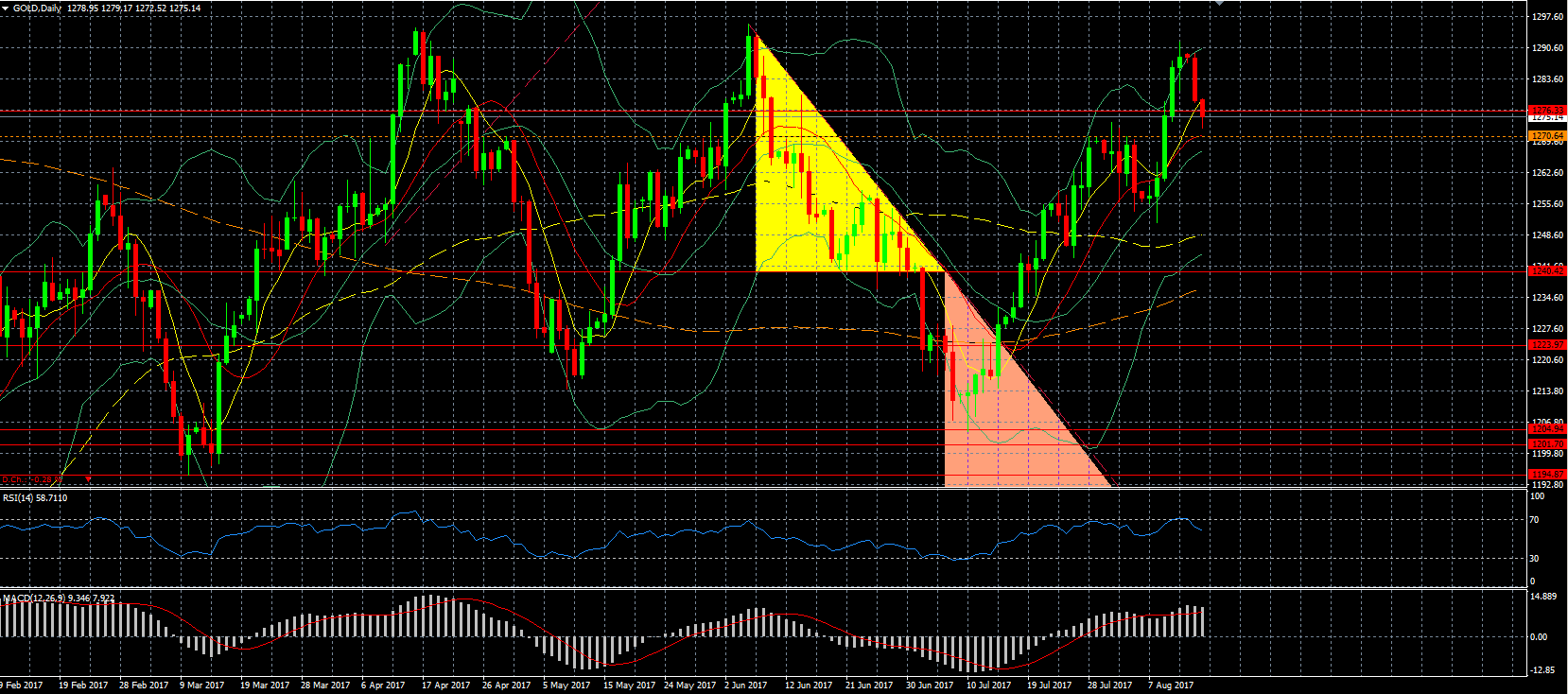

Gold – saw a leg down as risk sentiment improved and there was less demand for safe havens due to the reduced tensions between the US and North Korea. In addition, the USD strengthened which resulted in a drop of over $15 in the price of gold since the weekend.

