- The DXY US dollar index gained 0.2%

- The Kiwi dollar was the best performing G-10 currency gaining 0.4%

- The Aussie was basically flat on the session holding US$0.7612

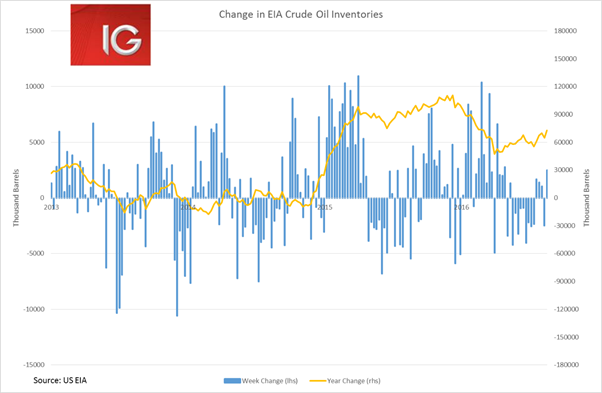

- WTI oil dropped 2.7% after an increase in EIA inventories

- Gold lost 1% falling to US$1,324

Earnings: Flight Centre Ltd (AX:FLT), Iluka Resources Ltd (AX:ILU), Mesoblast Ltd (AX:MSB), Nine Ent Fpo (AX:NEC), Perpetual Ltd (AX:PPT), Retail Food Group Ltd (AX:RFG), South32 Ltd (AX:S32), Southern Cross Media Group Ltd (AX:SXL), Village Roadshow Ltd (AX:VRL), Western Areas Ltd (AX:WSA), Woolworths Ltd (AX:WOW).

Markets began to lurch slightly lower overnight as traders started positioning in case Janet Yellen follows Stanley Fischer’s recent hawkish tone in her speech on Friday. This was most evident in the DXY US dollar index’s gains overnight. Although some of this was pared back after US existing home sales disappointed market expectations, the US Dollar Index still closed up 0.2%.

The Bloomberg commodity index did not fare well in the rising US dollar environment overnight, dropping 1.2%. Copper continued to slide a further 1.7%. But WTI oil also sold off heavily, losing 2.7% as the EIA crude oil inventories increased by 2.5 million barrels largely cancelling out last week’s decline. To add fuel to the fire, Iran also said it had not decided on whether it would attend next month’s OPEC meeting in Algiers, even though it was reported yesterday that it would.

Emerging markets certainly appear to be struggling this week as fears of a hawkish turn from the Fed have halted their rally. Global bond fund allocations towards emerging markets have reached their highest levels in four years according to Morningstar’s data. The heightened low yield environment in the wake of Brexit has seen investors seeking out yield and piling into emerging market carry trades with little consideration for the some of the messy situations these countries find themselves in. Concerns about the police investigating South Africa’s finance minister, and worries about Turkey’s newly launched military campaign in Syria have continued to sap sentiment in emerging markets.

Concerns about future Fed policy and the pullback in commodity prices are taking their toll with the EEM iShares MSCI Emerging Markets ETF (NYSE:EEM) losing 2.3% over the past week.

The Asian session looks like it will struggle at the open after a poor close from US markets. Low volumes and cautious trade are likely to dictate markets in the lead up to Janet Yellen’s speech on Friday. The S&P/ASX 200 is set to open slightly lower with the materials and energy sectors looking set for a tough day. BHP’s ADR dropped 2.2% overnight while CBA’s has a relatively muted session.