The financial markets were undergoing a big test of optimists yesterday. So far, they seem to have claimed local victory.

During the day, the NASDAQ 100 almost fell out of its 9-month uptrend. As of a week ago, it got support on a decline below 13000 and closed the day with minor growth, recovering its 2% intraday drop, gaining most of the way through the active trading session in New York.

There was equally significant tossing and turning in the currency market.

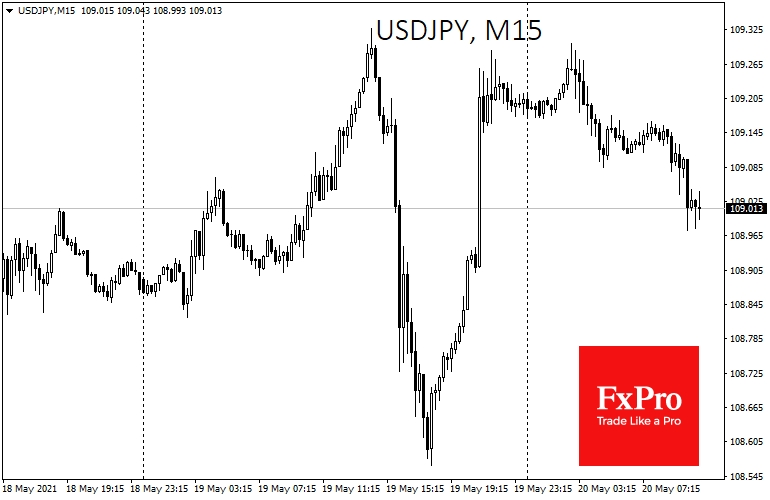

The USD/JPY hit a sell-off amid trading in Europe, collapsing from 109.30 to 108.50, only to soon make a V-shaped reversal to levels above 109. First selling in the pair and then rebounding buying reflected the uptick of risk demand.

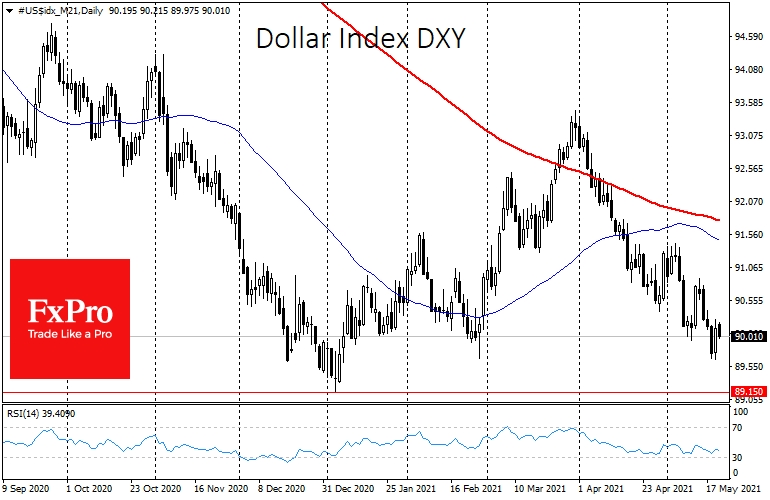

Intraday on Wednesday, the dollar also received support from the sell-off, managing to get back above 90 on the DXY, a basket of the world's six most popular currencies.

However, the battle for this support level continues. The move will be stronger after the surrender of one side, bulls or bears.

In describing yesterday's events, one cannot get past the cryptocurrency market dynamics. Bitcoin fell more than 30% at one point, and intraday lows were half of the historical peaks set a month ago.

The major altcoins also had a similar amplitude, but they saw halving the price in a much shorter timeframe.

On the other hand, gold received support intraday. Once again, there has been talk of institutional investors returning to gold from bitcoin.

That might well be true recently, as even with the more tempered market moves, gold has returned to growth since the beginning of April, while bitcoin lost momentum in the middle of last month. In the longer term, however, interest in these assets is weakly developing independently.

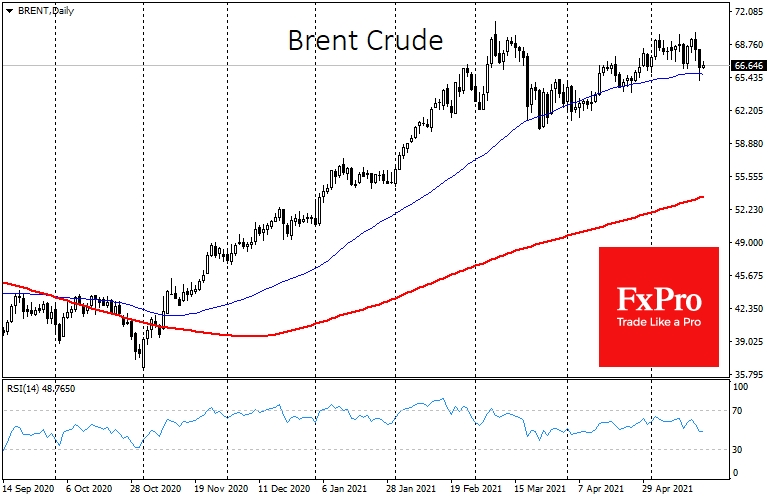

Oil also tested uptrend support in the form of the 50-day simple moving average. The bulls won locally thanks to reports that European and US talks with Iran are far from final. The Biden administration believes the world could well do without Iranian oil, thanks to other producers' capacity.

Today promises to be a defining day for market dynamics over the coming weeks. The buying rally after the recession suggests that the markets are set to continue trending higher on key stock indices and oil and gold.

For the dollar, the outcome of the battle for 90 will be important. A sharp fall below these levels opens the way to the un-traded area of recent years, where there will be much less resistance from buyers.

The FxPro Analyst Team