-

Inter-Korean liaison office demolished.

-

Fed to buy individual corporate bonds. (Equities next?)

-

What does the new bond-buying mean for gold?

-

Furlough schemes skew UK unemployment figures.

Inspiration

“A lot of people get so enmeshed in the markets that they lose their perspective. Working longer does not necessarily equate with working smarter. In fact, sometimes is the other way around.” - Martin Schwartz

Opening Calls

S&P 500: 3,109 (+43 pts)

A sharp reversal of fortunes on Wall Street setup strong gains across the Asian market today and Europe setup for a very positive start to Tuesday. The big announcement from the Fed that it plans to buy individual corporate bonds saw corporate bond prices jump (yields fall) and credit spreads narrow.

The dollar dropped as investors lowered the need for extra liquidity and haven assets – helping currencies perceived to be riskier like the British pound jump. Gold jumped on the weaker dollar and more ultra-accommodative policy.

Any risk left?

The Fed has set back the day of reckoning again. The US central bank announced yesterday that it will now buy individual corporate bonds as parts of its asset purchase program. Specifically, it is the $250 billion Secondary Market Corporate Credit Facility (SMCCF) which now involved the purchase of individual corporate bonds as well as bond ETFs.

Equities rose with the added layer of Fed protection – and possibly also with the idea that the Fed step just one step closer to directly buying individual stocks. It was when the SMCCF was introduced that the markets bottomed in March. Maybe having achieved putting in the bottom, the Fed is aiming for record highs?

Bonds and Gold

The ever-present Fed put makes for an interesting dynamic for gold. The most-interventionist central bank policy in history is the ideal backdrop for hard assets- but when the Fed seems to be so overtly encouraging the purchase of riskier assets, gold could come off second best.

"Detonation audible"

North Korea has made a clear demonstration of its dissatisfaction with inter-Korea relations by blowing up the liaison office. North Korea is putting itself into the spotlight again – adding another geopolitical challenge to the long list (that the market is ignoring under all the stimulus). The detonation was audible in the demilitarised zone according to reports. Sanctions on top of what could, for all we know be a serious coronavirus outbreak in the country might have driven Kim Jung un to desperate measures.

UK unemployment

The British pound knee-jerked high after UK jobless data toppled expectations but quickly reversed when reality kicked in. UK unemployment through April dropped to 3.9% versus expectations of a rise to 4.7%.

The glass-half full response to the data is that furlough schemes are on some level doing the trick in that people aren’t working but they are not unemployed. That adds hope that firms can hold over until the schemes end (and the economy recovers?) in August. The glass-half-empty reaction is that other stats away from the headline show the underlying weakness in the labour market – that includes a drop of 600k in payrolls, 9 million temporarily away from work and vacancies down 60% from March.

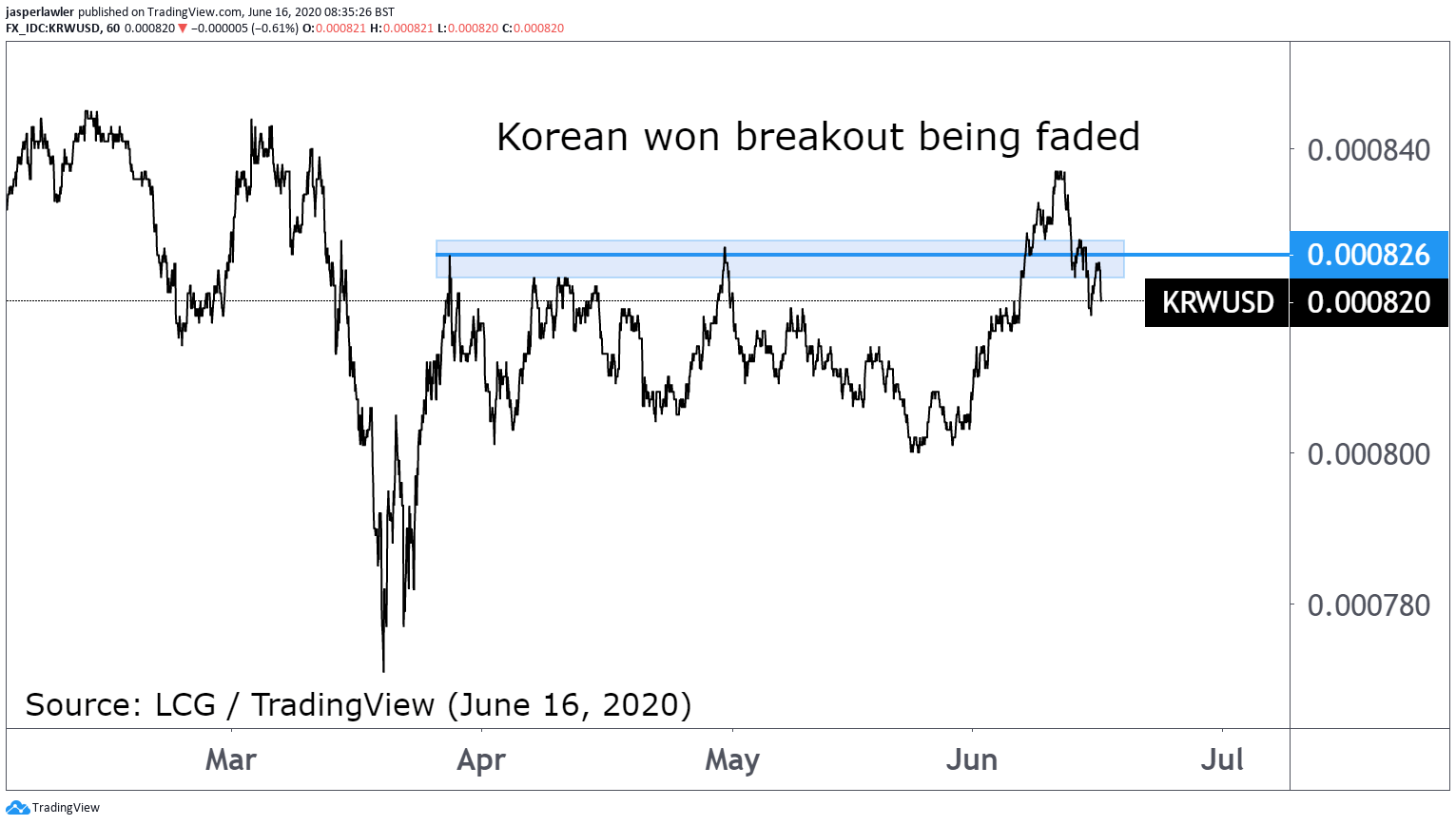

Chart: KRW/USD (3-months)

Korean won turning lower from 0.000826 (USD/KRW = 1,210).