Stocks are rallying this morning.

They are not rallying because of a change in fundamentals.

They are not rallying because of a significant debt restructuring.

They are not rallying because of great quarterly results from key economic bell-weathers.

They are rallying because of hope for more Central Bank stimulus.

This is the game traders have played for weeks now. Every time it has ended in failure.

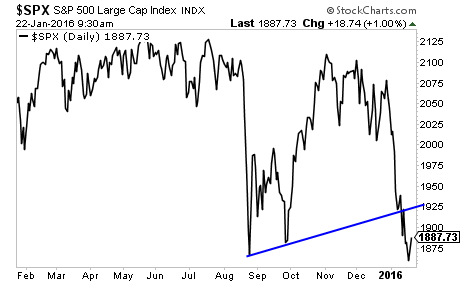

From a technical perspective, the S&P 500 could bounce to 1925 as a retest of former support.

However, the damage from the collapse has been severe. All told, $17 trillion in wealth has been erased in the last six months.

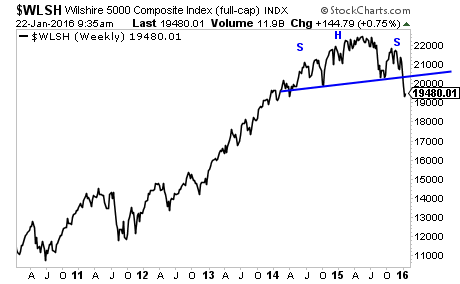

The Wilshire 5000 (the broadest stock index) has broken a clear Head and Shoulders pattern. It has erased two years’ worth of gains in a matter of days. BIG trouble.

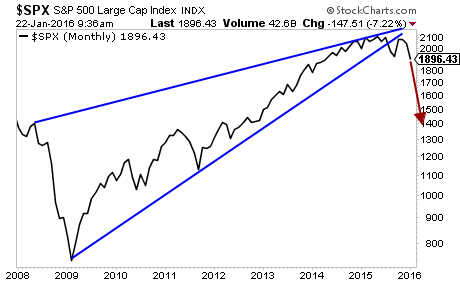

The S&P 500 has broken a clear rising wedge pattern. This is a classic topping pattern and tells us that the bull market started 2009 is probably over.

In simple terms, bounces and rallies may provide relief but the trend is now DOWN.

Another Crisis is coming. Smart investors are preparing now.