Our core measures of risk are very close to going negative. If they make it below zero by Friday we’ll be raising more cash and/or adding a larger hedge. Our measures of market quality and strength are also falling, but they’ve got a bit more room before going negative. With that said, the market is due for a bounce so conditions could change quickly. I’ll do a post on Friday well before the close with any changes to our portfolio allocations.

This decline is different in nature than the previous two this year in that it appears to be more about portfolio positioning for the longer term than fear (of any kind). The most sensitive components of our Market Risk Indicator aren’t being severely impacted while the slow moving components have rounded out tops and moved below zero. Our core measures of risk (that are completely independent of our Market Risk Indicator) have mostly been diverging with price since the end of last year and are now close to going negative. These measures are painting a pattern often associated with declines of 10% or more.

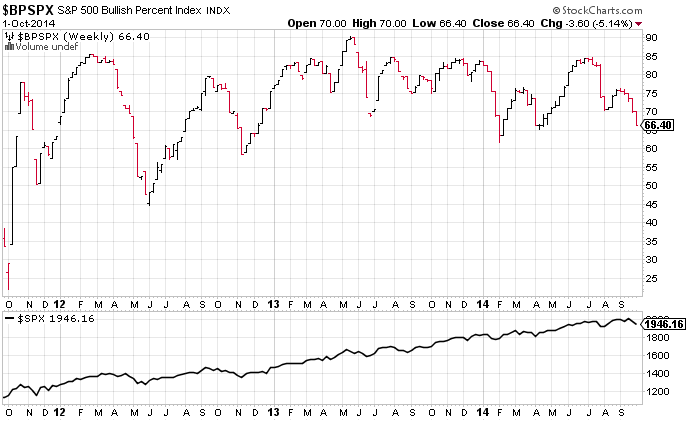

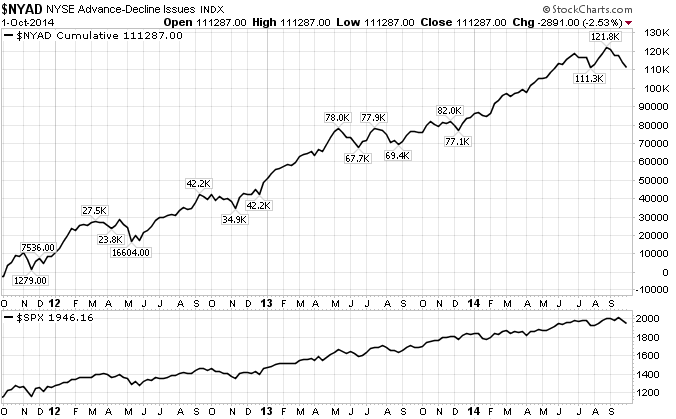

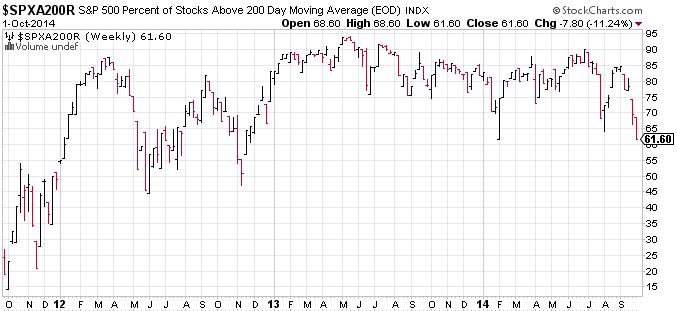

Below are three breadth charts that are all getting close to warning of a larger decline ahead.

The cumulative NYSE Advance / Decline line (NYAD) is painting a lower low for the first time in over three years.

The percent of stocks in the S&P 500 Index below their 200 day moving average is very close to the 60% level that I consider critical.

And the bullish percent index (BPSPX) isn’t far behind (60% is my warning level).