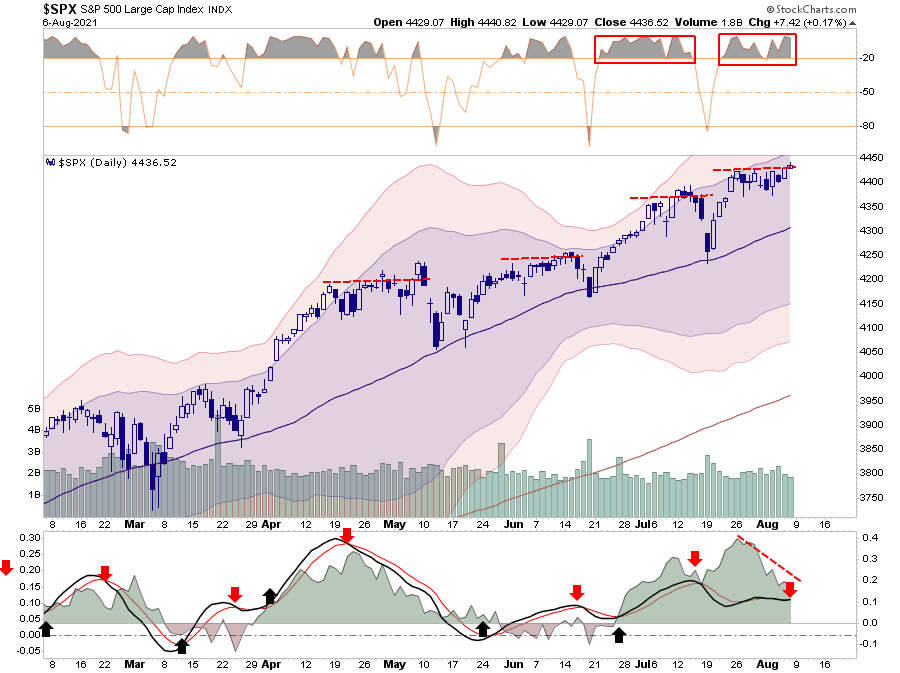

Last week, we discussed that further upside would be challenging with the market hitting new highs.

“Not surprisingly, the market didn’t make much headway this past week, given the current extended and overbought conditions. For now, ‘buy signals’ remain intact, which likely limits the downside over the next week. However, a retest of the 50-dma is certainly not out of the question.”

This week, such was the case again, as the market registered new highs only by a small fraction. Despite a record level of earnings “beats” and upgraded guidance, and a robust jobs report. (Corrections to the 50-dma continue to provide the best entry points to date. However, at some point the 200-dma will get tested.)

