The glass of economic data is half full if we estimate the reaction to the macroeconomic data. This applies to both last Friday’s U.S. employment report, and China’s GDP figures released this morning. The published data for the 4th quarter of 2019 showed that the economy slowed down to 30-year lows. A quarter earlier, this slowdown was seen as a strong enough reason to sell out in the markets. Observers are now paying attention to signs of stabilization, as the growth remains at 6.0% YoY for the second consecutive quarter, also noting that industrial production and retail sales accelerated in December.

Chinese yuan got a new boost from this data. The USD/CNH pair declined to 6.85, its lowest value since July 2019. Among the significant movements, it is also worth noting that the pair USD/JPY has overcome the 110 mark – a psychologically substantial round level, as well as 29000 for Dow Jones.

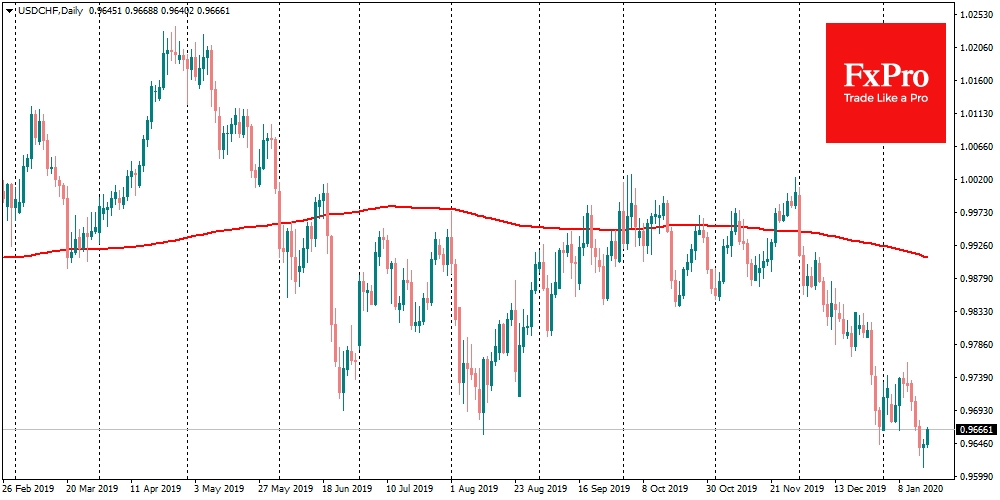

On the currency market, it is worth noting the dynamics of the Swiss franc. On Friday morning, USD/CHF and EUR/CHF rolled back from multimonth lows. The rally of the franc this week held on speculation that the SNB will reduce the scale of the FX interventions, curbing CHF growth. However, this rally was move against the stream amid declining prices for “safe” assets. Therefore, the reversal of the franc on Friday may turn out to be a more stretched move, rather than just a Friday’s profit-taking.

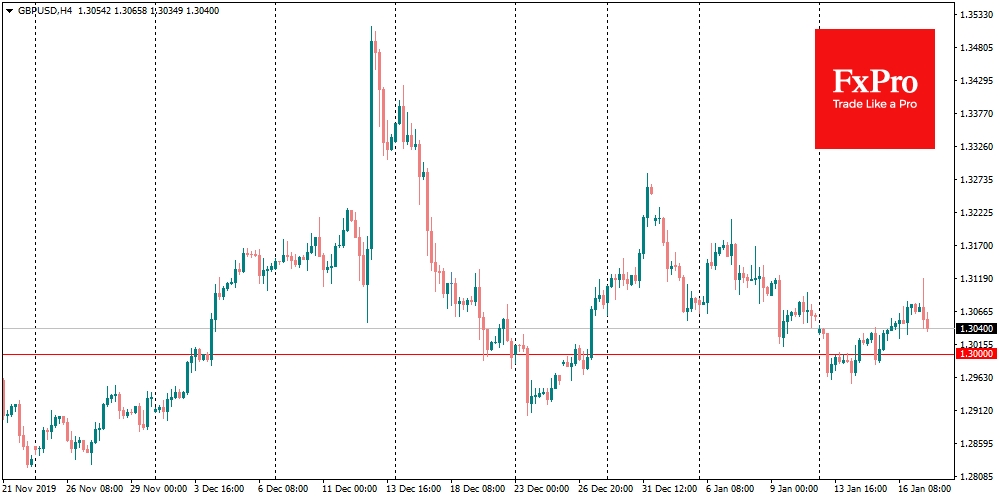

GBP/USD continue its struggle for the levels around 1.3000. The pair got support after the decline at the start of the week, despite the weak data. The retail sales figures, which will be published later today, may both bring the pair back to decline, confirming the weakness of the British economy, or contribute to the strengthening of purchases in case of retail activity recovery.

The FxPro Analyst Team