Financial media’s favorite headline is “here’s why you should be worried”. Blind “worrying” and “concern” is good for their business because it drives pageviews and ad $$$.

Certain markets around the world remain in a downtrend right now, namely emerging markets and oil.

Instead of “worrying”, let’s look at the facts.

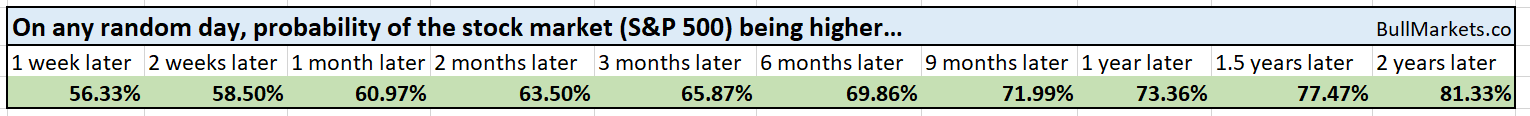

Let’s determine the stock market’s most probable direction by objectively quantifying technical analysis. For reference, here’s the random probability of the U.S. stock market going up on any given day, week, or month.

*Probability ≠ certainty.

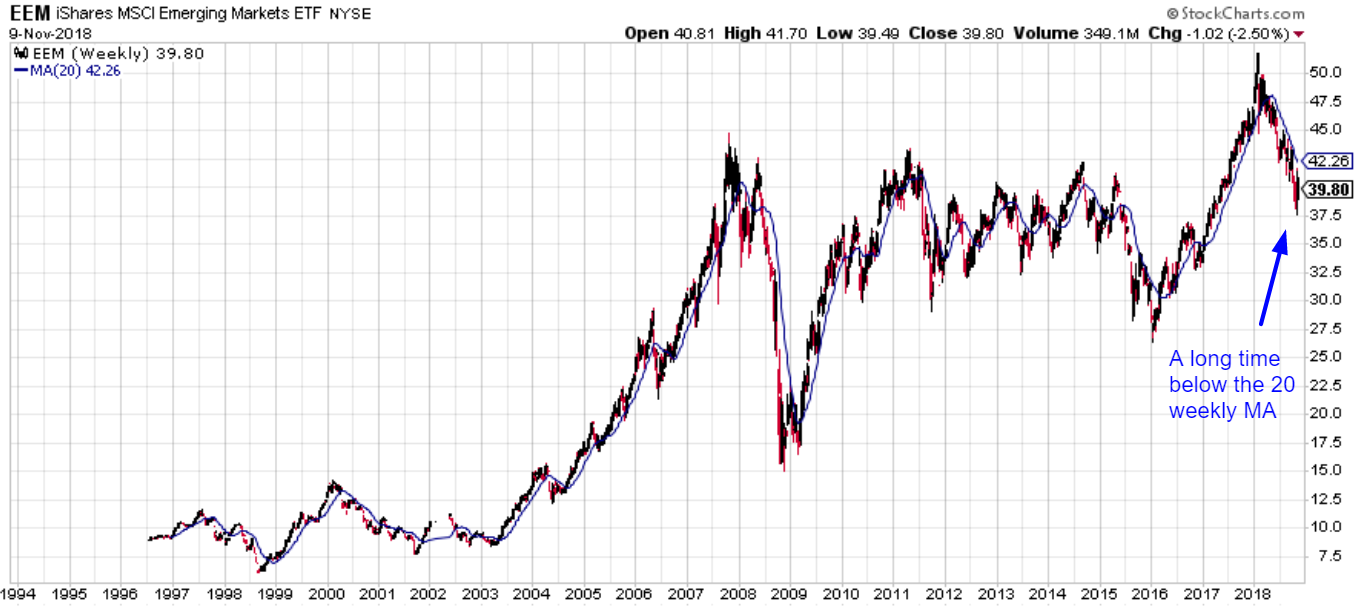

Emerging markets crash

Although emerging markets have bounced over the past 2 weeks, they remain in a downtrend. EEM (emerging markets ETF) remains below its 20 weekly moving average for the 32nd consecutive week.

Here’s what happened next to iShares MSCI Emerging Markets (NYSE:EEM) when EEM remained below its 20 weekly moving average for 32 consecutive weeks.

*Data from 1996 – present

One bearish case (for EEM and the U.S. stock market), and 1 bullish case. I wouldn’t read too much into this statistic, with n=2

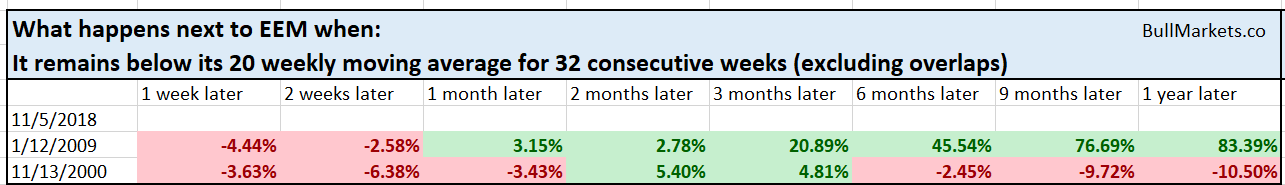

U.S. stock market bouncing

The U.S. stock market has bounced over the past 2 weeks. Each week has gone up more than 2%.

