Traders and investors are taking a little break today as stock futures in the US and Europe show no clear direction. This is because last week, the US and European equity markets performed tremendously.

The stock indices over in the US, especially, the Nasdaq index, invited many new investors as the sell-off that happened at the beginning of this month was considered an opportunity to bag a bargain. This week is important for traders because of important economic data and the FOMC Meeting Minutes due on Wednesday.

Asian Stock Market

In Asia, investors are adopting a more cautious approach to their trading. This is primarily due to the fact that we have a number of central banks in Asia that will release their monetary policy decisions.

For instance, Bank of Korea will release its decision on Thursday. Additionally, the inflation data will likely influence the monetary policy decisions among central banks. Japan's inflation is due on Thursday, and the BOJ will closely examine the data.

Traders do not anticipate a further response from the BOJ; however, if the inflation data significantly deviates from the chart, either too high or too low, the bank may need to take action.

Overall, the price action in the equity markets has been very much mixed, as the South Korean Kospi was trading lower at the time of writing this report while the Hong Kong’s Hang Seng Index was above water with a gain of over 1%.

Economic Docket That Matters

Our first item is Canadian dollar inflation data due tomorrow. The data is highly likely to impact the trading action of the Canadian dollar, as traders would anticipate a reaction from the BOC on the back of this number.

The expectations for CPI m/m are to fall to 2.5% from its previous reading of 2.6%. Connor Woods, from HowToTrade.com said, if the actual number doesn't align with the expectations, the market is likely to react, potentially leading to higher expectations of a rate cut from the BOC.

This is because the bar for action would be significantly lower given the current rates. A potential rate cut would also be positive for the country because it would spur economic growth and boost economic confidence.

But the most important event for this week is the FOMC meeting minutes. The question for traders is how tight the Fed Chairman will be in light of recent inflation data and the US NFP.

Market players are highly confident that the Fed will cut the rate much higher than previously anticipated. The question is whether the Fed Chairman will give any clues about this, as the September rate cut date is just around the corner.

The Chairman will also be giving a speech at the Jackson Hole Symposium, providing another opportunity to decipher any hidden clues about the future of monetary policy.

Gold Prices

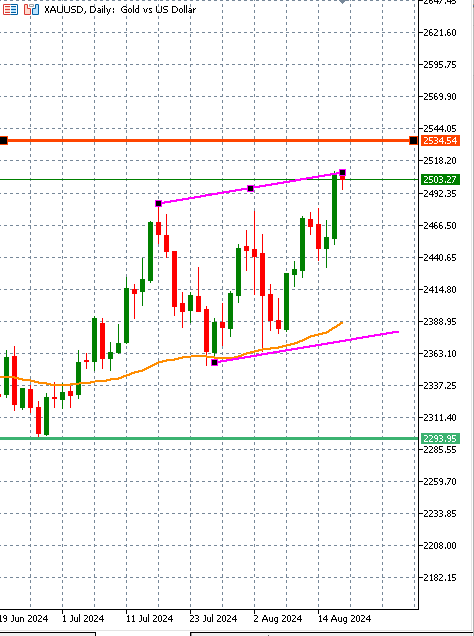

Gold prices closed in positive territory last week, as the shining metal recorded some really solid gains and closed above the important level of 2,500.

Now, traders are asking themselves if the rally will continue or if this is a good time for them to take some profit off the table given the fact that geopolitical tensions have eased off to a large extent.

Well, most traders are likely to take some profit off the table, and it is possible that the price may see retracement, and this is purely because the gold price has gone too far and too quick.

The price level of 2,500 is very hot for many traders, and they are not going to feel very comfortable buying gold above this price point. In addition, we have a risk appetite among investors and traders, which means that more and more traders are likely to support riskier assets rather than the gold price.

From a technical price perspective, the price is very much trading near the upper line of the upward channel which means that a retracement is highly likely.

Having said this, the bulls are not going to be worried as the shinning metal’s price is trading above the 50-day SMA on the daily time frame which confirms that bulls are on the driving seat and the trend is likely to continue as long as the price continues to trade above this SMA.

The immediate resistance and support levels are shown on the chart by the red and green horizontal lines respectively.