Investing.com’s stocks of the week

- Judging by the weakness in the US Dollar, one would think the risk sentiment on Thursday was rather benign, but that could not be further from reality, as the strength in the Swiss franc and the Japanese yen is a reminder that risk conditions continue to deteriorate, as illustrated in the risk-weighted index.

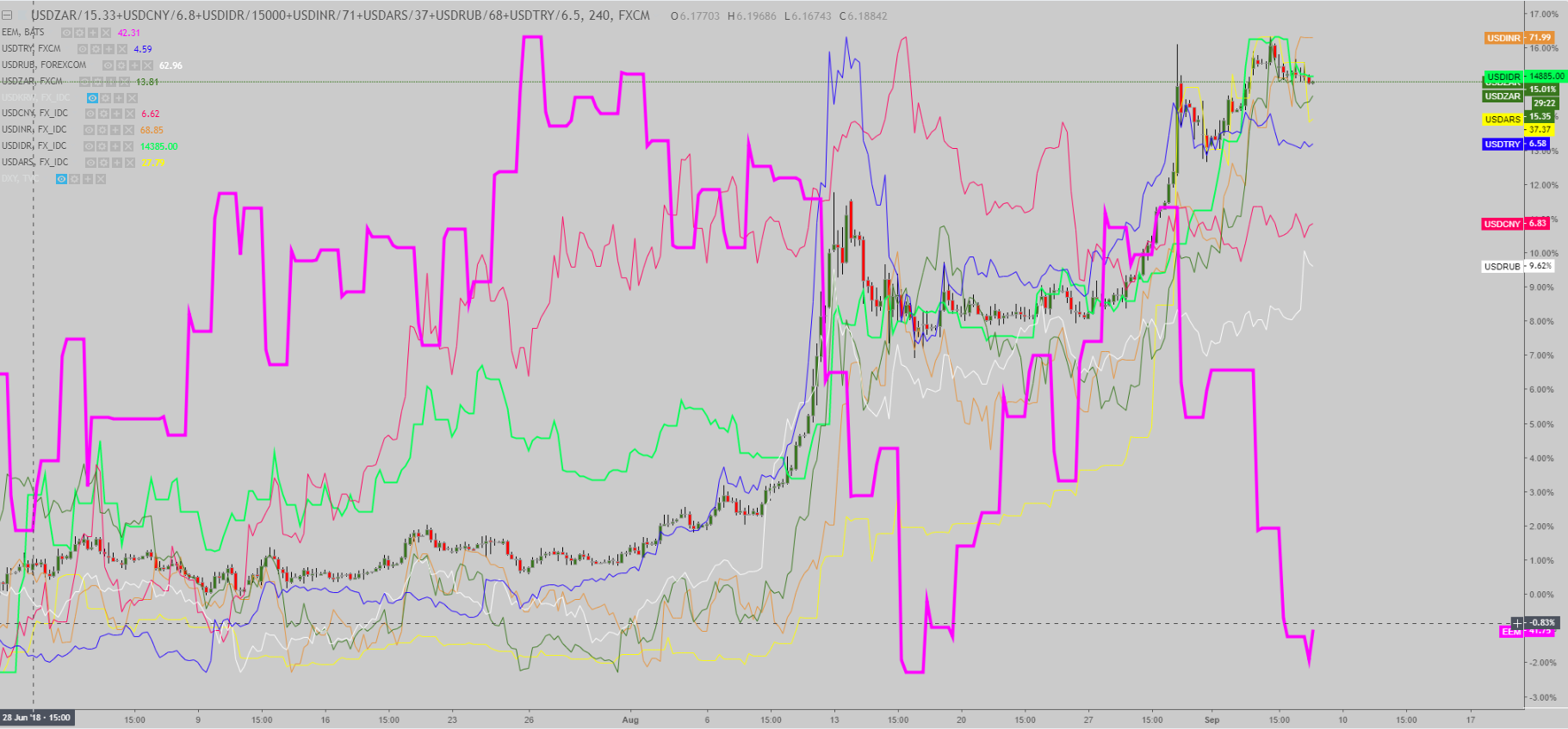

- The MSCI EM Index, as shown below in purple, has officially entered bear market territory after being hammered more than 20% YTD. In the chart below, one can notice the EM currency index I monitor having recently re-tested recent highs, communicating major stress in EM. The reprieve in USD strength in the last 24h has led to a minor pullback in EM vs USD, but insignificant in the big picture.