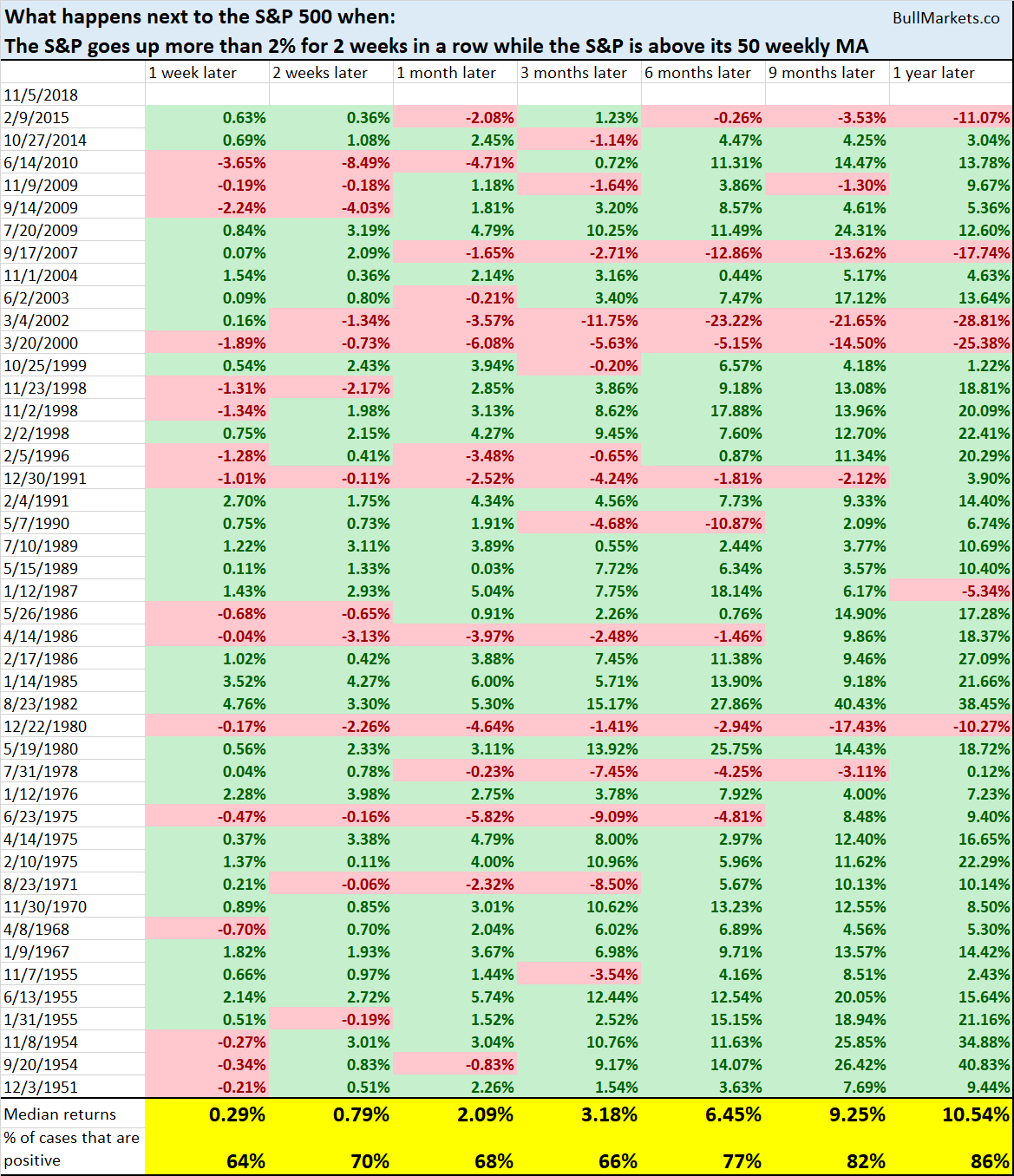

Here’s what happens next to the S&P (historically) when it goes up more than 2% for 2 weeks in a row.

*Data from 1950 – present

As you can see, the stock market has a greater than random chance of going up over the next 9 months.

