Currencies

EUR/USD – is trying to prevent a break below the 1.05 level as European data was good, but unable to really cause a change of direction. Today we have more European as well as US data, but it is currently more sentiment that is driving the markets, even though we are seeing a small correction this morning.

USD/JPY – the inflation data out of Japan showed a mixed result even though oil prices increased. Nevertheless, we are seeing the JPY strengthen, although that has more to do with a correction in the USD.

GBP/USD – closed without much change yesterday and is not seeing that much movement this morning either, but that is expected to change with the data out of the UK and the US later today, especially the speech of FED Chair Yellen this evening.

USD/CAD – with the USD strengthening and oil moving down, there is only one way this pair could go and that is up, even though Canadian GDP was solid. We reached the highest level in nearly 3 months.

USD/ZAR – has reached resistance around the 13.15 level and after that it will try to settle above the 13.22 level.

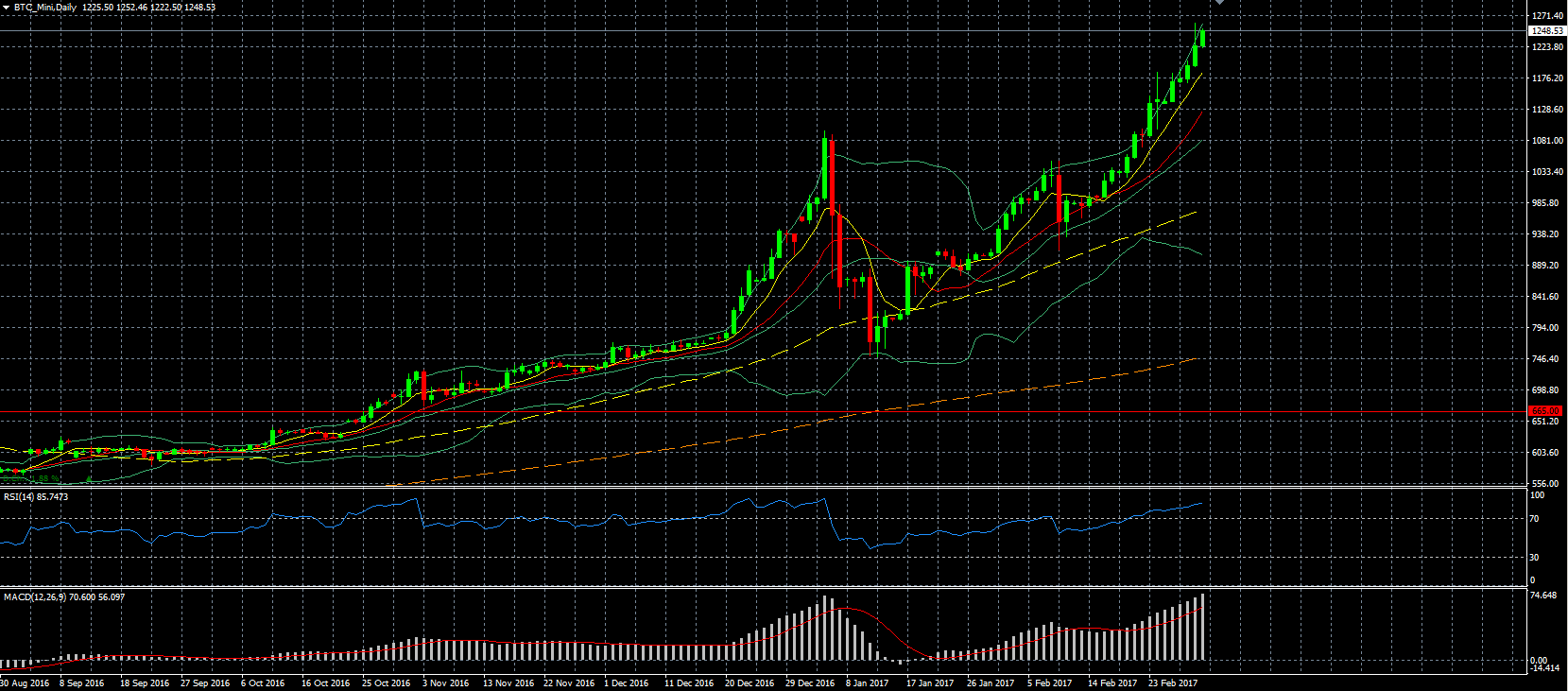

Bitcoin – has risen over $275 this year alone and it appears there is more ground to be covered. However, with such an impressive gain, the drop could prove to be very steep, so caution is advised.