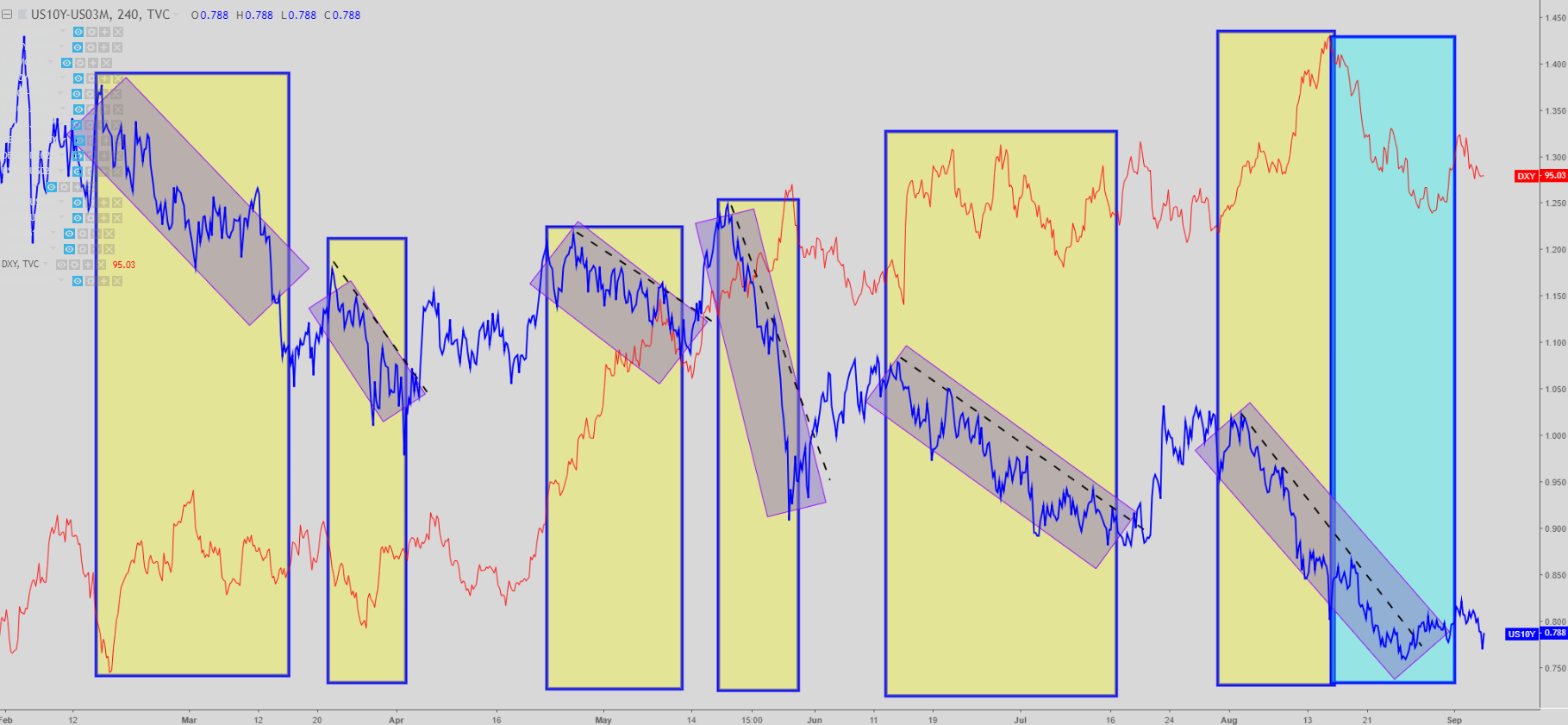

- The weakness in the USD, while may leave some scratching their heads amid risk-off flows, resonates with the latest observations by Morgan Stanley (NYSE:MS) about the US yield curve, noting that the curve has become a more accurate reflection of a decrease in demand for credit and growing signs that higher supply of capital is underway. If this trend continues, we should expect the flattening of the curve to potentially act as a more accurate indicator of the future direction of the US economy and the USD. Fed’s favorite 10y-3m curve has given back over 4bp, pressuring the USD one can conclude.

