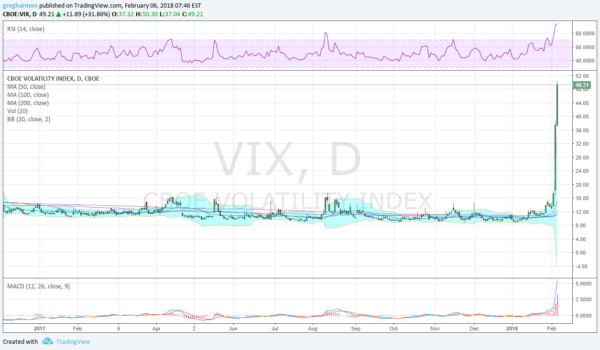

2017 was a great year. Broad markets rose 20% or more. There were basically no down days in the market. Volatility was low and unchanging. It was paradise. then we got corporate tax cuts at the end of the year and 2018 looked like it might be even better. Markets were up 5,7, even 9% in just one month. America was great again, right? Then February showed up and ruined the party. And now the markets dump. The January gains are gone in just 3 trading days. The Volatility Index went from dead to near 50 in just 3 days.

Wouldn’t we all like to go back to those 2017 days? What a difference a week can make. Pundits are arguing over the cause at 2nd derivative levels that they cannot ever really know for sure. Did tax cuts create what will be an overheated economy that will drive the Fed to tighten rates faster than anticipated and create a recession? Wow, there are a lot of ‘what ifs’ in that perspective.

It seems with hindsight that 2017 was perceived as the true Goldie Locks scenario. Not too hot or too cold. Is this the end of the bull-market run and the start of the apocalypse? Maybe so. Remember that 2nd derivative world view. The economic backdrop right now looks very bright though with corporate earnings rising and forecast to continue. Inflation is rising but is in an environment where the Fed is already raising rates. The debate about a need for either 3 or 4 rates hikes in the coming 12 months is laughable. In the big picture, 25 bps will not make or break any deal.

The S&P 500 is bearing the brunt of this desire to purge. The chart shows it closing Monday at the 100-day SMA. It has not touched that 100-day SMA since the election. Technically it is well outside of the Bollinger Bands® and with momentum very oversold. The after-hours price action (not shown in chart) touched a 38.2% retracement of the move up since the election. There are many indications that would suggest conditions are ripe for the fall to stop. But that does not mean it will. Human emotions are fickle too.