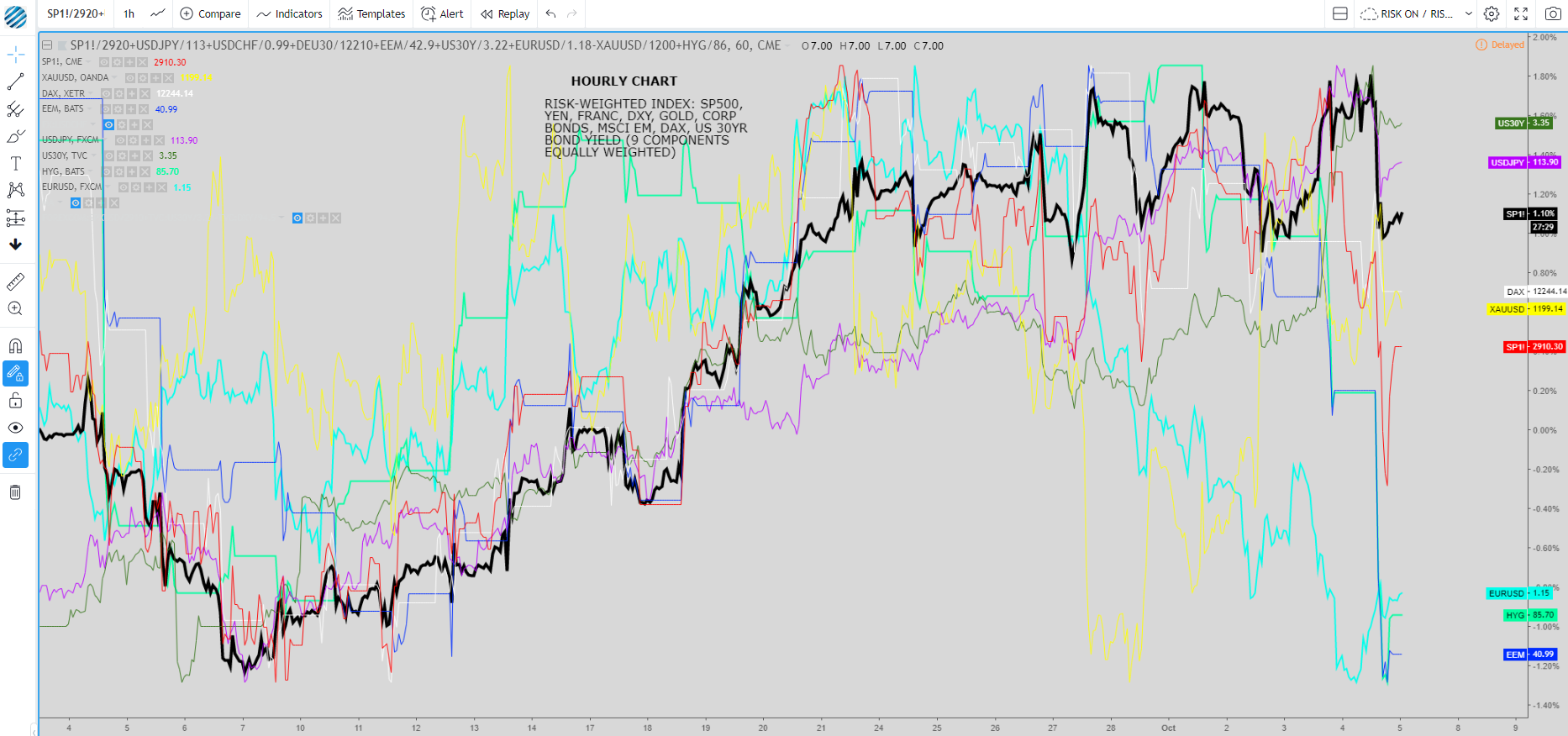

On Wednesday the big story was the spike in US bond yields, with the US 10-year Treasury yield standing at the highest since mid-2011 following the largest one-day spike since President Trump’s election. Fast forward 24h, and the positive ebbs and flows for risk have reverted, especially in equities.