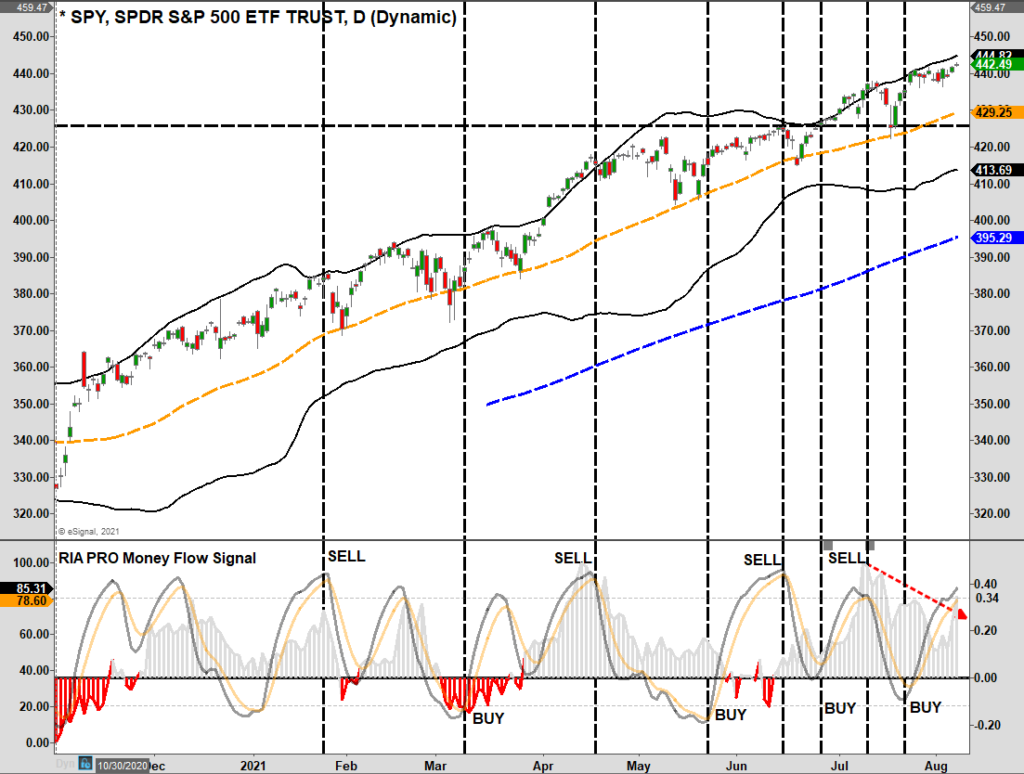

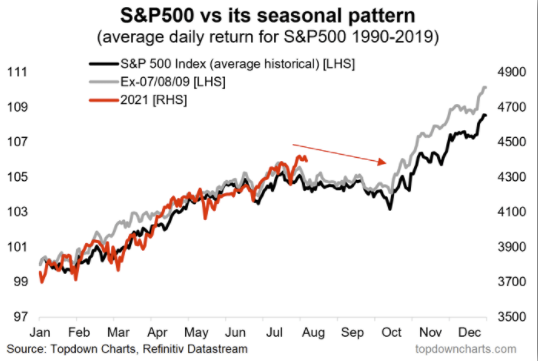

Notably, in both the chart above and below, buying pressure weakened despite several attempts to push markets higher. Thus, the “distribution” of the market remains a concern at these levels, particularly as we head into the seasonally weaker months of the year.

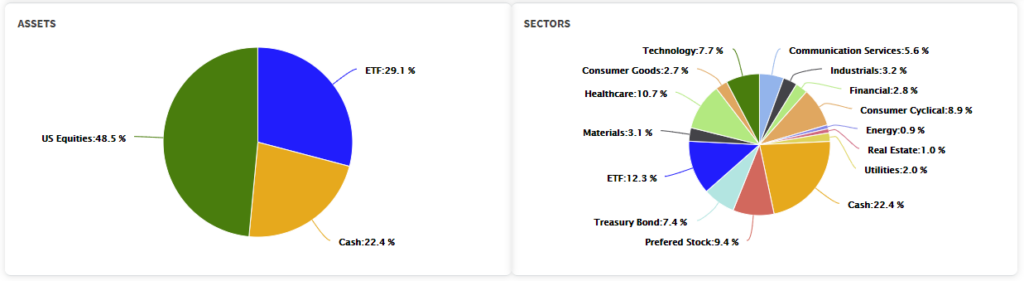

Despite these warnings, the “bullish bias” remains present, which limits downside risk currently. Therefore, we continue to maintain the majority of our equity holdings. In addition, however, we did raise our cash levels and increased the duration of our bond holdings to hedge against risk.

While there seems to be “NO” immediate risk to markets, Friday’s employment report should worry the “bulls.”

Fed Getting More Vocal On Taper

Over the past few weeks, Fed members have become much more vocal about the need to “taper” the current level of “Quantitative Easing.” Friday’s jobs report may accelerate that timeline.

For example, in a recent CNBC interview:

“Given this outlook, commencing policy normalization in 2023 would be entirely consistent with our new flexible average inflation targeting framework.’” – Richard Clarida

However, Dallas Fed President Richard Kaplan suggested that “tapering” could come even sooner.

“As we make substantial further progress, which I think will happen sooner than people expect, I think we’d be far better off, from a risk-management point of view, beginning to adjust these purchases of Treasuries and mortgage-backed securities.”

As Michael Lebowitz and I discussed on The Real Investment Show, the Fed drops these trial balloons to gauge the market’s reaction. Then, if markets remain stable, the Federal Reserve can adjust either the “verbal” language or take more specific actions.

So far, the market remains stable but could be overlooking an important point. Raghuram Rajan for Project Syndicate made a notable statement.

