Initially, reading that China's PMI beat market expectations may make you assume that risk should be performing well today, but the new quarter appears to have gotten off to a weak start, dragged down by the Nikkei falling almost 3.5%. Let's take stock of the facts.

There is a new fiscal year in Japan, a JPY funding squeeze via the basis, a sharp fall in the manufacturing outlook in the Tankan survey, and a survey suggesting that companies are still assuming a USD/JPY rate of 117.46 for hedging purposes. Some may argue that Yellen's focus on international conditions means that slightly stronger data increase chances of a US interest rate hike, and therefore are bad for risk, yet US bond yields have hardly moved, suggesting that the risk sell-off is led by Japan and potentially some profit-taking in the new quarter.

China's March PMI beating expectations, climbing to 50.2, makes us believe that risk currencies should continue to rally. Today's payrolls release will be less important than usual for markets, as it will take extremely strong data to change the immediate Fed reaction function. The Fed made it clear that it is focusing on international conditions, which means markets will pay closer attention to China data releases, the pace of USD appreciation and oil prices. Nonetheless, the focus will be on the wage data. Price action tells us USD has not been able to gain footing yet.

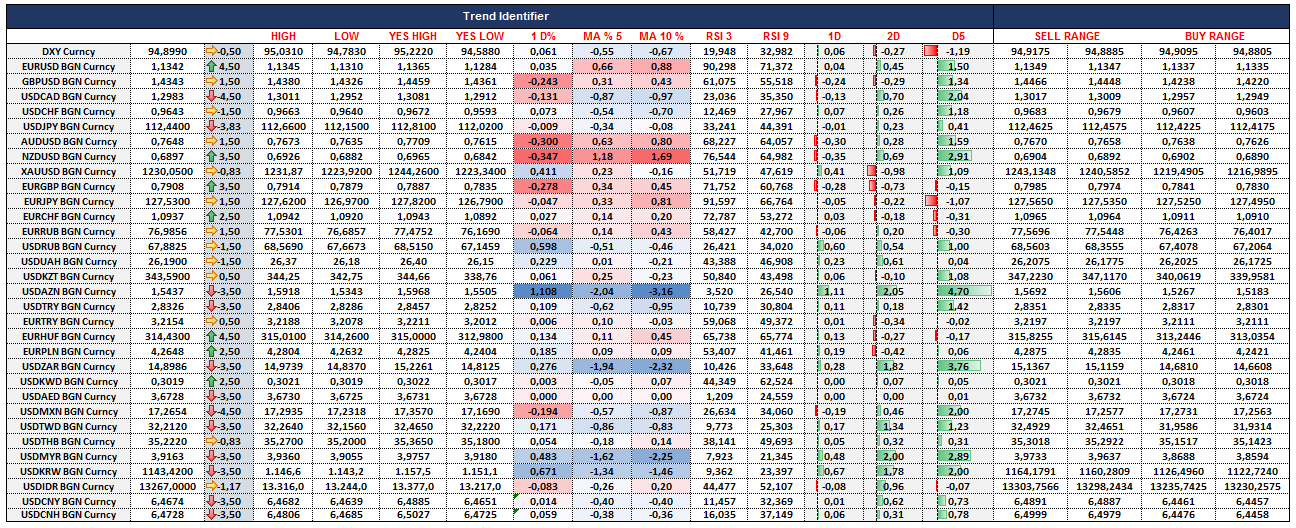

USD/CAD has staged an impressive rally after taking out long stop below 1.2900s, but still remains in a bearish trend. AUD and NZD have held on well to their trends, though AUD has lost momentum around 0.7720, which is an important level in monthly charts. Emerging market currencies are seeing some consolidation before payrolls, but almost all are still in a trend to strengthen. Asian EM lead the way with KRW and CNY. Latam is right behind with MXN, and Eastern Europe has stalled for now.

Volatility has been subdued and still seems to be drifting lower across currencies.