- Hong Kong Police fired tear gas at protestors – Hang Seng loses 1%

- EUR/USD back below 1.09 – 'Frugal Four' oppose EU Recovery Fund grants

- Offshore yuan (USD/CNH) tests yearly highs – White House considers new China sanctions

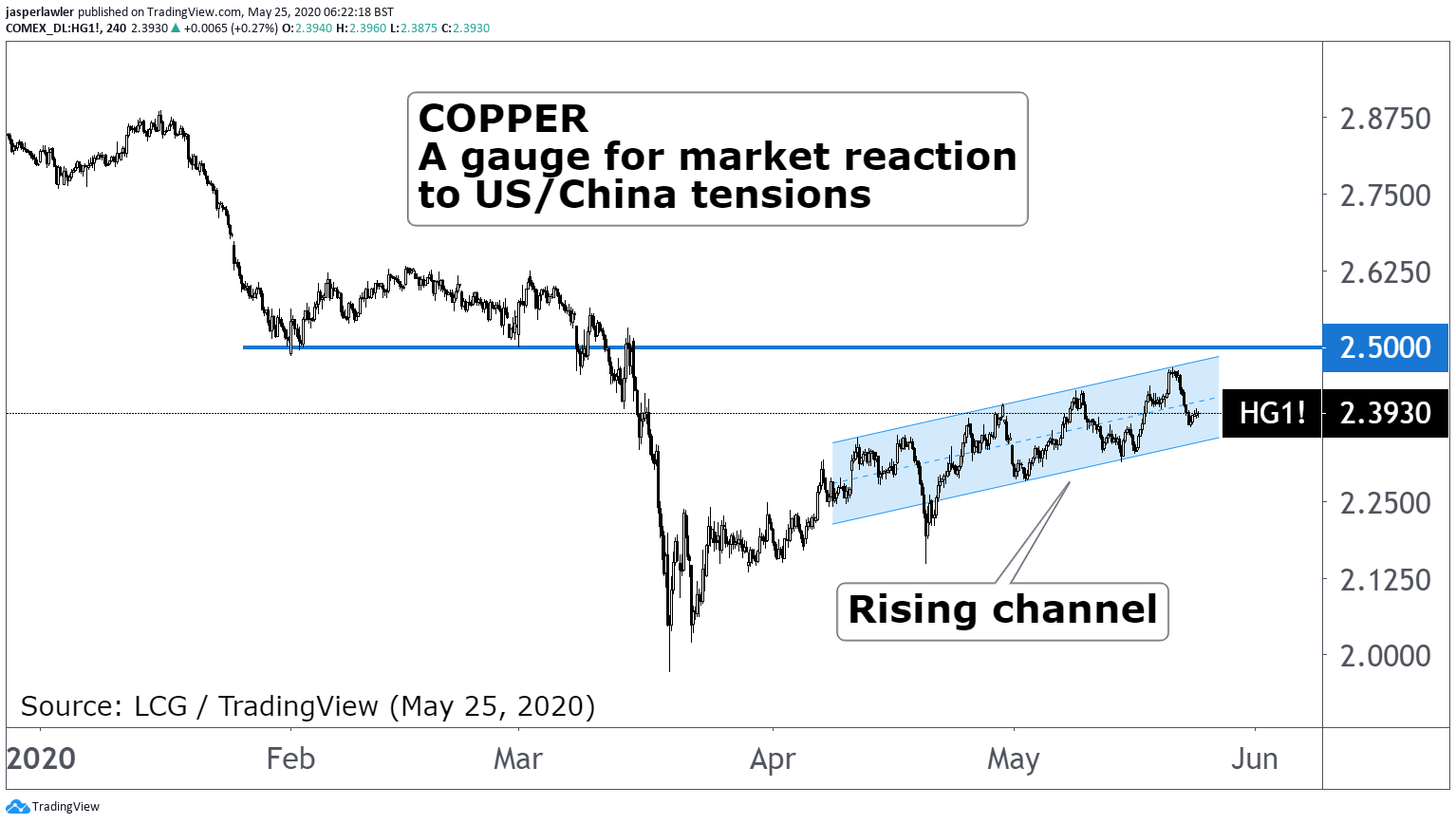

- Copper price slips – industrial metal pricing in US-China tensions

Hong Kong Protests

Shares in Hong Kong fell 1% while shares on mainland China were mixed in response to pro-democracy protests in Hong Kong that saw police use tear gas. The looming threat of extra US sanctions on China has seen the offshore yuan rise towards its highest this year near. We are watching 7.16 because it is a ceiling that has capped rallies since October last year.

Outside of China-specific markets sentiment has held up. Investors seem to be hanging their hat on China committing to the phase one trade deal at the NPC. That commitment may be tested in the coming days if the White House decides to impose new sanctions. The sanctions would be based on the ‘Hong Kong Human Rights and Democracy Act’ passed last year in the US Congress.

Shares in Asia outside of Hong Kong are shrugging of the US-China tensions. Australia’s ASX and Japan’s Nikkei were both up by around 1.5%.

European shares are holding up, even as the Franco-German recovery fund faces formal opposition from the self—styled ‘frugal four’ member states. It is Memorial Day and the UK Spring Bank holiday today so UK and US markets are closed.

Frugal Four fight back

Austria, Sweden, Denmark and the Netherlands stated formal opposition to the French-German proposal for a €500 billion EU Recovery Fund. The use of grants rather than loans is what made the plan a game-changer and it’s also the biggest sticking point.

There has been no decisive switch into Spanish and Italian shares in the last week. Had there been so, it might have demonstrated confidence in the Merkel-Macron recovery plan and a broader desire to take risk. Italy’s FTSE MIB and Spain’s IBEX are further off the April highs than Germany’s DAX.

The euro has given up over half of the initial jolt higher when Merkel and Macron made the proposal. It was never going to be straightforward for all the EU27 to agree. The more protracted the disagreement between the Frugal four and the PIGS, the more likely EUR/USD gives up 1.08.

Chart: Copper (HG!) Year-to-date

The price of copper has moved towards the bottom of a rising channel, suggesting the mood around the global recovery is still positive but has been impaired by the US-China tensions.