As far back as I can remember, I’ve been fascinated with the fetish that investors have about forecasts and predictions. When I was a strategist, clients wrangled me for a simple statement of where the market was going to go. I had my opinions, to be sure, but by the time I was a senior strategist I also knew that even good forecasters are wrong a lot. Forecasting, ironically, is not a job for people who care very much about being right. Because if they do care about being right, even good forecasters are depressed a lot.

So in my mind, a useful strategist was not one who gave all the right answers. Those don’t exist. A useful strategist was one who asked the right questions. Investing isn’t about being right; if it was, there would be no need to diversify. Just put everything in the one right investment. No, investing is about probabilities, and about maximizing the expected outcome even though that is almost never the best outcome given the particular path of events that actually transpires. Knowing the future is still the best way to make a million dollars.

A valuable strategist/forecaster, then, is not the one who can tell you what they think the actual future will be. The most valuable strategists have two strong skills. First, they excel at if-then statements. “If there is conflict in the Ukraine, then grain prices will soar.” Second, they are very good at estimating reasonable probabilities of different possibilities, so you can figure out the best average outcome of the probability-weighted if-then statements.

However, there aren’t a lot of great strategists, because those same characteristics are exactly what you need to be a good trader. I can’t remember if it was Richard Dennis or Paul Tudor Jones or some other legend who said it, but a good trader says:

“I don’t know what the market is going to do, but I know what I am going to do when the market does what it is going to do.”

As an investment manager/trader, that’s the way I approach investing. I don’t often engage in a post-mortem analysis about why I was wrong about how a particular chain of events played out, but I often post-mortem about whether the chain of events caused the market outcomes I expected, or not, and why.

All that being said, people keep asking me what I think happens next, so here is my guess at how the year will unfold. Feel free to disagree. I don’t really care if this is what happens, since my job is really to be prepared no matter what happens. But, you asked.

- I suspect the conflict in Ukraine will continue for quite a while. I also think there’s a reasonable chance that other countries will take advantage of our distraction to be adventurous on other fronts. April is a key month, and I think Russia might be waiting for this other front to open up before pushing harder in Ukraine.

- However, except inasmuch as the geopolitical uncertainty plays into the general de-globalization of trade, I don’t think about particular outcomes of Russian or Chinese adventurism. I don’t think the long-term inflation trajectory has a lot to do with who is invading who. In the short term it matters, but in the long run it means certain goods will have different relative prices compared to the market basket compared to what they have now—not that incremental inflation of those items, the rate of change of those relative prices, will continue. For example, cutting off the supply of Russian natural gas to Europe would permanently raise the relative price of nat gas in Europe, but after prices adjusted it wouldn’t permanently cause a higher level of inflation of natural gas.

- March’s CPI print, released on April 12th, will probably be the high print for the cycle for headline inflation, at around 8.5%. Core inflation will also peak at the same time, around 6.50%. This is mainly due to tough comps, though. Monthly prints will still be running at a 4-5% rate, or higher, for at least the balance of the year, and we will end the year with core around 4.5%-5%.

- The Fed is going to tighten again. I doubt they go 50bps at this next meeting unless the market is expressing desire for that outcome. The market sometimes fights the Fed, but the Fed these days doesn’t fight the market. The FOMC might even start reducing the mammoth balance sheet through partial runoff, but I suspect they will pocket-veto that and not do anything for a couple more months.

- Interest rates are going to go up, further. Real interest rates are going to rise—actually, our model says that more of the rise in nominal interest rates so far should have been real rates, so TIPS are actually marginally expensive (which is very rare). Long-term inflation expectations are also going to continue to rise, until at least 3.5%…something in line with the reality of where equilibrium inflation really is now, with an option premium built in to boot.

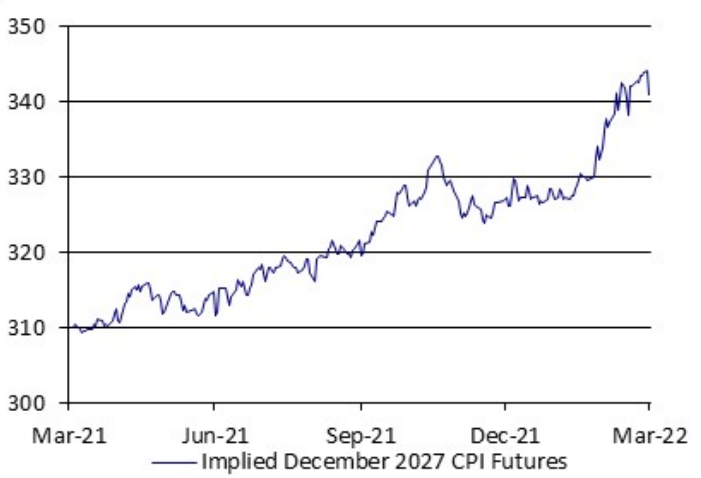

- Although the near-term inflation prints will come down, the increase in longer-term breakevens means that expectations of the forward price level will continue to rise. The chart below shows the level at which December 2027 CPI futures would be trading, based on the inflation curve, if some exchange actually had the courage to launch CPI futures. One year ago, the implied forward level of 310, compared to the November 2020 level of 266.229, implied that the market expected inflation from 2021-2027 to average 2.2%. That was in the thick of the “it’s transitory” baloney. Today, the theoretical futures suggest that inflation from 2021-2027 will average 3.6%, and that even ignoring the inflation we have seen so far, the price level will rise 3.25% per year above the current level over the next 5.75 years.

- Stocks are going to decline. It is a myth, unsupported by data, that stocks do well in inflationary periods. At best, earnings of stocks may increase with inflation (and even exceed inflation in many cases since earnings are levered). But multiples always decline when real interest rates and inflation rise. Modigliani said it shouldn’t happen. But it does. And the Shiller P/E right now is around 40.

- Then, the Fed is going to get nervous. Rising long-term inflation expectations will make the FOMC think that they should keep hiking rates, but the declining equity market will make them think that financial conditions must actually be tighter than they seem. And they’ll be afraid of causing real estate prices, which have risen spectacularly in the last couple of years, to decline as well. They will, moreover, be cognizant of the drag on growth caused by high food and energy prices, and in fact they will forecast slower growth (although it is unlikely that they will forecast the recession until it is over). And, since the Fed believes that inflation is caused by too much growth, rather than by too much money, the Committee will slow the rate hikes, pause, and possibly stop altogether. This is, of course, wrong but being wrong hasn’t stopped them so far.

- Long rates will initially benefit from the notion that the Fed is abandoning its hawkish stance and because of ebbing growth, but then will continue higher as inflation expectations continue to rise. On the plus side, this will keep the yield curve from inverting for very long, ‘signaling a recession’, but a recession will come anyway.

- Inflation by that point will only be down to 4-5%, but the Fed will regard what remains as ‘residual bottlenecks,’ since in their models a lack of growth puts downward pressure on inflation. They’ll stop shrinking the balance sheet, and may well start QE again if the decline in asset prices is steep enough or lasts long enough, or if real estate prices threaten to drop.

There you go—that’s my road map. I am not married to this view in any way, and am happy to discard it at any time. But I know what I am going to do when the market does what it is going to do. You should too!