A confrontational speech from US VP Pence against China’s policies set in motion the snowball effect in what became a consistent sell-off in US equities. US VP Pence hardened the rhetoric towards China by stating the country “is meddling in America’s democracy”, adding they are orchestrating a “comprehensive and coordinated campaign to expand” its influence inside the US and across other regions of the world.

“China has initiated an unprecedented effort to influence American public opinion, the 2018 elections, and the environment leading into the 2020 presidential elections,” Pence said in a speech to the Hudson Institute, a conservative Washington think tank.

These accusations only reinforce the suspicion by China’s leaders that the trade war is not really about a fair treatment but to undermine China’s strategic goal ‘made in China 2025’, where the aim is to develop a competitive, high-tech economy and extend its global influence. To make matters worse, CNN reported on Wednesday that the US Navy is proposing a major show of force to warn China.The CNN article read: “While one official described it as just an idea, it is far enough along that there is a classified operational name attached to the proposal.”

The US sees China’s rise as a threat and as I type, it looks as though we are entering a potentially long cold war. Unequivocally, the stocks that suffered the most were the tech names (NASDAQ index), down by 1.8%. Amid this gloomy environment, the commodity currencies (AUD, NZD, CAD) found further selling vs the USD. The European block held meritoriously firm though, especially the Sterling, printing a bullish outside day and recovering the 1.30 area.

The Euro saw a recovery but was not as impressive. The shared currency must still deal with its fair share of troubling drivers, including uncertainties around Italian politics, which has translated into multi-year highs in Italian bond yields, or battle through new decade lows in the German vs US 10-yr bond yield spreads.

A currency that received a much-needed boost was the Japanese yen, as risk-off flows settled in. A story making the headlines on Thursday was the more flexible approach by the BoJ on the bond market, as yields make multi-year highs. According to a report by Reuters, amid its bond-buying draining liquidity, “the central bank is seen tolerating further rises in super-long yields as long as the increase does not push the 10yr yields well above its zero percent target”, according to sources familiar with the thinking.