“Inflation readings in the United States have shot up in recent months. Labor markets are extremely tight. In one recent survey, 46% of small-business owners said they could not find workers to fill open jobs, and a net 39% reported having increased their employees’ compensation. Yet, at the time of this writing, the yield on ten-year Treasury bonds is 1.24%, well below the ten-year breakeven inflation rate of 2.4%. At the same time, stock markets are flirting with all-time highs.”

As he notes, something does not add up. With these current conditions, the Fed should tighten policy, reduce accommodation, and “reload their ammo” for the next downturn.

Instead, the Fed keeps pouring gasoline on the bonfire.

Jobs Report Shows “Substantial Progress”

As noted, Jerome Powell has already set the table for tapering bond purchases by noting “substantial progress” towards the Fed’s goal of full employment and price stability.

Friday’s job report, on the surface, was robust, providing that evidence.

“Hiring was the fastest pace in a year. The economy added 943,000 jobs in July, nearly 100,000 more than the Dow Jones consensus estimate. The unemployment rate also fell to 5.4%, beating the forecasted jobless rate of 5.7%. Employment in May and June was also revised higher by a total of 119,000 payrolls.” – CNBC

As discussed previously, we think we could see the Fed openly discuss the issue of reducing its monetary support at the upcoming “Jackson Hole Summit.” Such could even include a general timeline to the reduction process in an attempt to maintain market stability.

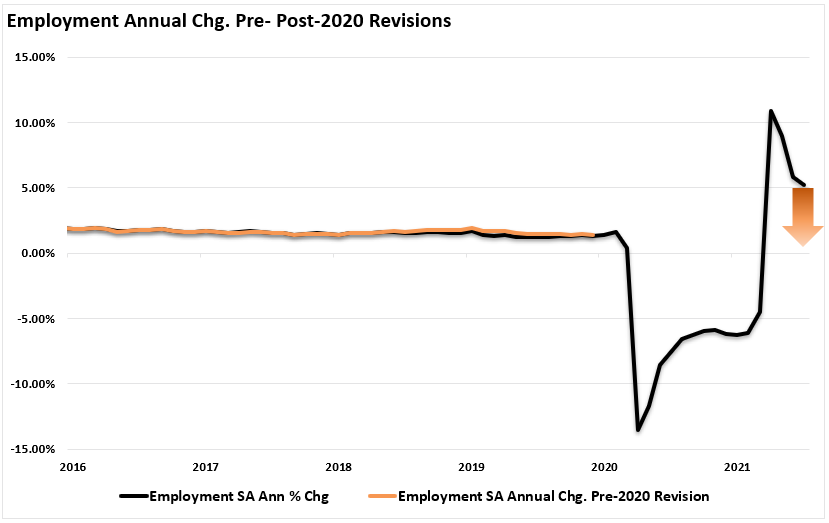

However, below the headline report, the employment number was not all that exciting. Without seasonal adjustments, employment fell by 133,000 people. As you would expect for July, the vast majority of hires were retail, hospitality, and teachers. (Vacations, Retail, and Back-To-School)

Notably, after a significant layoff cycle in March 2020, jobs are returning to normal. It is not a cycle of NEW job creation due to a booming economy, rather just the re-employment of those previously let go. (Getting back to even isn’t the same as growing.)

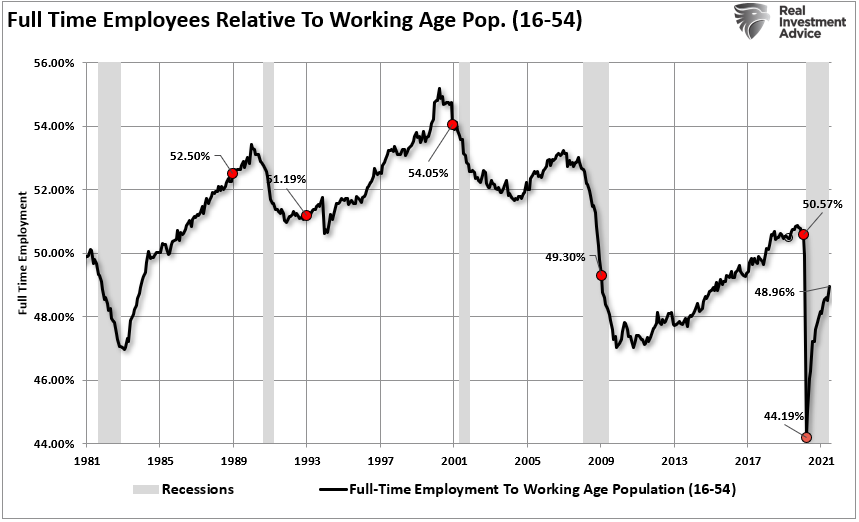

Lastly, if we strip out all of those “retiring baby boomers,” it is hard to suggest we are in a roaring economy when less than 50% of the working-age population are employed full-time. (Which is lower than any previous employment peak in history.)

