- Stocks attempt another rebound amid lack of fresh Ukraine headlines

- But markets struggling for clear direction ahead of key events

- Oil keeps surging after US and UK ban imports of Russian oil

Slowing Russian advances might be aiding sentiment

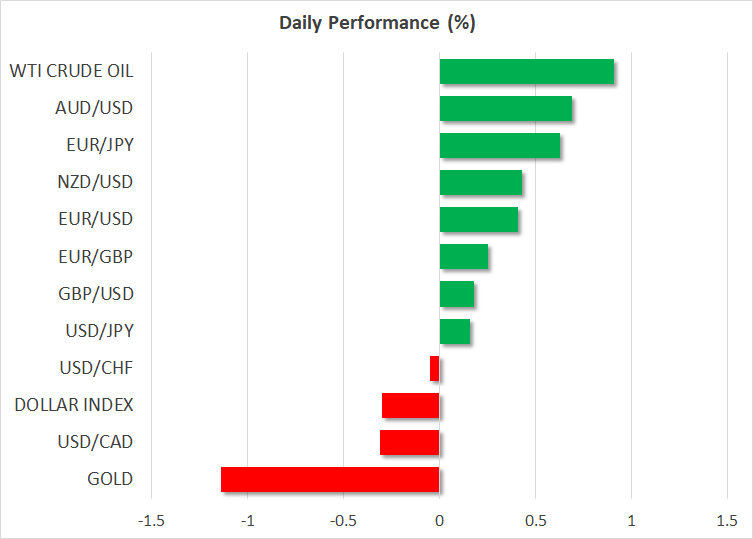

Riskier assets were back in fashion on Wednesday while safe havens were largely on the retreat as ‘risk-on’ was attempting another comeback after yesterday’s bid fell flat in another highly choppy session. There is no single factor that seems to be driving this turnaround in the mood but rather, a number of catalysts that are bolstering investor sentiment after what’s been a pretty torrid time for the markets.

Western intelligence reports that Russian troops in Ukraine have failed to gain significant new ground in recent days and have resorted to shelling civilian infrastructure might be kindling hopes that President Putin will be more inclined to negotiate some sort of a ceasefire agreement with Ukraine. An apparent change of heart by Ukraine’s leader Volodymyr Zelensky in his insistence that Ukraine must join NATO might also be seen as increasing the odds of a peaceful solution to the conflict.

But perhaps a more likely explanation is that investors have already priced in the worst-case scenario for the Ukraine crisis and as equity prices potentially reach the bottom, dip buyers are stepping in. The S&P 500 ended lower for the fourth straight day on Tuesday, reversing earlier gains, while the Nasdaq has fallen back into bearish territory.

However, Wall Street futures have perked up today, firming by more than 1% in European trade as stocks in Paris and Frankfurt jumped by about 4% soon after the open. London’s FTSE 100 lagged slightly and was last quoted up 1.7%. But the rebound came too late for Asian markets, which mostly closed lower.

Investors eye Fed, ECB and Russia-Ukraine talks

But it’s doubtful at this point if this can be the start of a sustainable revival in risk appetite and much of it will depend on whether commodity prices will continue their upsurge and what the outcome is of the major political and central bank events that are coming up over the next week.

The Ukrainian and Russian foreign ministers are set to hold talks in Turkey on Thursday, in what is expected to be more crucial discussions than the negotiations that have been taking place on the Belarus border.

More importantly, investors will find out over the next seven days what the response of the world’s two biggest central banks will be to the fallout of the war in Ukraine.

The European Central Bank meets tomorrow and there’s a strong chance policymakers will forfeit their 2% inflation goal to cushion the Eurozone economy from the crisis. The US Federal Reserve on the other hand will probably only modestly tone down its hawkish rhetoric next week. Tomorrow’s US CPI numbers for February could provide some clues as to what to expect, though, with inflation expectations spiking higher again, it’s hard to see the Fed following in the ECB’s footsteps.

Euro bounces back as dollar eases from highs

In the meantime, however, the euro is benefiting from the global pause in the flight to safety, reclaiming the $1.09 level to climb as high as $1.0990. Plans by the European Union to issue joint bonds to raise funds for defence and energy spending could also be lifting the single currency.

The US dollar is on a broad pullback, with its index against a basket of currencies dropping below 99.0. The Japanese yen and Swiss franc are also weaker across the board today, along with gold, which was last down about 1.7% at $2,017/oz.

The Australian dollar was the biggest gainer, being boosted by comments from RBA Governor Philip Lowe overnight, who gave his clearest indication yet that a rate hike was on the cards this year.

But the Russian rouble extended its slide, plunging by over 7%, as more and more Western businesses halt their operations in Russia in protest over its invasion of Ukraine.

Oil rally cools despite US and UK oil sanctions

Fresh sanctions by the US and UK also contributed to the rouble’s pain after the two countries banned the import of oil and gas from Russia, while the European Union announced its decision to cut its reliance on Russian gas by two thirds by year-end.

Nevertheless, the oil rally was taking a breather today with prices dipping as the risk-tone improved. WTI and Brent crude futures were both down around 1% at the time of writing.