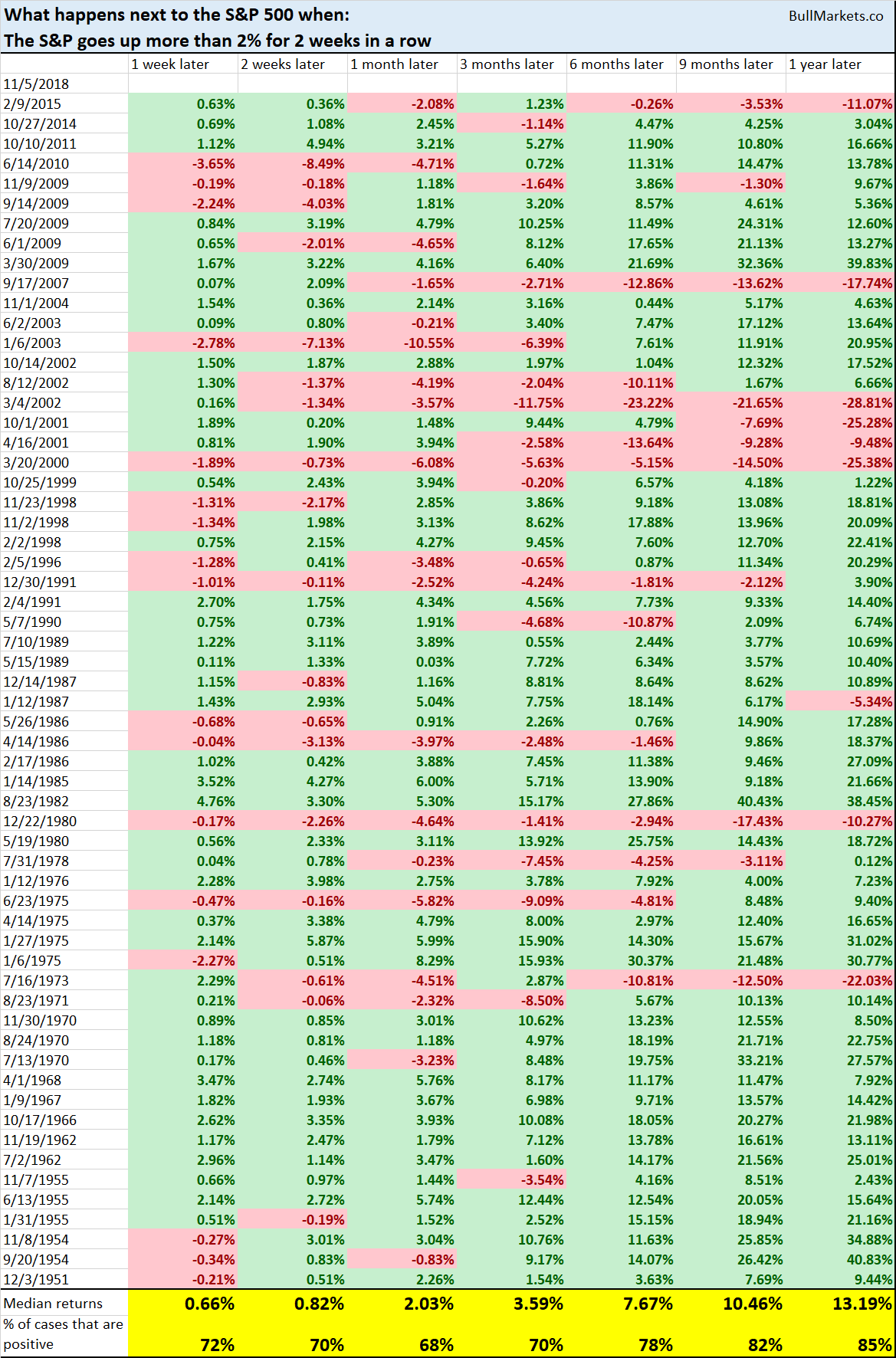

Let’s add some context to this study. Let’s only look at the historical cases in which the S&P 500 was above its 50 weekly moving average.

Once again, the stock market has a greater than random chance of going up over the next 9 months.

Oil’s crash

WTI oil has tanked recently.

As a result, WTI oil’s RSI (momentum indicator) is very low. It is almost at 20 right now.

