Markets took a huge dive today as a variety of fears weighed on investor sentiment and triggered a big sell off. Tech stocks took a big beating as many high-fliers got severely cut down. NASDAQ Composite is down almost 8% for the month–that is the worst it has performed during the fourth quarter since the Great Recession began back in 2008.

As the sell off spread today, companies heavily tied to the global economy were also battered. Investors are worried about global trade and the effects of the Trump Administration’s tariff wars with China and other nations. They are also worried about the Fed’s belt-tightening as the US Central Bank continues to clear its balance sheet of assets from the ZIRP days. In addition, the yield curve for bonds is sending a sell signal for equities as well.

So, is this a momentary glitch or something different? Do we have some momentary noise here or the beginning of the end for the Bull Market that started way back in March 2009? That’s tough to say. But investors today looked to the Utilities Sector for shelter from the storm. Those “un-sexy” companies are traditionally the sort of stocks for those worried about the future and unable to force themselves to buy on the dip.

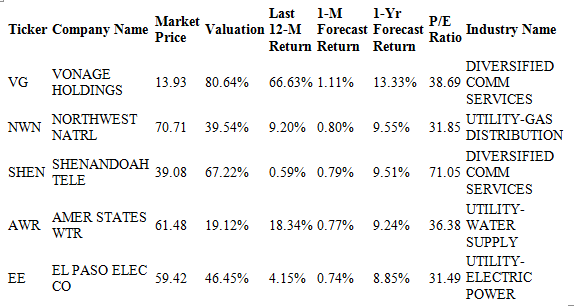

For today’s edition of our bulletin, we used our website’s advanced screening functions to search for top utilities stocks with complete forecast and valuation data. They are presented by one-month forecast return. Our top five stocks from the sector are listed below. Vonage is rated STRONG BUY. The rest of our top-five utilities stocks are rated BUY.

Today, we take a look at Vonage Holdings Corp (NYSE:VG). Vonage is redefining communications by offering consumers and small businesses an affordable alternative to traditional telephone service. The fastest growing telephony company in North America, Vonage’s service area encompasses more than 2000 active rate centers in over 130 global markets. Vonage is sold directly through their website and retail partners such as SAM’s Club, Amazon.com (NASDAQ:AMZN), RadioShack, Best Buy, Circuit City, Staples, Fry’s Electronics and Office Depot. Wholesale partners such as EarthLink, ARMSTRONG(R), Advanced Cable Communications and the Coldwater Board of Public Utilities resell the Vonage broadband phone service under their own unique brands. With more than 300,000 lines in service, Vonage continues to add more than 30,000 lines per month to its network. Over 10 million calls per week are made using Vonage, the easy-to-use, feature-rich, flat rate phone service.

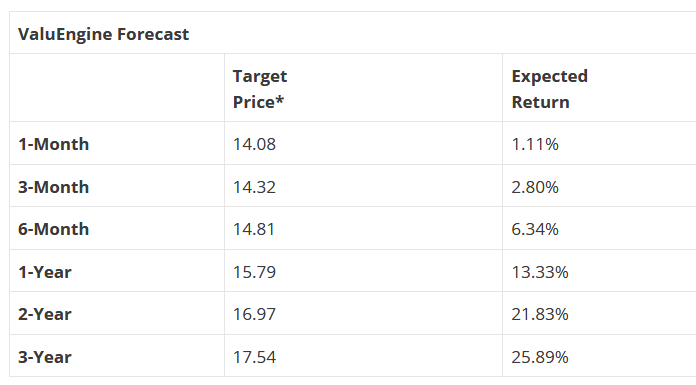

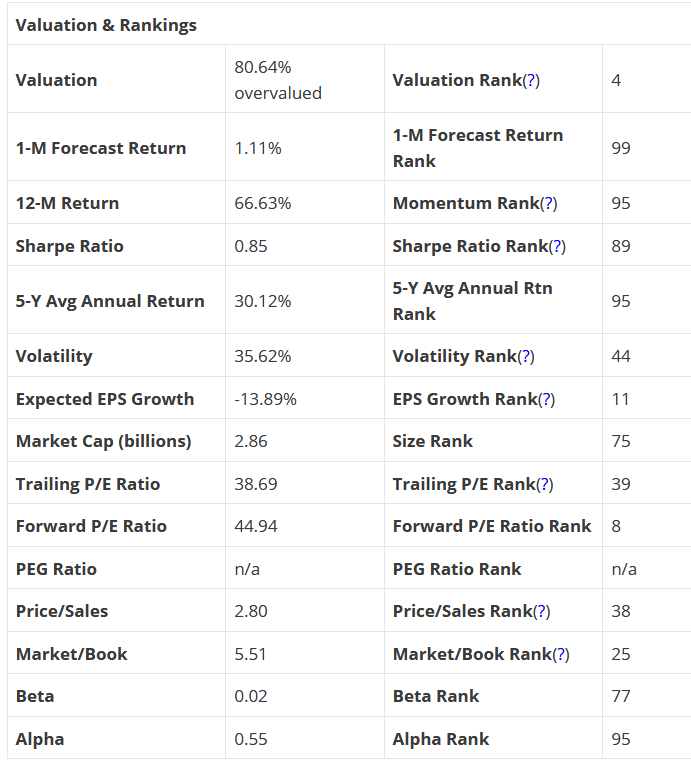

ValuEngine continues its STRONG BUY recommendation on VONAGE HOLDINGS for 2018-10-09. Based on the information we have gathered and our resulting research, we feel that VONAGE HOLDINGS has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Momentum and Sharpe Ratio.

You can download a free copy of detailed report on Vonage Holdings (VG) from the link below.