The financial markets turned mixed as traders getting cautious ahead of FOMC rate decision. There are also talks that hedge funds are lightening up positions ahead of year end holidays. DJIA closed another record high at 19796.43 overnight, up 39.58 pts, or 0.2%. But S&P 500 closed lower at 2256.37, down -2.57 pts or -0.11%, after initial rise. NASDAQ meanwhile, suffered selling from the beginning and dropped -31.96 pts or -0.59% to close at 5412.54. Treasury yield surged initially with 10 year yield breached 2.5 handle to 2.512 but pared gains to close at 2.479, up 0.015. In other markets, WTI crude oil was boosted by non-OPEC countries agreement on production cut and reached as high as 54.51 but is back at around 52.70. Gold stays soft at around 1165 as there is no follow through buying for stronger recovery.

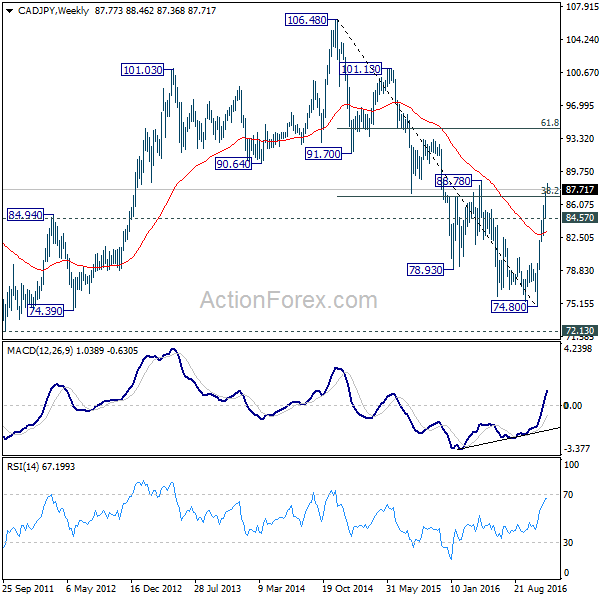

In the currency market, Dollar weakens broadly for the week but loss is limited so far. Yen and Swiss Franc followed closely. Meanwhile, Kiwi and Sterling are so far the strongest ones, followed by Euro which recovered some post ECB loss. Canadian dollar failed to extend the crude oil inspired rise and turned mixed. Overall, the forex markets are lacking a clear direction for the moment. Nonetheless, CAD/JPY is staying as the strongest pair for the month, trading up nearly 3%. CAD/JPY reached as high as 88.46 so far and took out 38.2% retracement of 106.48 to 74.48 at 86.90 firmly. Next focus is 88.78 medium term resistance which could limit upside on initial attempt. But near term outlook will stay bullish as long as 84.57 support. Current momentum warrants extension to 61.8% retracement at 94.37 and above.

On the data front, New Zealand manufacturing activity rose 0.4% in Q3. Australia house price index rose 1.5% qoq in Q3, below expectation of 2.6% qoq. NAB business confidence rose to 5 in November. China industrial production rose 6.2% yoy in November, retail sales rose 10.8% yoy, fixed assets investment rose 8.3% yoy. Inflation data will be a major focus in European session as UK will release CPI and PPI. Eurozone will release employment and German ZEW economic sentiment. US will release import price index.