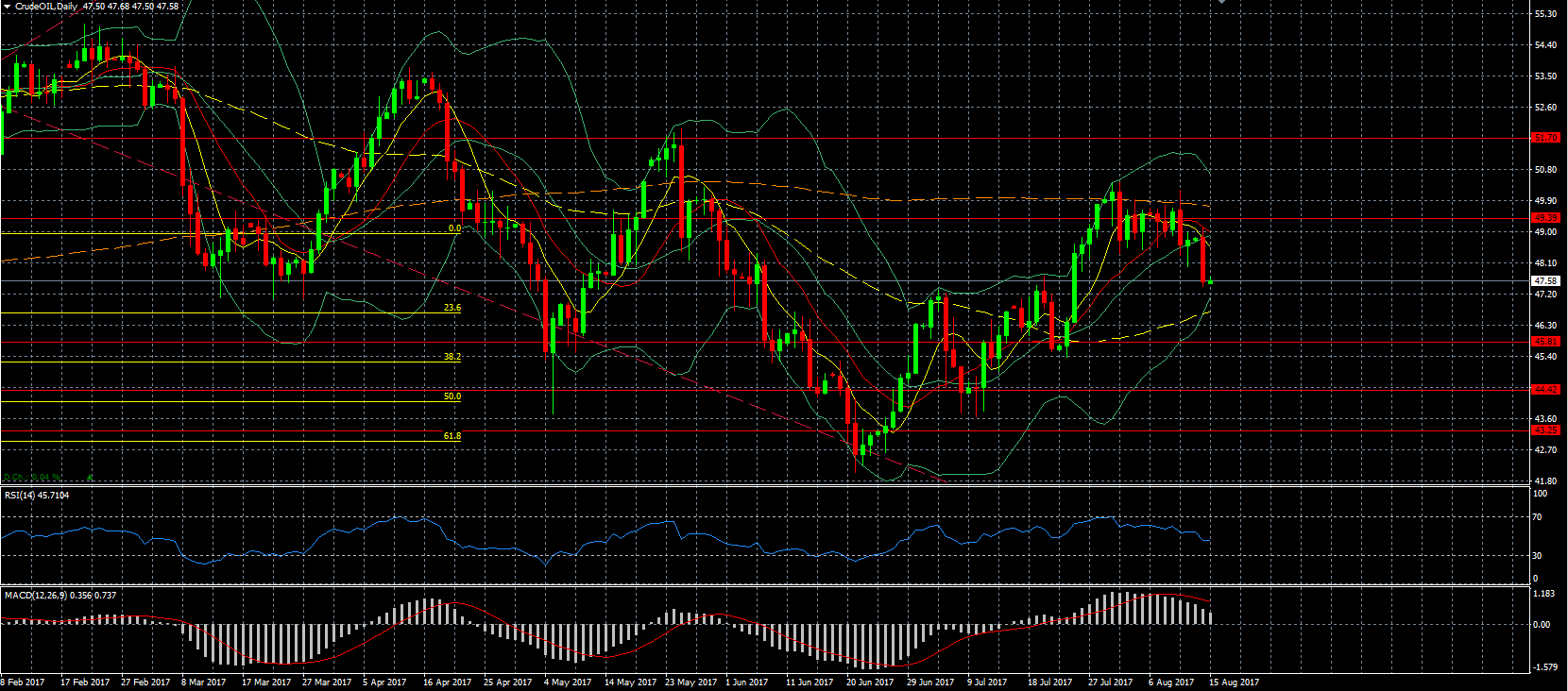

Oil – dropped sharply as data indicates that production in the US is increasing and the weak data out of China had some worried that demand could be lower as well. The fear for lower Chinese demand also follows a report that the level at which Chinese refineries operate dropped to the lowest since September in July. Also, the reduced risk of war weakened the oil price although this was less of an influence. We will be gearing up for the API data again tonight, obviously followed by the EIA inventories tomorrow.

Stocks

GE – is in a clear downtrend with a monthly drop each month since April as also Warren Buffet’s Berkshire Hathaway (NYSE:BRKa) is ending its stake in the company, which could be a trigger for others to do the same as there are quite a few who tend to follow the Oracle (NYSE:ORCL) of Omaha.

Snapchat – moved up from its all-time low even though its lockup period for employees ended, which means that they are now also able to sell the stocks they own since the IPO.

Tesla (NASDAQ:TSLA) – has been moving up again and could be trying to reach a new record high as demand for its bonds has been very high. It initially planned to raise $1.5 billion with the bonds but due to high demand it has raised this to $1.8 billion. This obviously comes amid optimism that Tesla will be able to deliver and that the new Model 3 will make at least part of its promises come true.