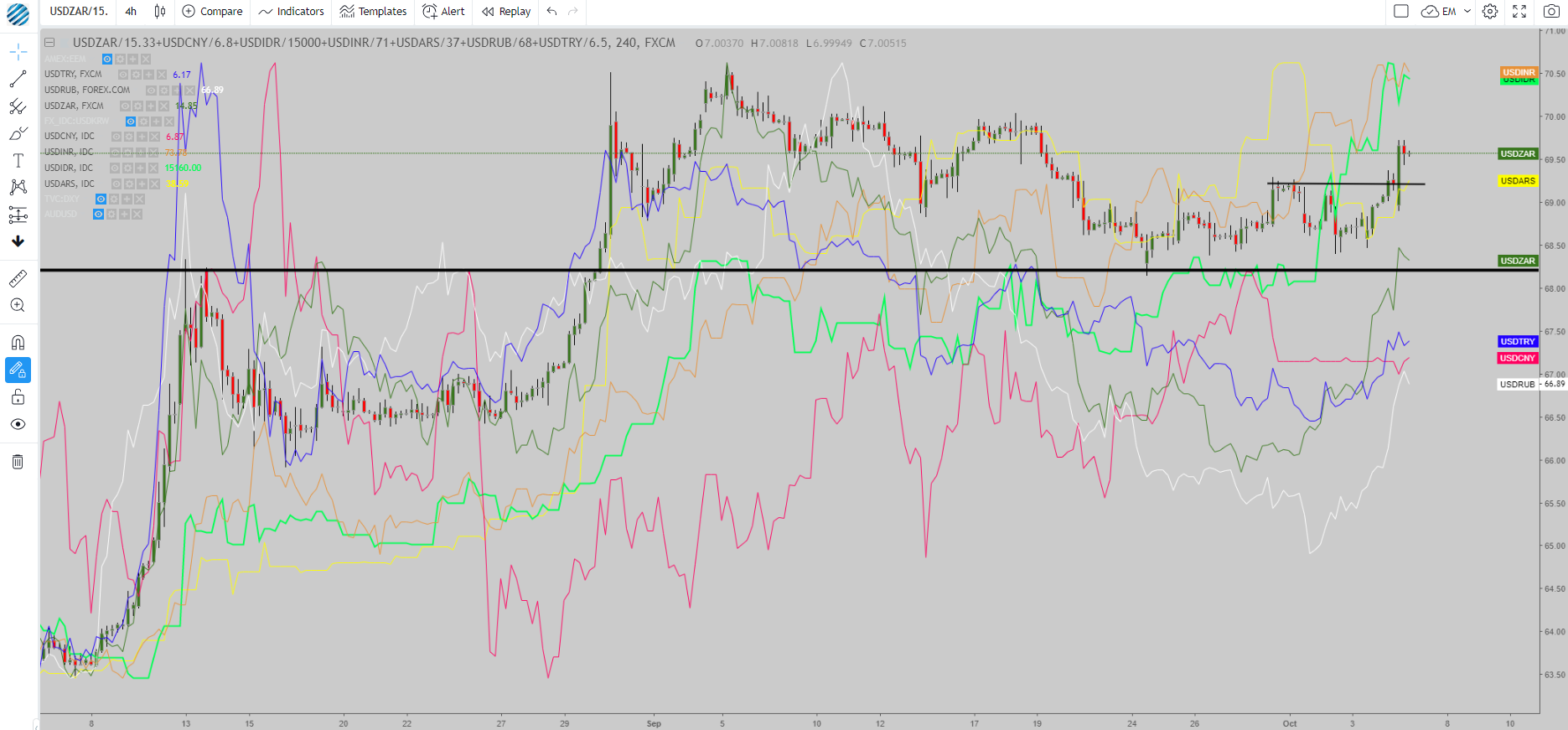

EM currencies is another source of concern that is starting to see some technical cracks as the USD resumes its upward trend. A bullish structure in our prop EM currency index is firming up, which heralds more trouble ahead for EM. As a result, the Aussie and the Kiwi are especially vulnerable, as the breaks below 71c and 65c indicate.

A major theme that is slowly sinking into investors’ minds is the notion that the Federal Reserve is set to maintain a fairly aggressive tightening campaign heading into 2019. This is the last thing EM economies flooded with USD-denominated debt need at this stage, as it worsens the difficulty to serve their obligations.

Also, right from the horse’s mouth, on Wednesday, Fed’s Chairman Powell stated that “we’re a long way from neutral at this point, probably.” Bond traders took immediate notice by selling treasuries in mass, so continue to monitor this theme very closely, especially the confirmation of a major breakout in the US30s, as it battles some major sticky weekly/monthly resistance levels. Looking at the 10y TSYs, it reached 3.23% before easing back around 3.19%., although the break and hold way above the 3% has been a psychological win.

The announcement of Amazon (NASDAQ:AMZN) to raise salaries and its planned lobbying to increase the minimum federal wage in the US has been another catalyst putting further pressure on US Treasuries. The line of reasoning is that it may assist in kickstarting a virtuous cycle of higher wages as competitors must adjust to the new norm of higher salaries to retain their employees at a time of full employment and extreme capacity utilization.

Bottom line, the environment remains one with many perils ahead for the likes of EM and the Oceanic currencies as the steepening of the US curve develops, while the European block FX face a different set of circumstances in order to challenge the positive USD flows, largely dependable on how the immediate short term risks, namely Italy and Brexit, play out. On the Euro front, keep an eye on a recent article by MNI, indicating that “the ECB may engineer a pseudo operation twist next year while deciding where to put re-investments of maturing bonds”, citing unnamed ECB officials.

Heading into Friday, the focus will shift towards the US NF release, which comes on the heels of further evidence of the rude health by the US economy, as depicted by this week’s 21yr high in the US non-manuf ISM numbers or the rise in ADP employment figures. On Thursday, US Factory orders were up 2.3% m/m in August vs 2.1% estimates, while durable goods orders came in a tenth below their initial estimate at 4.4%. According to ANZ, “early reads (ADP etc) are pointing to a large number, market consensus 185K.”