The forex markets are rather steady as the week opens. Yen is mildly lower against the greenback as Asian stocks recovered. Japanese Nikkei is up 132 pts, or 0.88% while Hong Kong HSI is up 107 pts, or 0.46%. It looks like the yen is having some difficulty to extend last week's rally for the moment and we'd probably see some consolidations. Elsewhere, European majors are also mixed against the greenback as recent consolidations continue. The economic calendar is rather light today. Japanese industrial production was revised to 0.7% mom in May. Eurozone will release industrial production later today and is expected to show 0.3% mom growth in May. ECB president Draghi will speak. With the lack of important events, we'd likely see some more consolidation ahead.

Over the weekend, Bundesbank Chief Weidmann said that monetary policy is "too loose" from Germany's viewpoint. But he also noted that as the country is in a "currency union", the monetary policy decisions must "orientate" to the whole union. He urged that "this phase of low interest rates, this phase of expansive monetary policy, should not last longer than is absolutely necessary." Meanwhile, he said that the crisis in eurozone "has not been overcome yet" and governments have the key in their hands.

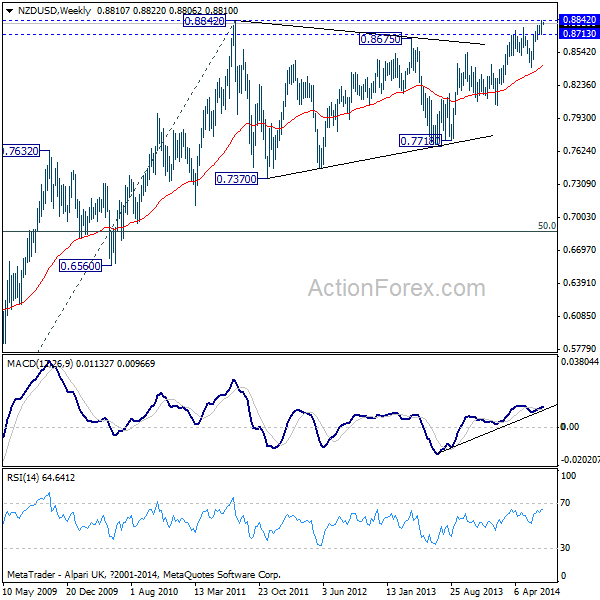

Looking ahead, a key event is Yellen's testimony to Congress on Tuesday. Fed will also release the Beige book economic report. Besides, a number of important economic data will be released from US. Two central banks will meet this week including BoJ and BoC, RBA will release meeting minutes. Sterling will look into inflation and employment data for strength to extend the rally in crosses. New Zealand dollar will look into inflation data for the strength to take out an important resistance at 0.8842 against dollar. here are some highlights of the week.

- Tuesday: RBA minutes; BoJ rate decision; UK CPI, PPI; German ZEW; US retail sales, Empire state manufacturing, import price.

- Wednesday: New Zealand CPI; China GDP; UK employment; Swiss ZEW; Eurozone trade balance; BoC rate decision; US PPI, TIC capital flow, industrial production, NAHB housing market index, Fed's Beige Book

- Thursday: Eurozone CPI; US new residential construction, jobless claims, Philly Fed survey

- Friday: Canada CPI; US U of Michigan sentiments

Technically, NZD/USD will be a major focus this week as it's now testing key resistance level of 0.8842 (2011 high). The long term consolidation pattern from 0.8842 could have completed at 0.7718 already. But the momentum of the rise from 0.7718 is not too convincing yet. As long as 0.8713 near term support holds, a break of 0.8842 is in favor. And, in that case, NZD/USD should at least have a take on 0.9 psychological level. However, break of 0.8713 will argue that rise form 0.7728 is already completed and the long term sideway pattern is starting another falling leg. In that case, near term outlook will be turned bearish.