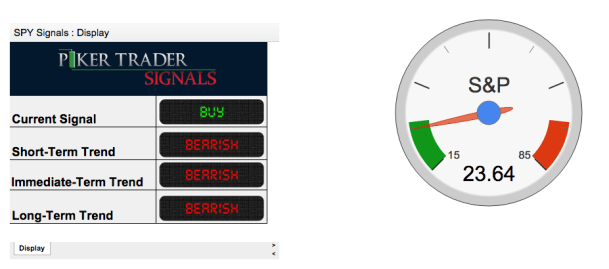

The market looked bad again today before a late day rally. The whole day we had a continuation of the buy trading signals for N:SPY, O:QQQ and the Dow. Now our signals are showing a positive divergence along with a buy trading signal. Looking at the SPY, Thursday the indicator reading was 18.72, Friday 19.13 and now today 23.64. Since our indicator is based around internals what we are seeing is that buying is coming into the market and some strength near the support area marked in the charts. This positive divergence is also occurring in the Qs and Dow.

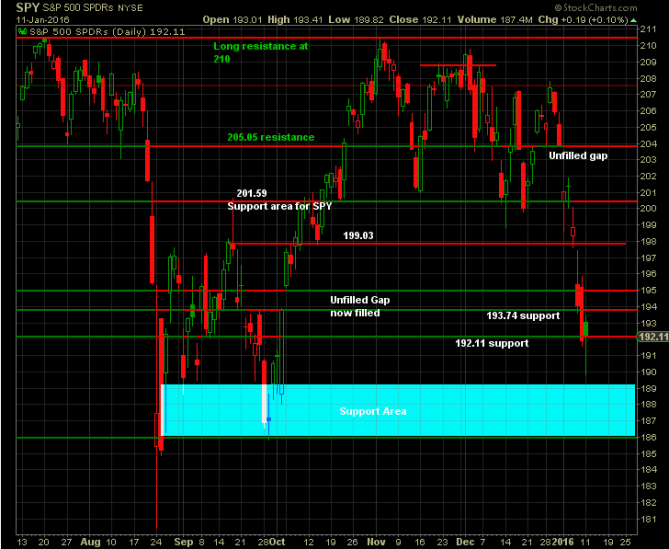

We can see from the chart, that SPY has sold off during the last three buy trading signals but has maybe found support at 190. Buying picked up near this level after SPY broke below 190 a key psychological level. In fact, the buy set up a nice bullish hammer candle on the daily chart. The long tail of the candle signals the bull regained control the price action and shows strength. We continue to see a short-term rally here and will watch key resistance levels to determine if the rally has legs.