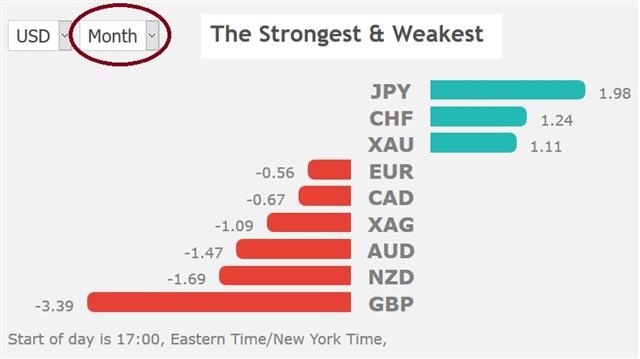

Global indices take a sharp leg down after president Trump shifted attention from China to Mexico. The selloff began around 3 am London time when Trump threatened Mexico with a 5% tariff on all its goods, if it does not halt immigrants from illegally entering the US. The Mexican peso andoil were the bigggest decliners, as was the loonie. The chart below shows how May's ugly market showing has pushed JPY, CHF and gold to the top of the performers at the expense of GBP, AUD and NZD. has been The allowed the DAX long to be stopped out, while the existing Index short deepens in the money. A new FX trade was added before yesterday's NY close.

The Trump team warned that the 5% tariff would rise to 25% by October 1st if illegal immigration were not addresed by the Mexico.

Just as China was threatening to restrict its rare earths exports, Trump shifted to Mexico, broadening the risk-off impact of the trade war, which increasingly appears to become the New Cold War of global economics.

Today's upcoming release on US PCE is a key test for the US dollar as Clarida cracked open the door to a rate cut. More on the PCE below.

On the Bank of Canada

A few word on the thenotable contrast in speeches between the top deputies at the BOC and Fed.BoC's Wilkins emphasized upside and downside risks while highlighting that lower bond market rates since the start of the year are stimulating the economy. Fed's Clarida warned that downside risks could call for more accommodative policy and that the global economy has been softer than assumed six months ago.

He also emphasized that inflation has been lower than expected. That was a key takeaway from revisions to Q1 GDP as PCE inflation was cut to 1.0% annualized from 1.3%. That drop led to a bid in bonds that pushed yields 5 bps lower across the curve and back to Wednesday's lows.

Those levels could be taken out if Friday's April PCE report paints a similar picture. The PCE deflator is expected up 1.6% y/y on both core and headline but after GDP, those risks are certainly on the downside. The details in the data will be especially important because the FOMC has been pushing a narrative that the weakness is temporary and confined to a few skews. The data is out at 1230 GMT, 13:30 London.