Indices

Dollar Index – continued to move higher as the market now sees a close to 80% chance that the interest will increase this month.

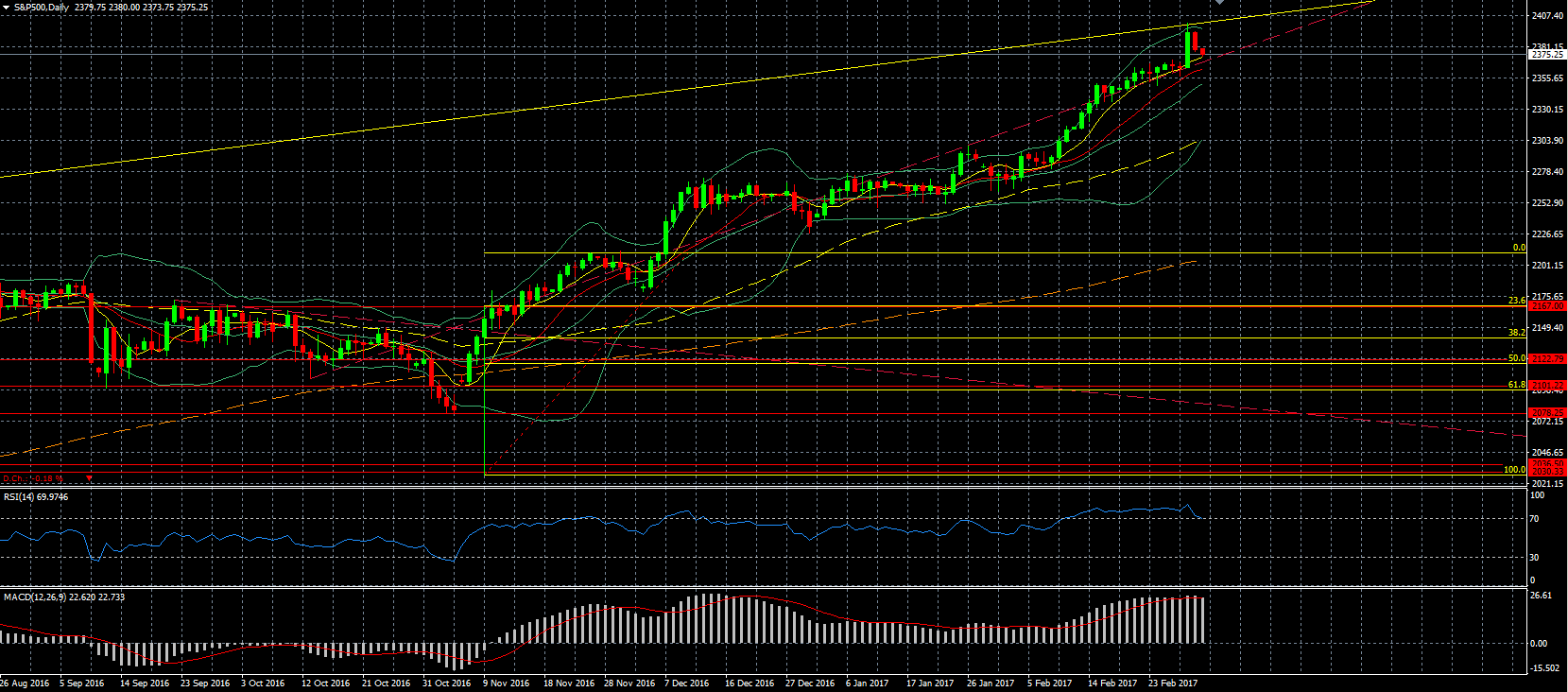

S&P 500 – the party can’t go on forever, and we see that the S&P dropped after a long streak of record highs.

Commodities

Gold – finally dropped firmly as we would expect with the expectation for a rate hike this month increasing. The nearest support level can be found around the 1224 level, as we will wait to see what FED Chair Yellen will say in her speech this evening.

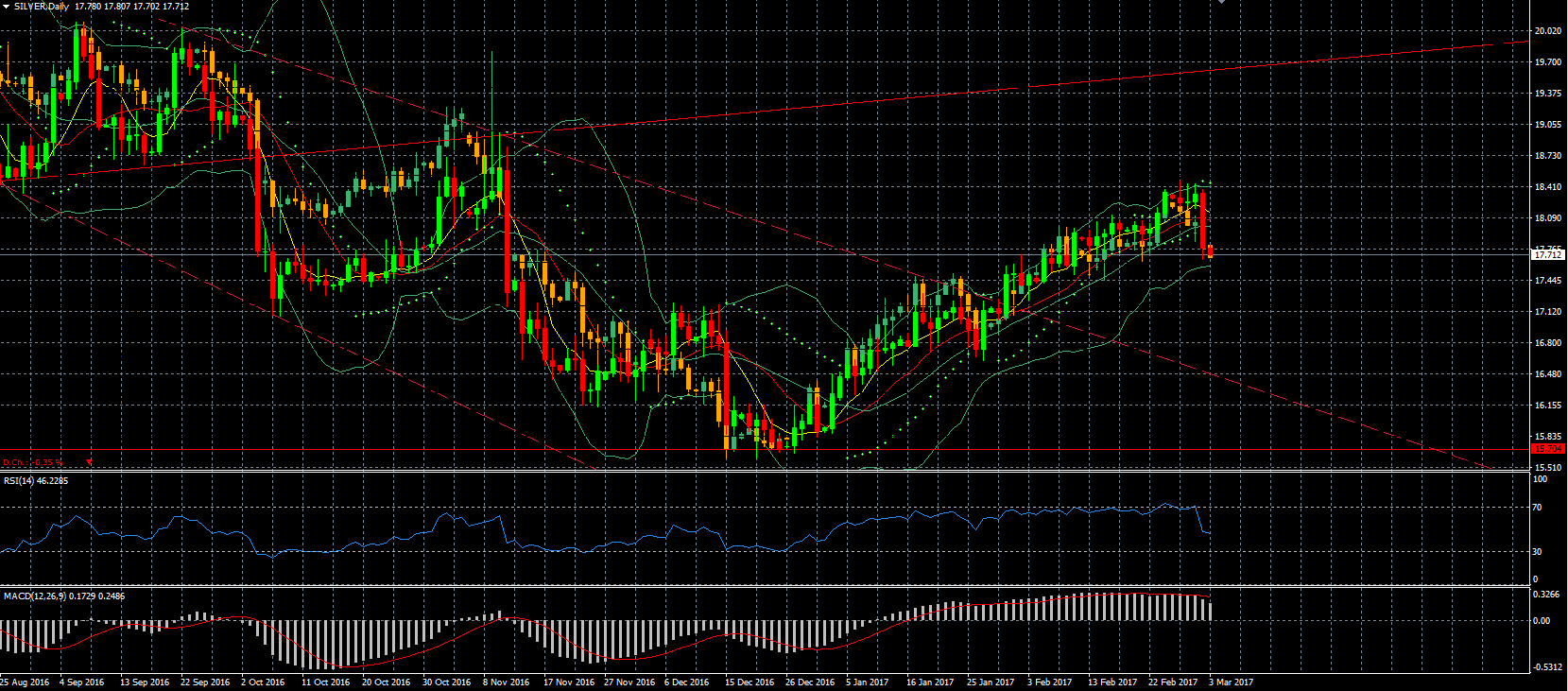

Silver – what was expected did indeed happen and silver corrected down to regain correlation with gold.

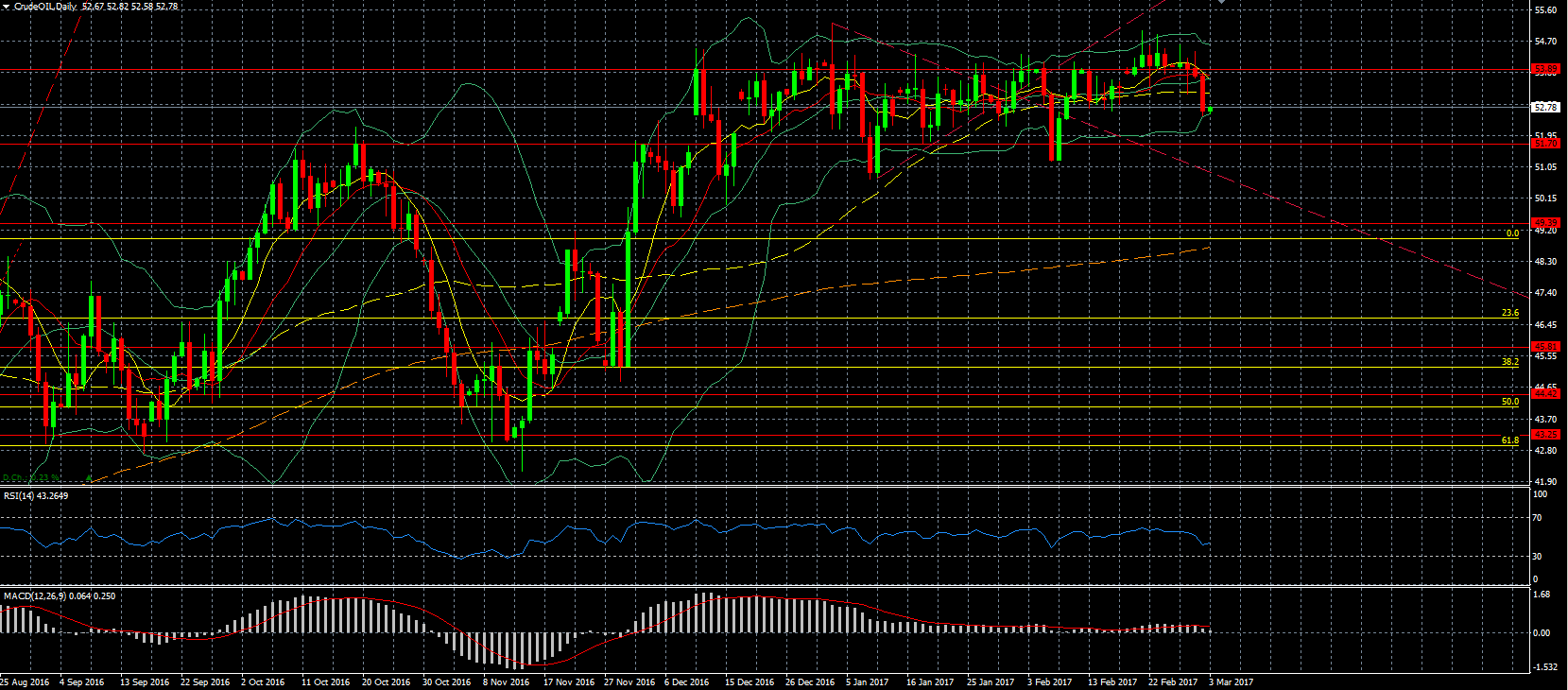

Oil – declined sharply and reached the lowest level in 3 weeks and the strong USD is pulling commodities down and rising US inventories and production are also weighting on oil. Another aspect is the fact that Russia has kept production unchanged from its January levels and as such is far from complying to the agreement to cut production. This in turn obviously casts doubts on the longer term viability of the agreement. However, Russia not implementing its part of the deal should not come as a surprise based on previous agreements.

Stocks

Caterpillar (NYSE:CAT) – dropped over 4% in trading as it was reported that its headquarter was being searched by law enforcement.

Snapchat – had a great first day and closed 44% higher and now has a market capital of over $28 billion.