It has almost been lost this year but it is true, markets go both up and down. Not just on a broad time scale but day to day and intraday. Trends develop and can persist, but there is no straight line move in one direction.

With the S&P 500 and Russell 2000 moving mainly sideways this year the brain has been primed to think that there is a range and when the price hits the bottom it moves up. The US dollar and oil have been that way too. When it hits the top it moves back down. It has been so predictable that seasoned traders are no longer waiting for it to happen but anticipating it.

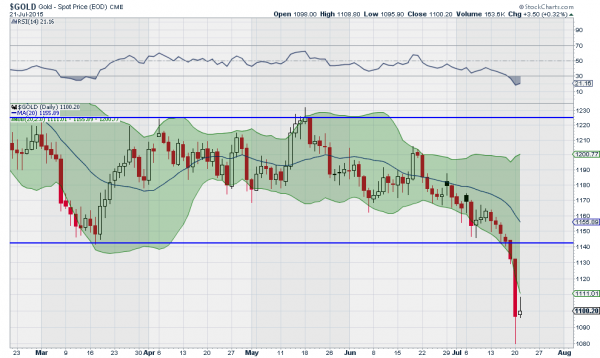

But there is one market now showing us that relying on that reversal may be a death warrant to your portfolio:gold. Gold has been moving in a broad tightening range sideways for over 2 years, since it pulled back from the 2011 high. It has recently showed signs of another leg lower and I wrote about that a couple of weeks ago here. Up and down off of 1140 and up to 1225 before reversing and doing it again. Until the last few days.

The last few days have show a major breakdown in gold. No longer can you rely on the reversal at support and a move back higher. But remember, markets move up and down. Another leg down is also not likely to be a straight line. And the short term chart above suggests that this would be a good place for a bounce, maybe even a retest of the breakdown, before continuation lower. With the price outside of the Bollinger Bands® and the RSI oversold it is ripe for at least a pause if not a bounce. If it does, watch the 1140 level as it approaches. And remember, markets go up and down.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.