- In the US session, we saw signs of stress in financial markets, with intense selling pressure in what’s often a barometer of risk such as the US 30-yr Treasury yield, down 3bp from 3.08% to 3.05%, while the S&P 500 and the tech-ceneted Nasdaq kept falling, down 0.37% and 0.91% respectively.

- A headline by BoC member Wilkins, noting that the Central Bank may transition toward a more proactive tightening cycle, acted as fuel for theLoonie, which recovered part of the ground lost earlier on, as negotiations between the US and NAFTA drag on. The risk of fading the move remains fairly high as the market is currently paying more attention to trade talks.

- Another source of uncertainty is the rising fear that the US may take aim on Japan as the next country to impose tariffs on trade. In an interview with WSJ, Trump, in a rather off-the-cuff move, said that while the relationship with Japan is one of cordiality and bonafide, although it may end the moment they find out how much they have to pay to make business with the US, Trump said. This is yet another major stepping stone for risk conditions, and a reason to justify sustained risk aversion.

- The market has two clear focal points to end the week. Will US President Trump enact the additional $200bn in tariffs to Chinese good imports? The sell-off in risk is most likely a reflection of the uncertainty that Trump will flex his muscle on China in the near term. Recent reports have suggested Trump is unwilling to backtrack his rhetoric and aims for the tariffs at the earliest possible time. Additionally, it’s US NFP day in the US, also in Canada, set to inject the usual volatility.

- China reopening legal and illegal trade with North Korea + US trade deficit with China widening earlier this week adds to the case of a full-blown trade war with China.

- Global liquidity conditions continue to tighten with Australian banks squeezing households on higher wholesale funding costs, EM sovereign credit and US credit spreads close to widest levels in history, risk aversion up a few notches as the uncertainty over a prolonged global trade war lingers.

- The heavy buying in the Japanese yen is supported by the latest CoT reading, which showed further evidence of a market positioning for a resumption of risk-averse conditions.

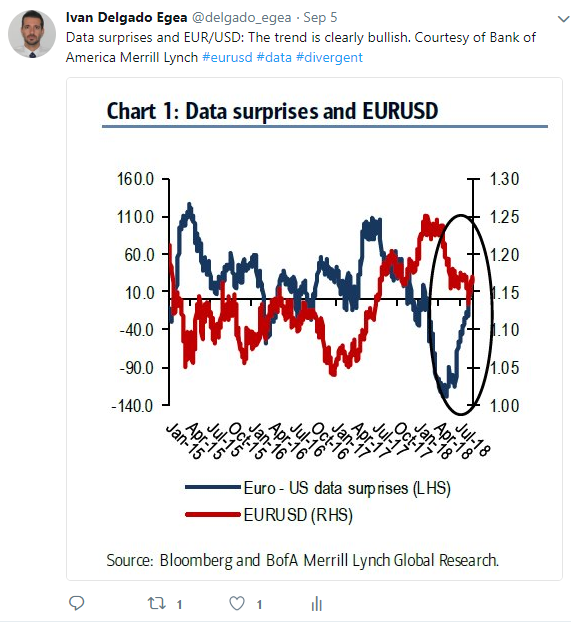

- The resilience by European currencies (EUR, GBP) is a reflection of the tentatively more positive tone in the Brexit negotiations, with the market still giving the benefit of the doubt to the latest headlines that Germany and the UK are said to drop key demands to facilitate a post-Brexit transition. The short squeeze in an overly short GBP market, improving Italian vs German yield premium, narrowing of the yield spreads against the USD, capital entering surplus currencies like the EUR, positive data surprises in favor of Europe or mere demerits of a weaker USD as the import of capital into the USD slows down.

- While some AUD bulls may have been blaring the trumpets on the back of a blockbuster Q2 GDP data, in a twitter conversation I had with Andrew Ticehurst, Economist at Nomura, and who happened to nail the latest growth read, he notes “GDP momentum has peaked, and CPI clues in the data all look low.” Additionally, the saving rates by households keep declining at an alarming pace, and as more banks (ANZ, CBA) hike the lending rate in Australia, it should keep the RBA cautious for the foreseeable future. The pressure in EM, and the Aussie the fav proxy to manifest market fears, also weighs.