My market risk indicator is warning today. That changes the portfolio allocations of the long/short portfolio and the volatility hedged portfolio to 50% long high beta stocks and 50% aggressively hedged. An aggressive hedge is a vehicle that benefits from higher volatility such as put options, or volatility ETF/ETNs like VXZ or XVZ. Please note that XVZ is thinly traded so limit orders (and likely several small purchases) would be prudent. Use your own discretion in which product you use and as always never buy a product you don’t understand.

If you’re using put options our portfolio allocations indicate that you should fully cover your portfolio at or near the money. Use your own discretion in term structure, but be aware that I look to mid term (4-7 months) puts first.

If you’re uncomfortable with volatility or put options an actively managed bear fund like HDGE is a short option to use as a hedge. It will likely offer more protection than a simple short of the S&P 500 Index (or the ETF SH).

An important note about the market risk indicator. It tends to signal at important inflection points. It either signals just before the final washout low or at the point where the market accelerates lower into a very significant decline. The whipsaws are the price we pay to have aggressive protection in place for the big declines.

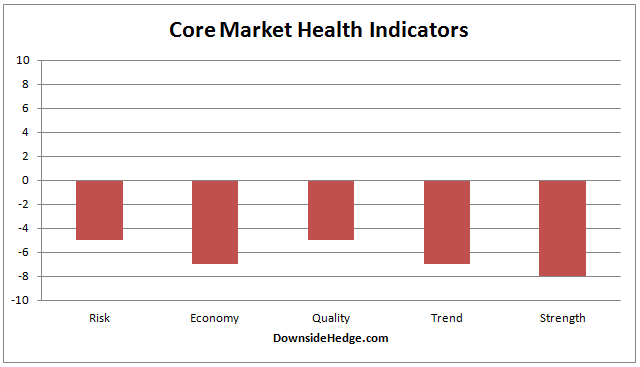

Below is a chart with the current core market health indicator categories: