Some reduced uncertainty regarding China, USMCA, and Brexit, has helped lead stocks to record highs once again. The Fed is in a dovish holding pattern, and investors are realizing that slowing growth doesn’t mean recession. What a difference a year makes.

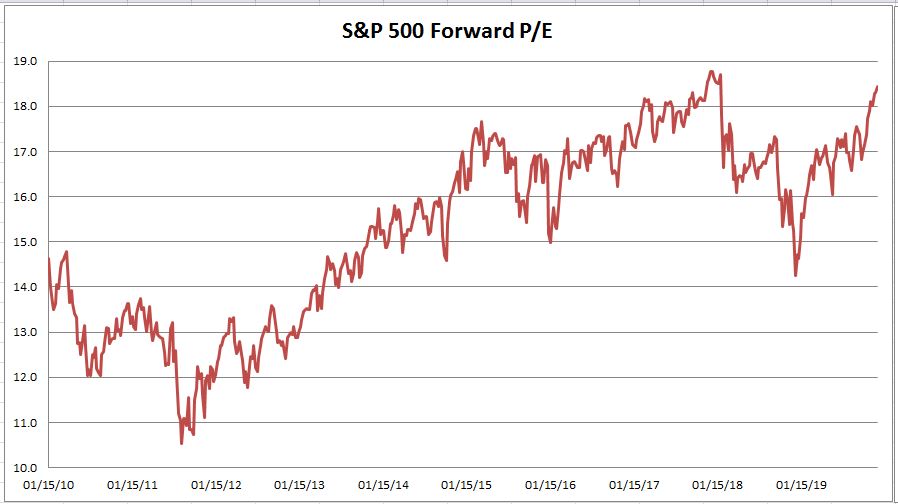

The S&P 500 is now trading about 18.4x forward earnings. 18.8x was the weekly highs reached in December 2017, and the market made little to no progress for the next two years. Also, notice the decline (bear market) in valuation between December 2017 and January 2019, going from 18.8x to 14.6x (-22.34%). This was a result of strong earnings growth in 2018 (+22%) coupled with the S+P 500 index having a negative year (-4.23%), making valuation more attractive.

18.8x current forward earnings would take us to roughly 3232 in the S&P 500. About 1% away from current levels. Valuations are one of those things that don’t matter until they do. Momentum can take over in the short term. With interest rates and inflation this low, it’s historically been supportive of higher valuations such as these.

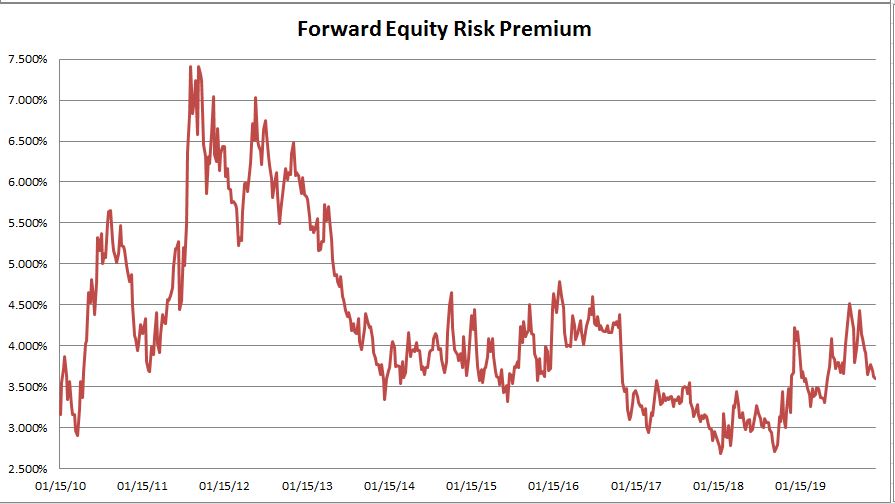

Except you really can’t make a valuation call without first taking into account interest rates and inflation. The 10-Year treasury bond rate fell to 1.43% in September and still stands at only 1.90%. Interest rates were higher when the forward PE topped out. So the equity risk premium is still looking attractive.

In my view, an attractive equity risk premium and a low risk of recession in the near term is a good combo for investors. That doesn’t mean we couldn’t have a negative year. We may be overextended in the short term and a normal correction is well within the realm of possibility.

2019 has turned out to be a good year for investors who were able to stay the course. I never make predictions on annual returns. The formula is dividend rate + earnings growth + change in valuation. The first two can be quantified but the third element, valuation, is incredibly unpredictable. I’m hoping to see some of the lagging areas of the market pick up the slack in 2020, (International, Value, Small cap) but its anyone’s guess what will happen.