- Fed’s Waller hints at first half rate cut, but dollar edges up.

- Wall Street slips despite solid US retail sales and strong bank earnings.

- China GDP beat also fails to lift markets as Trump inauguration looms.

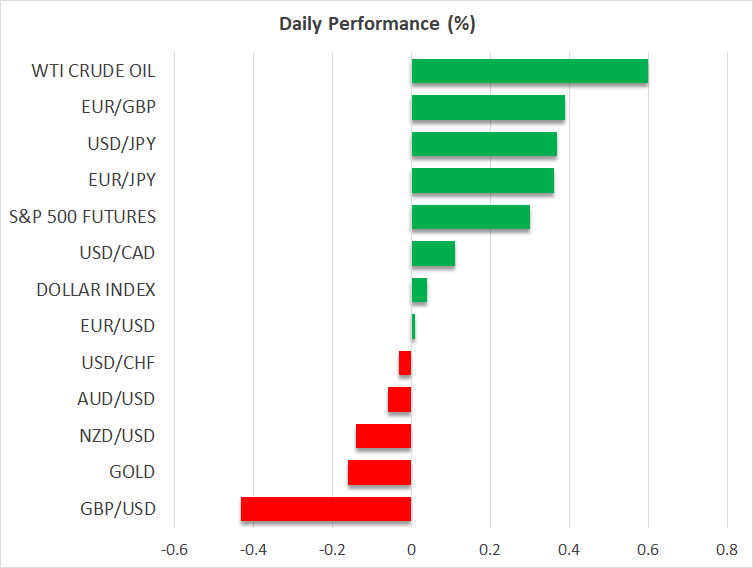

- Pound continues to bleed, stronger yen weighs on Nikkei.

Fed Rate Cut Bets Receive Another Boost

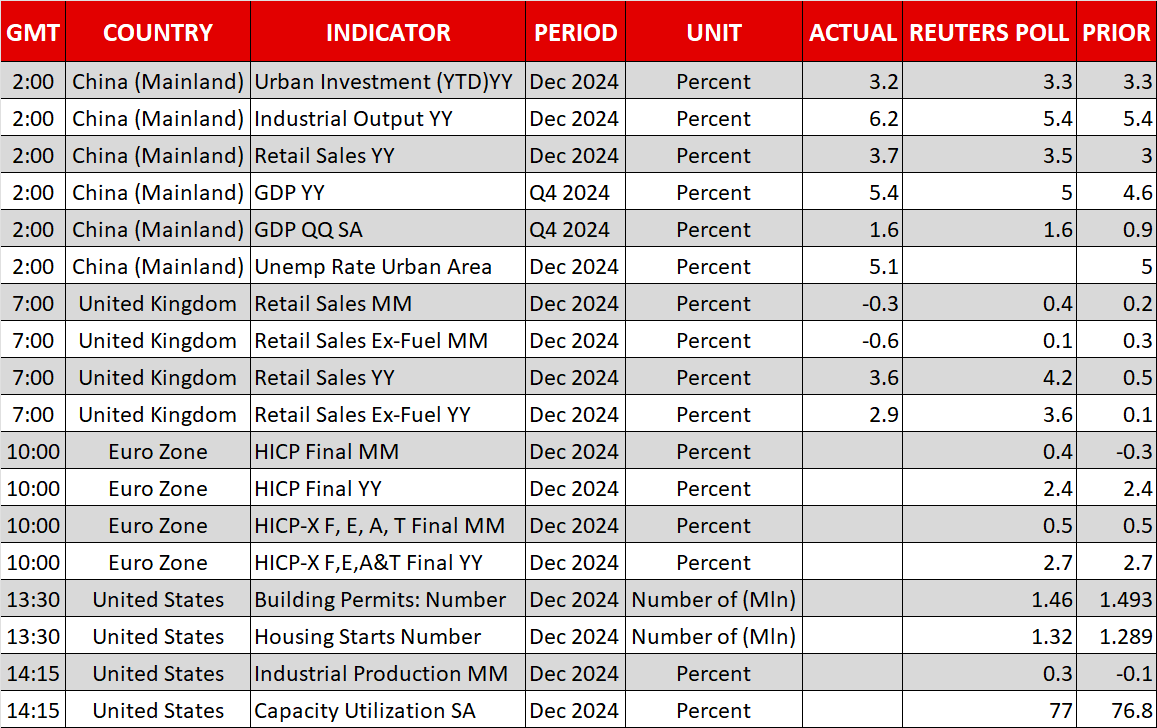

Government bond yields extended their pullback on Friday as investors further ratcheted up their expectations of Fed rate cuts this year. After the surprise drop in core CPI in Wednesday’s inflation report, it was Fed governor, Christopher Waller, who on Thursday gave rate cut hopes another lifeline.

Waller told CNBC that if the CPI data continues to improve, it would be “reasonable” to reduce rates in the first half of the year, adding that the Fed could hit its 2% target “a little quicker than maybe others are thinking”.

Investors responded by bringing forward their expectations of a 25-basis-point rate cut to June from September at the start of the week, while year-end expectations have shot up from just under 30 bps to around 42 bps.

The 10-year Treasury yield has subsequently fallen from 4.80% to about 4.60%.

No Big Selloff for the Dollar Amid Trump Uncertainty

Yet, the slide in the US dollar has been modest relative to its recent gains. When considering that much of the weakness has been against the Japanese yen, which is benefiting from renewed speculation about a rate hike by the Bank of Japan, there doesn’t seem to be strong grounds for a sustained correction in the dollar just yet. Yesterday’s upbeat retail sales numbers out of the US probably added to the restraint for getting too excited about the Fed turning less hawkish.

However, uncertainty ahead of Donald Trump’s inauguration on Monday when he will be sworn in as the 47th president of the United States is likely giving rise to some caution today, supporting the greenback.

Weaker Pound Lifts FTSE, but Nikkei Pummelled by Stronger Yen

Still, the pound stands out as being the weak link among the majors, as it looks set to post a third straight weekly decline. It’s been a busy week for UK data releases consisting of CPI, GDP and retail sales figures. But all three reports came in below expectations, boosting the odds that the Bank of England will lower rates at its February 6 meeting.

Nevertheless, the pound’s freefall has been good news for UK stocks, with the FTSE 100 hitting intra-day record highs today. European stocks have also been rallying this week.

In contrast, Japan’s Nikkei 225 index has been underperforming this month, pressured by the rising yen. Expectations that the Bank of Japan will hike interest rates next week have intensified in recent days following hawkish remarks by policymakers.

Wall Street Rebound Loses Steam, Bitcoin Soars

On Wall Street, however, it was a surprisingly subdued session on Thursday, with impressive bank earnings and Waller’s dovish remarks unable to stretch the week-to-date gains, and the three major indices closed lower. E-mini futures are only modestly higher today and even better-than-expected growth data out of China hasn’t been able to put US stocks on a much firmer footing.

China’s economy grew by 5.4% y/y in Q4, outstripping forecasts of 5.0%. However, question marks remain about the speed of China’s recovery, especially as Trump is widely anticipated to announce higher tariffs on Chinese imports soon into his presidency.

That likely explains why the reaction to the GDP numbers in Asian equities was also muted. Those worries, however, don’t concern crypto traders, as Bitcoin is surging this week, climbing back above $100,000, as the start of Trump’s second term nears.