However, this data will not factor into the Fed’s decision-making cycle, which is deeply flawed, to begin with.

The Fed’s Decision Making Cycle

There is ample evidence the Fed is complicit in exacerbating the “wealth gap” and fostering speculative activity. As such, they should engage in reducing the monetary accommodation sooner rather than later. To wit:

“To those who care about sound asset prices, Fed Chair Jerome Powell’s announcement last week that the economy had made progress toward the point where the Fed might end its $120 billion monthly bond-buying program was good news. Phasing out quantitative easing (QE) is the first step toward monetary-policy normalization, which itself is necessary to alleviate the pressure on asset managers to produce impossible returns in a low-yield environment.” – Rajan

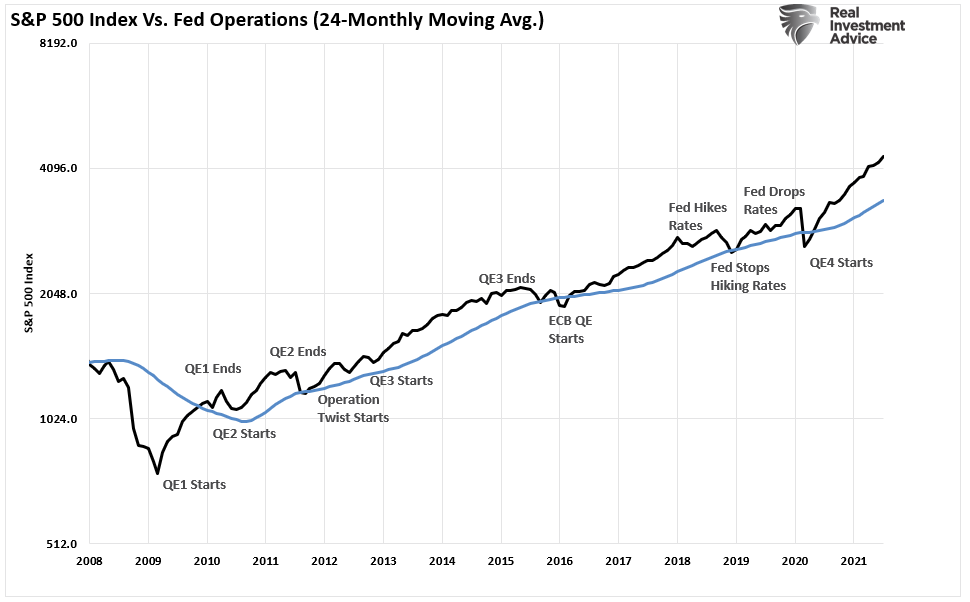

However, given the Fed has tied itself to the stock market as a sign of “economic stability,” any withdrawal of monetary policy leads to poor outcomes. The chart below shows the Fed’s Monetary Decision Making Cycle.

If the Fed does try to reduce accommodation, the market will decline as liquidity gets drained from the system. As the market declines, consumer confidence falls, and the Fed becomes concerned about a weakening economic environment. Moreover, given the high amounts of leverage in the system, as asset prices fall, the risk of defaults and credit risk rise.

This cycle forces the Fed to bail out the major Wall Street banks to ensure that a credit event doesn’t take hold. (Such is despite the fact the major banks pass an annual “stress test.” The Fed assures us the bank capitalization is strong enough to withstand such an event. (Unfortunately, it is pretty apparent they are not.)

The Fed May Be Trapped

That decision-making process is the Fed’s “kryptonite.” As noted above, every time the Fed does try to extract itself from the “monetary policy” game, the system fails.

Such is why we noted previously:

“Since the “Financial Crisis,” total Government interventions surpassed $43 Trillion into the economy to keep it “afloat.” I say “afloat” rather than “growing” because, since 2008, the total cumulative growth of the economy is just $3.5 trillion. In other words, for each dollar of economic growth since 2008, it required $12 of monetary stimulus.”

