Markets are holding their breath as the highly anticipated FOMC meeting awaited. DJIA's recovery lost steam and closed down -44.11 pts, or -0.21%, at 20837.37 after breaching 20800 briefly. S&P 500 also lost -8.02 pts, or -0.34%, to close at 2365.45. Both indices are holding above last week's low at 20777.16 and 2354.54 so far. 10 year yield stayed in tight range below recent resistance at 2.621 and closed down -0.013 at 2.595. Gold continued to engage in range trading around 1200. WTI crude oil dived sharply to as low as 47.09 but recovered to 48.50 for the moment.

Dollar index trading mildly higher to 101.70 at the time of writing, holding above 100.66 near term support. In the currency market, despite some volatility, major pairs and crosses are generally stuck in last week's range, except GBP/CHF. General weakness is seen in Euro for the week as the common currency pared back post ECB gains. Yen follows as the second weakest as its rebound attempt quickly falters.

Fed to upgrade economic projections

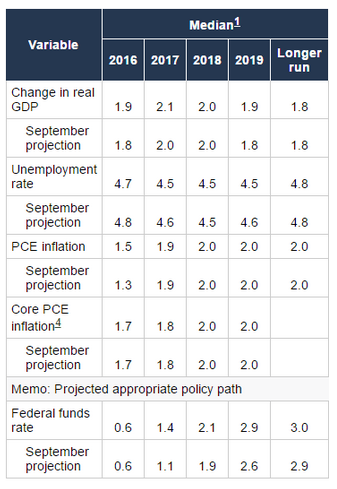

Fed is widely expected to hike federal funds rate by 25bps to 0.75-1.00%. The rate hike itself is well priced in. Thus the focus will be largely on three things, the FOMC statement, new economic projection, and Fed chair Janet Yellen's press conference. Markets are looking through today's hike and are eager to get the hints on what Fed would do next. The table below showed FOMC's median projections back in December.

Federal funds rate are projected to be at 1.4% by the end of 2017, 2.1% by the end of 2018. They equivalent to 3 rate hikes in total for this year and 2-3 hikes next year. Any upward revision to the numbers will imply a faster path. In particular, some analysts are anticipating a meaningful revision to 2018's projections to reflect a firmer chance of 3 hikes. Meanwhile, the markets will also look closely to the revisions to economic projections, with focuses on the core PCE number for this year and next.