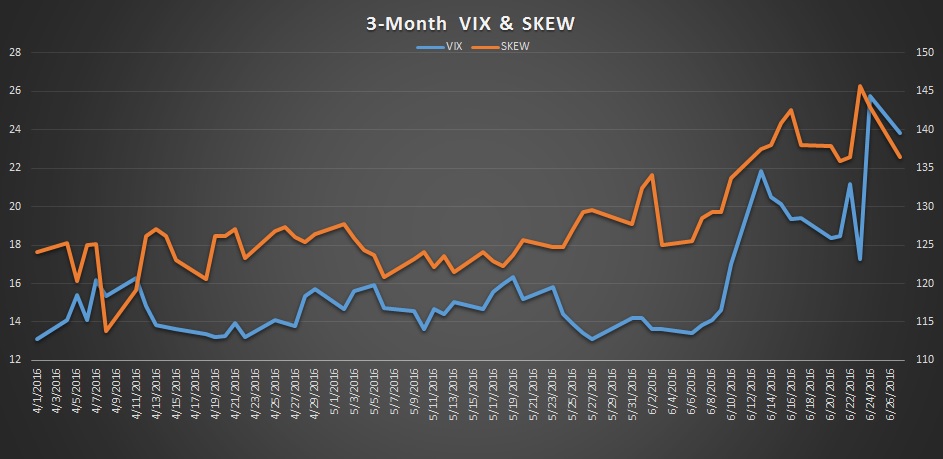

Until the beginning of June, when Brexit worries intensified, the US equity market had seen one of its quietest quarters in terms of volatility since the financial crisis, with the VIX “fear gauge” staying below 17. VIX is an S&P 500 options-based index, tracking the expectation of stock-market volatility over the next 30 days. As we can see in Figure 1, market agents began hedging their positions two weeks before the UK referendum. The VIX jumped 49.25% in just two trading days from June 9 to June 13, indicating concern and uncertainty surrounding the Brexit vote. Additionally, the S&P 500 out-of-money, options-based tail-risk index SKEW also painted a similar picture, shooting up to above 140 the week before the vote. Keep in mind that the SKEW Index at 150 suggests a high probability of a looming “black swan” event.

Over the weekend before the vote, the latest poll showing the “remain” camp winning calmed market volatility. And while the SKEW stayed over 140 the day before the vote, the stock market mistakenly priced the vote result as “stay” causing a $2T equity market wipeout globally in one day. This is a typical contradictory example of the market efficiency hypothesis: market price does not predict the future; it is only an implication without definitive probability. If yesterday’s price could predict tomorrow’s movement, we wouldn’t see disastrous events like the post Brexit selloff or 1987's “Black Monday”.

What To Expect

Where is the stock market headed from here? Is the volatility going to stay? First, the forthcoming risks, albeit with low probability, are as follows: Grexit, Departugal, Italeave, Francoff, Czechout, Oustria, Finish, Slovlong, Latervia, Byegium and Germalone. From a trading perspective, the ripple effects do signal that short-term volatility will be with us for some time. In academic research, ongoing recalibrations of expectations are described as Bayesian updating and optimal behavior learning—agents update their beliefs about the market using the latest prices, which contributes to the short-run momentum. Hence, if investors believe it is time to buy the dip as a panic selloff bargain, they need to have the stomach to face the risk of catching a falling knife, or the potential for a further drag down.

Interestingly, volatility has been falling after the Brexit vote. This settling is not necessarily a sign that we are out of the woods, but rather suggests that the market expects that Brexit’s negative impact on US equity markets might not linger in the long run. Again, volatilities may vary drastically due to the mathematical design of particular indices. Just as we can’t know if polls are correct until an actual vote, we will have to wait till the market provides further signals to make our next investment decisions.

By Leo Chen