The diminishing rate of return on QE programs is becoming more evident. While increasing QE doesn’t increase economic activity, the removal immediately slows activity as individuals hoard savings. But, of course, that eventual outcome requires a return to more debt-funded policies to sustain low economic activity rates.

There are few good options.

Most notably, is the surge in debt from unbridled Government largesse is increasingly problematic. As Rajan notes:

“And yet, even if monetary policymakers are not overly concerned about high asset prices or inflation, they should be worried about another risk that prolonged QE intensifies: the government’s fiscal exposure to future interest-rate hikes.”

The bond market is indeed sniffing something out.

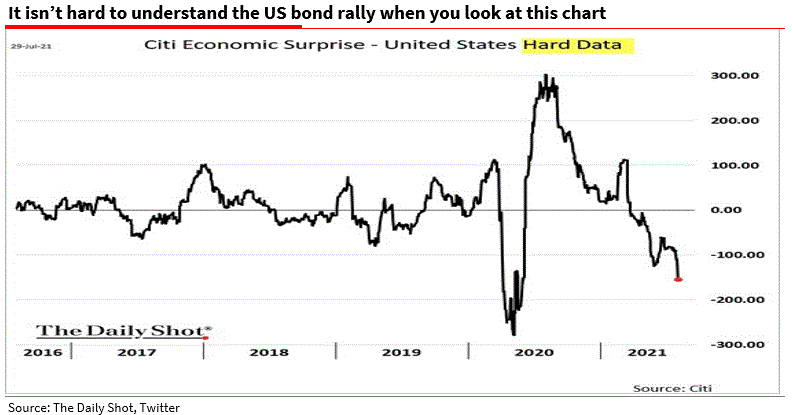

Bond Rally Not Hard To Understand

My colleague Albert Edwards had a great note on the bond rally this week:

“As real yields in the US (and Europe) slump to new lows, Fed Chair Powell has been left scratching his head. Really? He should take a look at the ‘Hard Data’ chart below.

Real yields continue to collapse to new record negative lows, falling in the US below MINUS 1.2%. Chairman Powell was at a loss to explain the drivers behind this recent decline in yields, so attributed it to technical factors (always a cop-out when you have no idea) as he thinks the fundamentals remain strong.Really? I know central banks tend to live in a parallel universe where they hear no evil, see no evil and speak total nonsense, but just look at the chart below. It shows the collapse in the Citi economic surprise index for hard data. This together with the increasing threat of imminent tapering – which usually leads (perversely) to falling bond yields – leads me to think that the US bond market rally is actually wholly explicable.“

Albert is correct and supports our thesis that bonds continue to deliver an important message the Fed ignores.

More importantly, as bottleneck’s ease, the risk of a manufacturing recession is rising rapidly next year.

“John Dizard’s FT column discussed the potential for an old-fashioned inventory-led recession next year when the current bottlenecks affecting container shipping dissipate. All that “delayed stuff, when it finally lands where it is supposed to, looks as though it will create a big enough pile to trigger a bad inventory recession.” – Albert Edwards

Pay attention to the data. Unfortunately, it isn’t nearly as strong as headlines suggest.

Portfolio Update

Not surprisingly, with earnings season in full swing, the markets maintained their bullish stance again this week. However, with that said, the upside remains limited, as we suggested previously.

With money flows continuing to weaken and technical indicators setting up to produce sell signals, we reduced exposure a bit more this week by increasing cash and reducing our financial holdings. With interest rates falling and yield curves flattening, there will be impacts to the earnings for major money center banks in the future.

If our analysis is correct and the economy slows much faster than anticipated, banks will underperform. We also reduced some of our energy exposure given the weakening dollar, and falling rates also suggest growth is weakening.

At the moment, as has been the case all year so far, there is no reason to be overly defensive. Bullish trends remain intact, liquidity continues, and overall sentiment is optimistic.

However, such does not preclude risk management in portfolios to protect recent gains against a potentially weak August and September timeframe. As noted on Thursday by Isabelnet.com:

As noted above, the market is moving through its current “buy” signals reasonably quickly. The next set of “sell” signals could lead to enough of a correction to set up a “buy” point for the end-of-year rally.

There is more than a decent chance the market ends up this year at about the same level we are currently. If that turns out to be the case, being a little cautious now might pay off.