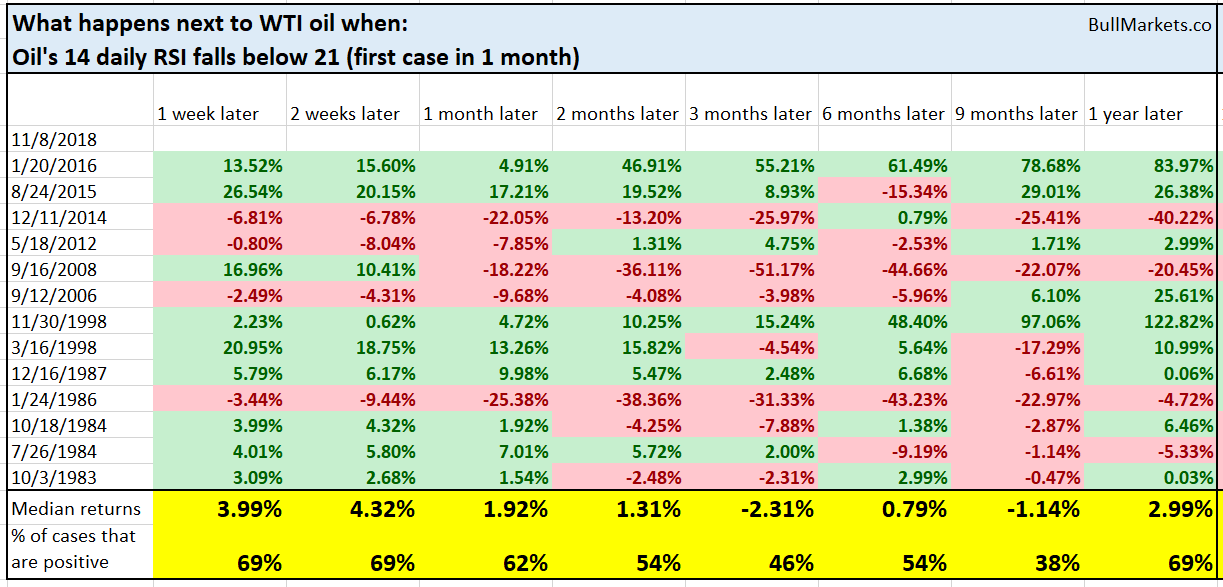

Here’s what happens next to oil when its 14 day RSI falls below 21 for the first time in 1 month.

*Data from 1983 – present

As you can see, while oil can make a short term bounce, this is not a medium term bullish sign for oil.

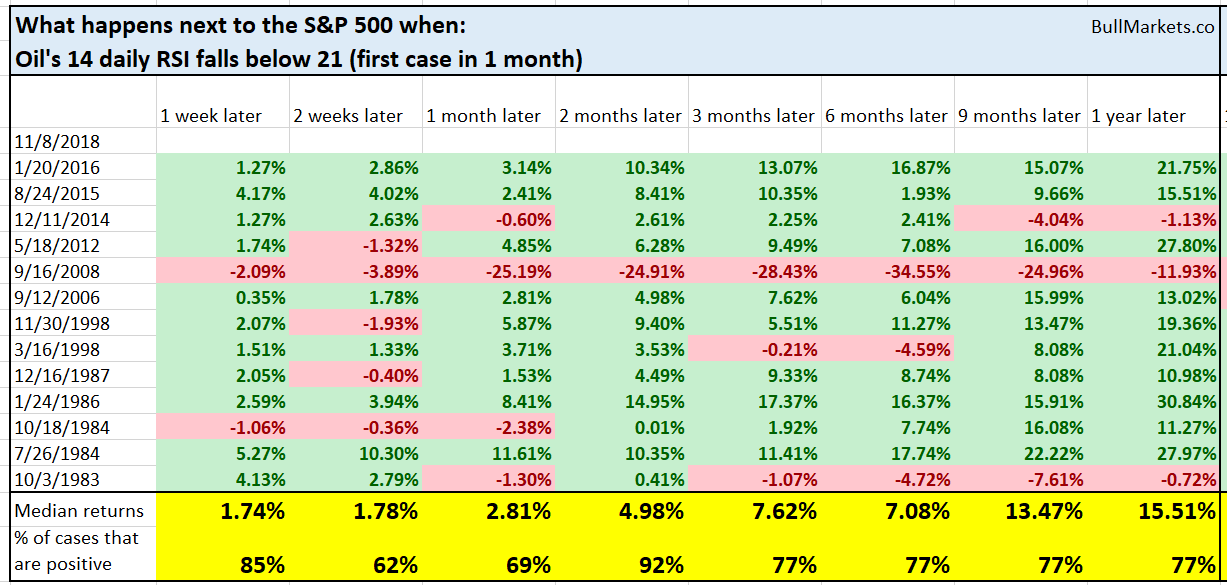

But should U.S. stock market investors be “concerned”? Is this “HOLY SHIT OIL IS GOING DOWN THE WORLD IS ENDING!!!!!”?

Here’s what happened next to the S&P when oil’s 14 day RSI fell below 21.

As you can see, the S&P’s forward returns are bullish, especially 2 months later.

Click here to see yesterday’s market study

Conclusion

Our discretionary technical outlook remains the same:

- The current bull market will peak sometime in Q2 2019.

- The medium term remains bullish (i.e. trend for the next 6-9 months).

- The short-medium term leans bearish. There’s a >50% chance that the S&P will fall in the next few weeks.

Focus on the medium term and long term. The short term is usually just noise.