It's been two days that the US equity market has rallied after the bloodbath in the momentum stocks. So where are we now?

Market facing technical resistance

Here is my take on the current technical position of the market. As the chart below shows, the SPX bounced off support at 1840 and rallied for two days. However, the rally was on declining volume, which is never a good sign, and the index is approaching a couple of technical resistance levels. One is shown by an uptrend that stretches back to early February; and the other is a well defined resistance zone at the 1874-1884 level.

Risk appetite is rolling over

Score another for the bears.

CapEx Index still constructive

I wrote on Sunday that in order for the bull market to continue, we need to see an acceleration in capital expenditures at this part of the cycle and the acid test will come this Earnings Season (see What equity bulls need for the next phase). While it is still very early, the initial report by Alcoa (NYSE:AA) was well received by the market.

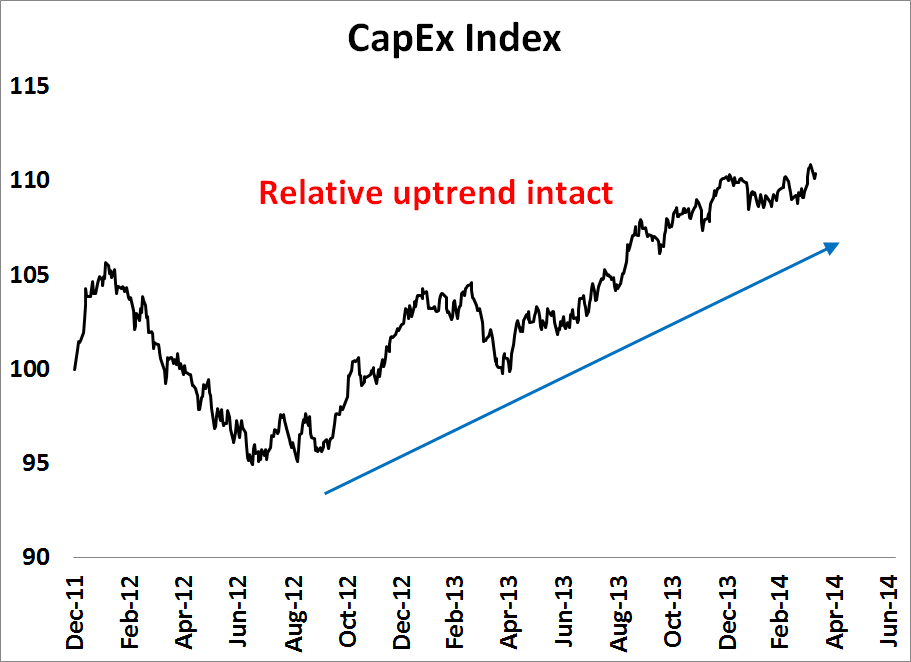

My CapEx Index, which is composed of an equal weighted relative return index of the Industrial sector (Industrial Sector SPDR Trust (ARCA:XLI)) and the (Morgan Stanley Cyclical Index) against SPX, remains in an uptrend, which is a constructive signal for the stock market. For now, Mr. Market is giving the cyclical recovery story the benefit of the doubt.

Game not over

The bulls, on the other hand, need to sidestep these risks and convince the market that a cyclical acceleration of growth is indeed at hand. Their cause could be helped by further dovish pronouncements from the Federal Reserve or news of a decisive stimulus program out of Beijing.

Disclsosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. (“Qwest”). The opinions and any recommendations expressed in the blog are those of the author and do not reflect the opinions and recommendations of Qwest. Qwest reviews Mr. Hui’s blog to ensure it is connected with Mr. Hui’s obligation to deal fairly, honestly and in good faith with the blog’s readers.”

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this blog constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or I may hold or control long or short positions in the securities or instruments mentioned.