U.S. stocks get their demand despite weak employment data, that is a good sign for short-term. But still, technical analysis and some secondary labor market indicators force us to look cautiously on the perspectives.

The stock market showed a rather interesting reaction following the publication of Friday’s data on the labor market. In our opinion, the important thing is the market dynamics during the last trading hours, when professional players dominate the trading floors rather than trading robots on the news.

On the news of employment growth of only 20K in February, the US S&P 500 extended Friday’s losses from 0.5% to 1.0%, but strong purchases at the end of the day allowed the index to close near zero marks.

Previously, we have repeatedly noted that the dynamics at the end of the trading session in the US can be considered as a fairly reliable indicator of market sentiment. And in this case, we saw a positive signal. Apparently, market participants focused on wage growth by 3.4% y/y, that is, the highest rate since 2009, which can be considered as an early signal of increased inflationary pressure. Key technical indicators do not yet allow to take the bulls side. S&P is trading below the 200-day moving average, while the RSI on the daily charts dropped from the overbought area to 50, which is also a moderately bearish signal.

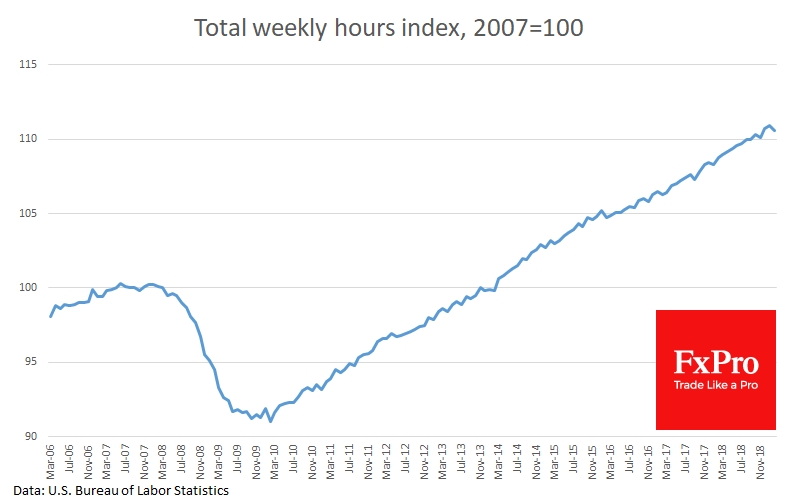

Regarding employment news, it is important to keep in mind that wage growth occurred along with a reduction in the average actual length of the week and a very low number of jobs created. The index of aggregate weekly hours in February fell by 0.3%. Last time it was in September 2017, when the statistics were spoiled by the effects of hurricanes.

As a summary of this confusing situation, we can only note that professional market participants consider current stock levels acceptable for purchases in general, although technical analysis and some secondary labor market indicators force us to look cautiously at market growth prospects in the coming days.